Get the free Credit bureaus and ColleCtion praCtiCes - Parkway C-2 - pkwy k12 mo

Show details

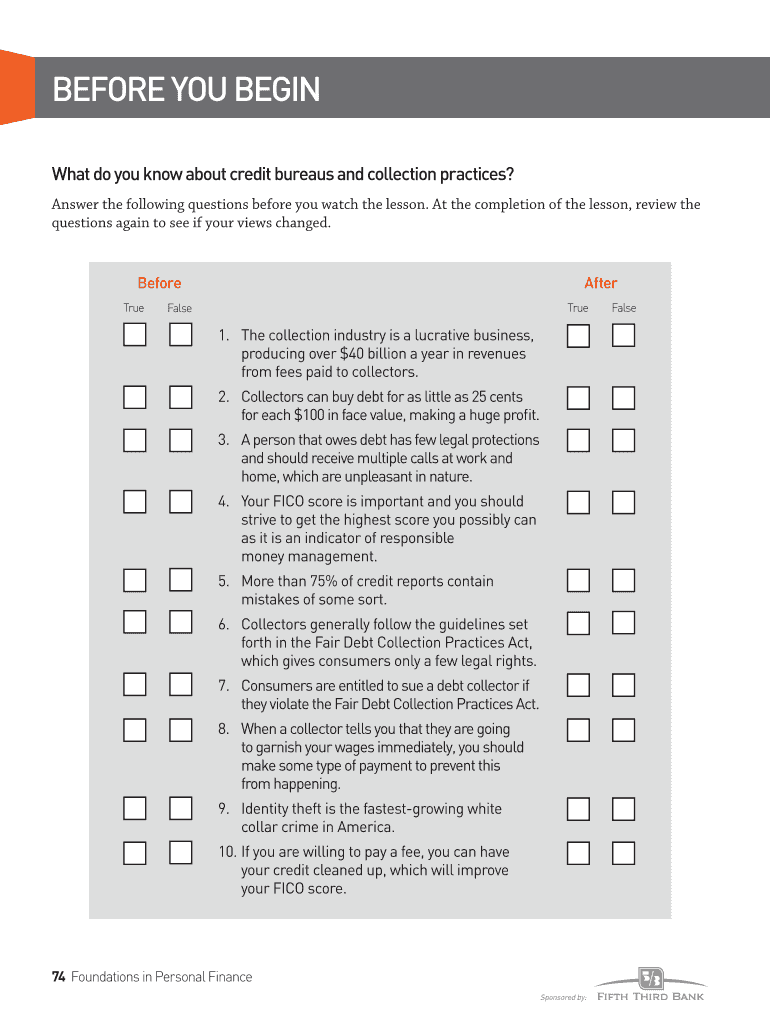

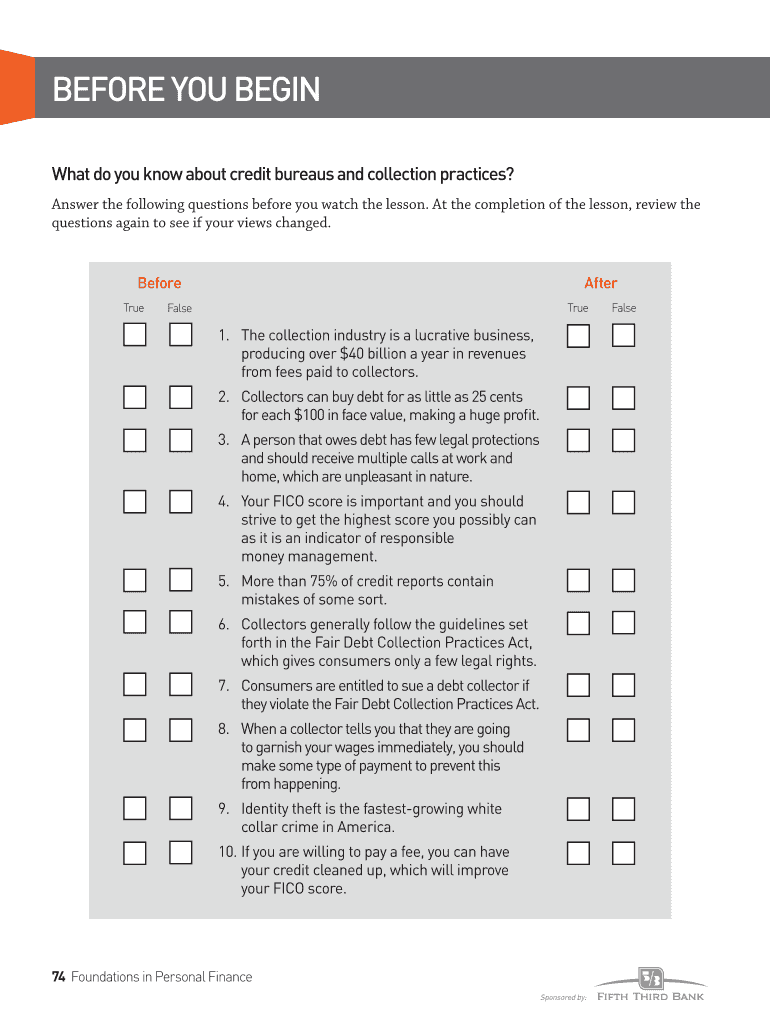

Credit bureaus and collection practices What do other high school students know about credit bureaus and collection practices? Learning Outcomes Bad decisions lead to bad debt and bad credit. We asked

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign credit bureaus and collection

Edit your credit bureaus and collection form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your credit bureaus and collection form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing credit bureaus and collection online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit credit bureaus and collection. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out credit bureaus and collection

How to fill out credit bureaus and collection:

01

Obtain all necessary documents and information. This may include personal identification details, any relevant financial documents, and a list of any outstanding debts or collections.

02

Contact the credit bureaus. There are three major credit bureaus in the United States – Equifax, Experian, and TransUnion. Each bureau allows individuals to request a copy of their credit report online, by mail, or by phone.

03

Review the credit reports carefully. Check for any errors, inaccuracies, or outdated information that could negatively impact your credit score. If you find any discrepancies, contact the credit bureau to dispute the information and have it corrected.

04

Understand your credit score. Your credit score is a numerical representation of your creditworthiness. It is essential to know your credit score and understand how lenders may perceive it when considering granting you credit.

05

Pay outstanding debts and collections. If you have any outstanding debts or collections, it is crucial to address them. Develop a plan to pay them off or negotiate with creditors to settle the debts. Making consistent payments and reducing outstanding balances can improve your creditworthiness over time.

06

Monitor your credit regularly. After completing the necessary steps, continue to monitor your credit reports regularly. This will allow you to stay informed about any changes or updates and ensure the accuracy of the information being reported.

Who needs credit bureaus and collection?

01

Individuals applying for loans or credit cards: Lenders and financial institutions rely on credit bureaus to assess an individual's creditworthiness when deciding whether to approve a loan or extend credit.

02

