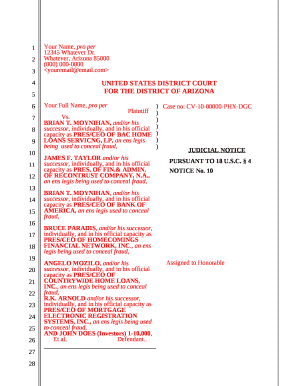

Get the free PREMIUM AUDIT REPORT - Chesapeake Employers Insurance Company

Show details

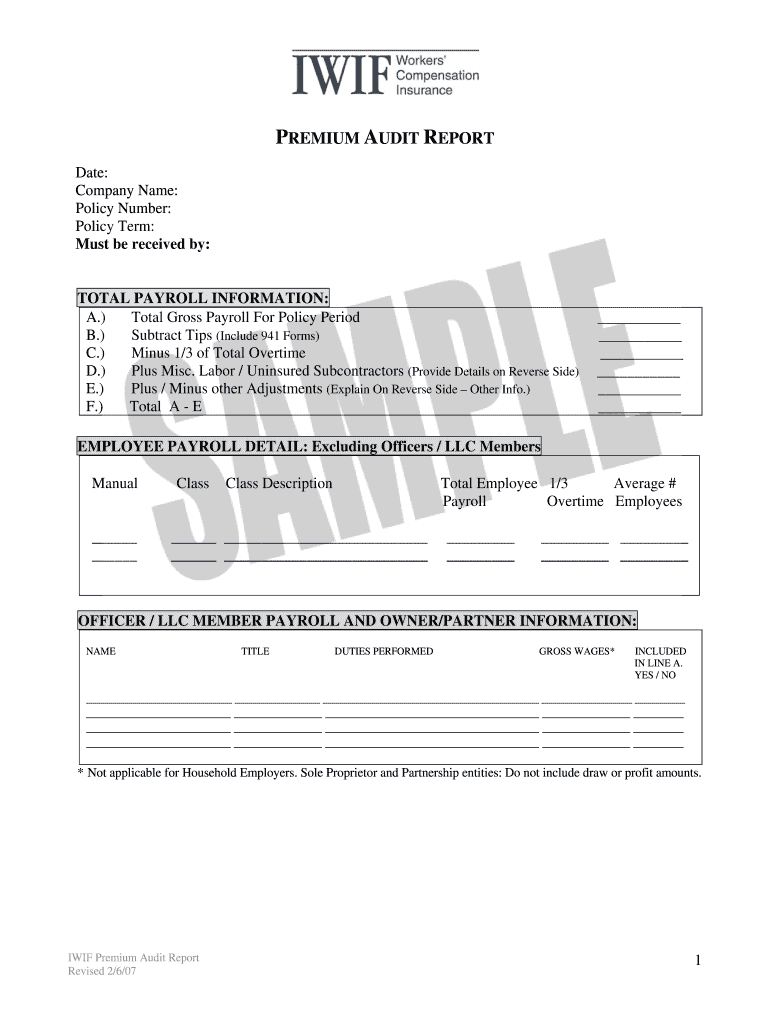

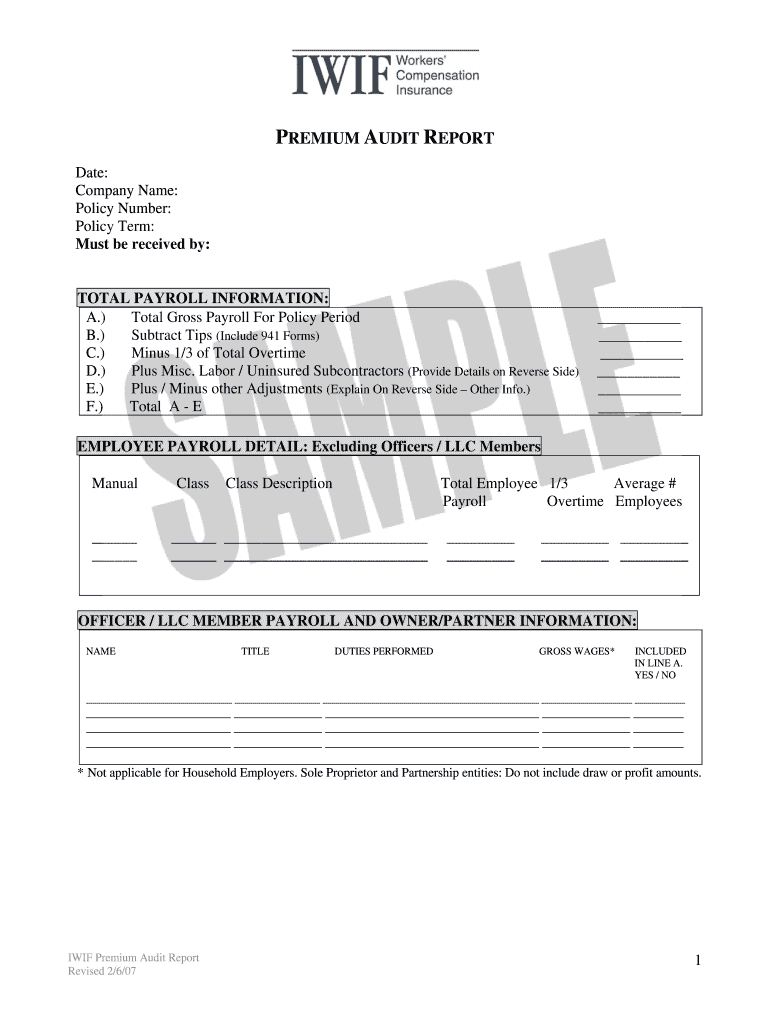

PREMIUM AUDIT REPORT Date: Company Name: Policy Number: Policy Term: Must be received by: TOTAL PAYROLL INFORMATION: A.) Total Gross Payroll For Policy Period B.) Subtract Tips (Include 941 Forms)

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your premium audit report form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your premium audit report form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit premium audit report - online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit premium audit report -. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

How to fill out premium audit report

How to fill out premium audit report:

01

Gather all necessary documents, such as payroll records, tax forms, insurance policies, and any other relevant financial information.

02

Review the insurance policy to understand the specific requirements for the premium audit report.

03

Use accurate and up-to-date information when completing the report, including employee wages, job classifications, and payroll details.

04

Double-check all calculations and ensure that they are accurate.

05

Include any additional information or explanations where necessary, such as changes in business operations or payroll during the audit period.

06

Submit the completed premium audit report to the insurance company according to their specified deadline or instructions.

Who needs a premium audit report:

01

Businesses or organizations that have purchased insurance policies that require a premium audit.

02

Insurance companies that need to assess the accuracy of the premium charged based on the actual exposures and payroll of the insured.

03

Auditors or accounting professionals who are responsible for conducting the premium audit on behalf of the insurance company.

Fill form : Try Risk Free

People Also Ask about premium audit report

What is an insurance premium audit?

Why would my insurance company audit me?

What does a premium audit reviewer do?

What is included in an insurance audit?

