Get the free Checks should be made out to Covenant Day School an IRS - covenantday

Show details

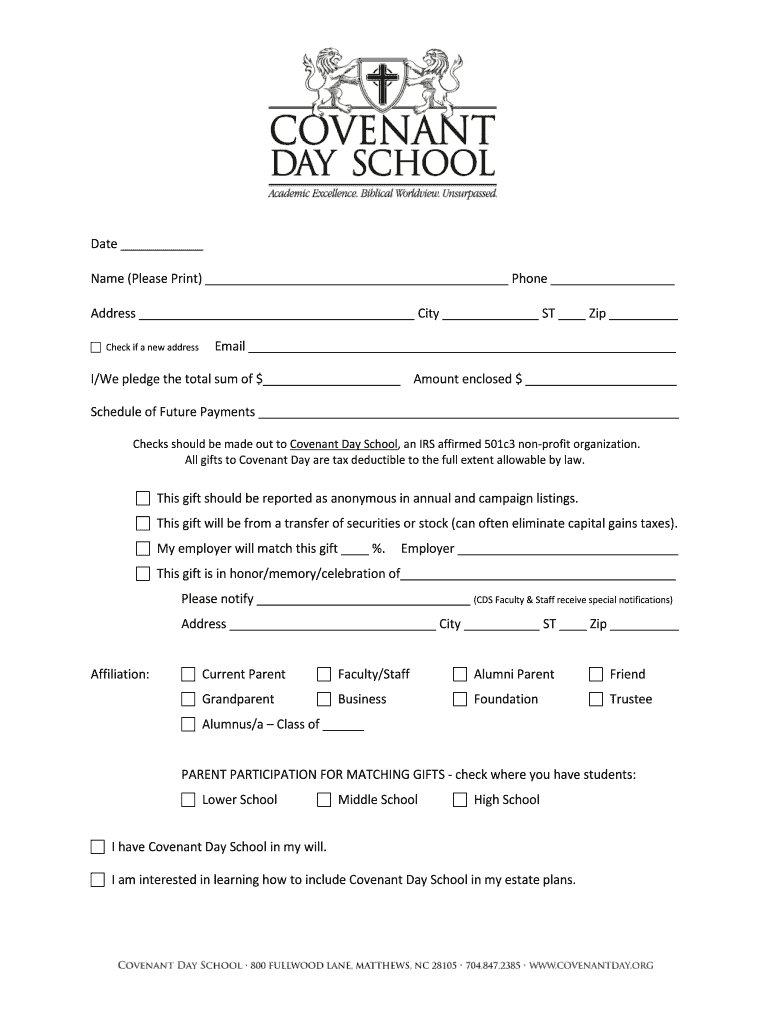

Date Name (Please Print) Phone Address City ST Zip Check if a new address Email I/We pledge the total sum of $ Amount enclosed $ Schedule of Future Payments Checks should be made out to Covenant Day

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign checks should be made

Edit your checks should be made form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your checks should be made form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit checks should be made online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to account. Start Free Trial and register a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit checks should be made. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out checks should be made

How to fill out checks should be made:

01

Start by writing the current date on the "date" line located at the top right corner of the check.

02

Next, enter the name of the recipient or payee on the "pay to the order of" line. Make sure it matches the name exactly as it appears on their account.

03

On the line below the payee's name, write the numerical value of the check in dollars and cents. For example, if the amount is $100.50, write "100.50" in this line.

04

Following the numerical amount, write the written version of the amount in words. For example, using the previous example, write "One hundred dollars and fifty cents."

05

On the line labeled "memo" or "for" located at the bottom left corner of the check, you can enter a brief description of the payment or any additional notes. This step is optional.

06

Lastly, you need to sign the check on the bottom right corner. Your signature confirms that you authorize the payment and it matches the signature on record with your bank.

Who needs checks should be made:

01

Individuals who prefer paper-based transactions: Many people still prefer writing checks for various transactions, such as paying rent, bills, or making donations. They find it convenient to have a physical record and a means of payment other than electronic methods.

02

Businesses and organizations: Checks are commonly used by businesses to make payments to suppliers, vendors, and employees. The check serves as proof of payment and provides a paper trail for accounting purposes.

03

Small business owners and freelancers: These individuals often need checks to receive payments from their clients or customers. Checks can be issued to the business or individual and used as a legal document to track income and expenses.

In summary, knowing how to correctly fill out a check is important for anyone who needs to make or receive payments with checks. Whether you are an individual who prefers paper transactions or a business owner, understanding this process ensures you can use checks effectively and accurately document financial transactions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit checks should be made from Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like checks should be made, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How do I edit checks should be made straight from my smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing checks should be made right away.

How do I complete checks should be made on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your checks should be made by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

Fill out your checks should be made online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Checks Should Be Made is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.