Tenants applying for rental properties: Landlords often use credit reports to evaluate potential tenants' financial responsibility and determine if they are likely to pay rent on time.

03

Job applicants: Some employers may request access to an applicant's credit report as part of their hiring process, particularly for positions that involve financial responsibility or access to sensitive information.

04

Individuals seeking insurance coverage: Insurance companies may use credit reports to assess risk and determine premium rates for policies such as auto or home insurance.

05

Individuals looking to monitor and improve their credit: Credit reports and scores provide individuals with valuable information about their financial health. Regularly reviewing credit reports can help identify areas for improvement and take steps to strengthen creditworthiness.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send credit bureaus and collection to be eSigned by others?

When you're ready to share your credit bureaus and collection, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How can I get credit bureaus and collection?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific credit bureaus and collection and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How can I edit credit bureaus and collection on a smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit credit bureaus and collection.

What is credit bureaus and collection?

Credit bureaus are agencies that collect credit information on individuals and businesses, while collection refers to the process of pursuing unpaid debts.

Who is required to file credit bureaus and collection?

Lenders, financial institutions, and businesses that extend credit to consumers or clients are typically required to file credit bureaus and collection.

How to fill out credit bureaus and collection?

Credit bureaus and collection reports can be filled out electronically through the respective credit bureau's website or by mail using the appropriate forms.

What is the purpose of credit bureaus and collection?

The purpose of credit bureaus and collection is to assess an individual or business's creditworthiness, track their credit history, and pursue unpaid debts.

What information must be reported on credit bureaus and collection?

Credit bureaus and collection reports must include details of the individual or business's credit accounts, payment history, outstanding debts, and any collection actions taken.

Fill out your credit bureaus and collection online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Credit Bureaus And Collection is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.