What triggers an insurance audit?

What is an insurance audit report?

Under what circumstance may insurance companies conduct a premium audit?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is premium audit report?

A premium audit report is a document that provides a detailed analysis and evaluation of the premiums paid by an insured party in relation to their insurance coverage. It is typically prepared by an auditor on behalf of an insurance company. The purpose of the audit is to verify the accuracy of the policyholder's reported data, such as sales revenue, payroll information, or property values, which are used to determine the premiums charged. The report includes findings and recommendations based on the audit, which may result in adjustments to the policyholder's premiums either with a refund or additional payment. Ultimately, the premium audit report ensures that the insurance premiums accurately reflect the risks and exposures of the insured.

Who is required to file premium audit report?

Premium audit reports are commonly required to be filed by insurance companies. They are used to determine if a policyholder has accurately reported their insurance exposures, such as payroll or sales, and if they have paid the correct premium for their coverage. Additionally, policyholders may be required to file premium audit reports if they have a self-audit policy or if their insurance policy includes an audit provision.

How to fill out premium audit report?

Filling out a premium audit report typically involves gathering and submitting accurate information about your business operations and relevant insurance coverage. Here are the general steps to fill out a premium audit report:

1. Review the audit instructions: Start by carefully reading and understanding the instructions provided with the audit report. These instructions will guide you through the process and provide specific requirements for each section.

2. Collect financial and operational data: Gather all the necessary documents and information related to your business operations during the audit period. This may include payroll records, general ledger, sales invoices, employee records, and other relevant financial and operational data.

3. Provide employee information: List the names, job titles, and corresponding annual salaries or wages of all your employees. Include both full-time and part-time employees, as well as any seasonal or temporary staff.

4. Report subcontractors: If you hired subcontractors during the audit period, provide their names, addresses, services performed, and amounts paid to them. Ensure that you have relevant certificates of insurance or other documentation to verify their coverage.

5. Document sales and revenue: Report your total sales, revenues, or other financial data relevant to the premium calculation. Be prepared to provide supporting documents such as sales invoices, tax records, or financial statements.

6. Disclose changes in business operations: If there were any significant changes in your business operations during the audit period, such as new product lines, acquisitions, or expansion into new markets, make sure to report these changes accurately.

7. Complete supplementary questions: Some premium audit reports may include supplemental questions related to specific industry risks or operational practices. Answer these questions accurately based on your business activities.

8. Submit supporting documentation: Include all required supporting documents with the audit report. This may include payroll records, financial statements, tax records, certificates of insurance for subcontractors, and any other relevant documents requested in the audit instructions.

9. Review and verify accuracy: Before submitting the completed report, review all the information provided to ensure accuracy and consistency. Double-check calculations and verify that all required sections have been completed.

10. Submit the report: Once you are satisfied with the accuracy of the report, follow the specified submission instructions. This may involve mailing or uploading the report to the designated address or online platform.

It is advisable to consult with your insurance company or auditor directly if you have any specific questions or require further guidance while filling out the premium audit report.

What is the purpose of premium audit report?

The purpose of a premium audit report is to ensure that the insurance premium for a policy accurately reflects the actual exposure of the insured. It aims to verify the information provided by the policyholder at the time of policy inception or renewal, and ensure the appropriate premium is charged based on the actual risk exposure.

The premium audit report examines various factors such as the number of employees, payroll figures, sales, contracts, and other relevant details that affect the policy premium. The report helps insurance companies to properly evaluate the risk and determine the correct premium amount. It also ensures that the policyholder is not overcharged or undercharged for their coverage.

Additionally, the premium audit report serves as a tool for maintaining fairness and accuracy in insurance transactions. It helps prevent fraud and misrepresentation by policyholders and helps insurance companies maintain their financial stability by collecting accurate premiums based on the actual exposure of the insured.

What information must be reported on premium audit report?

The information that must be reported on a premium audit report can vary depending on the specific requirements of the insurance policy and the type of coverage. However, some common information that is typically included in a premium audit report includes:

1. Policyholder information: This includes the name, address, and contact information of the insured entity.

2. Policy details: This includes the policy number, effective dates of coverage, and the type of insurance coverage provided.

3. Payroll information: For workers' compensation or general liability insurance policies, the audit report may include details of the payroll for the policy period, including employee names, job classifications, salaries/wages, and hours worked.

4. Sales/revenue information: For policies covering business operations, the audit report may include details of the insured's sales or revenue for the policy period.

5. Subcontractor information: If the insured utilizes subcontractors, the audit report may require information about the subcontractors, such as their names, addresses, and the amount paid to them during the policy period.

6. Certificates of insurance: The audit report may require the insured to provide certificates of insurance for any subcontractors or other entities that were hired during the policy period.

7. Records and documents: The insured may need to provide supporting records and documents, such as payroll registers, financial statements, tax filings, or other relevant documentation, to substantiate the information reported.

It is essential to consult the specific insurance policy and any audit requirements provided by the insurance company to ensure that all necessary information is included in the premium audit report.

What is the penalty for the late filing of premium audit report?

The penalty for the late filing of a premium audit report can vary depending on the specific insurance company and the terms of the policy. However, common penalties for late filing may include:

1. Late Payment Fees: A penalty fee may be imposed for failing to submit the premium audit report on time.

2. Interest Charges: In addition to late payment fees, interest charges may be applied to any outstanding amounts owing as a result of the late filing.

3. Policy Cancellation: In some cases, repeated late filings or failure to comply with premium audit reporting requirements may result in the cancellation of the insurance policy.

It's important to review the terms and conditions of the insurance policy to understand the specific penalties that may apply for late filing of a premium audit report.

How can I send premium audit report - to be eSigned by others?

premium audit report - is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

Can I create an eSignature for the premium audit report - in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your premium audit report - right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

How do I fill out the premium audit report - form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign premium audit report - and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

Fill out your premium audit report online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.