Get the free CERTIFIED PUBLIC ACCOUNTANTSREVISED LICENSING

Show details

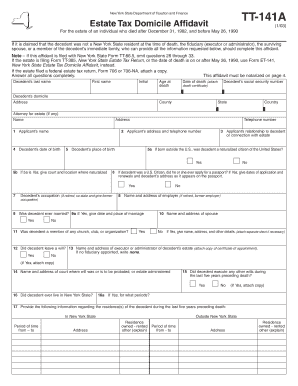

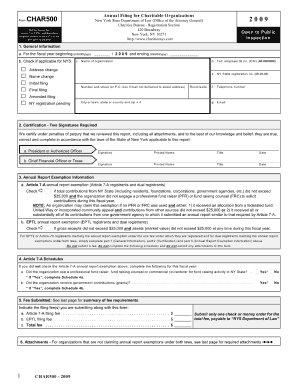

CERTIFICATION OF ENROLLMENT ENGROSSED SUBSTITUTE HOUSE BILL 2293 Chapter 103, Laws of 1992 52nd Legislature 1992 Regular Session CERTIFIED PUBLIC ACCOUNTANTSREVISED LICENSING AND PRACTICE REQUIREMENTS

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign certified public accountantsrevised licensing

Edit your certified public accountantsrevised licensing form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your certified public accountantsrevised licensing form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit certified public accountantsrevised licensing online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit certified public accountantsrevised licensing. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out certified public accountantsrevised licensing

How to fill out certified public accountants revised licensing:

01

Research the specific requirements: Start by understanding the specific requirements for certified public accountants revised licensing in your jurisdiction. Check with your local accounting board or regulatory body to obtain the necessary information. This will include educational qualifications, work experience, and any additional certifications or exams that may be required.

02

Gather the required documentation: Once you are familiar with the licensing requirements, gather all the necessary documentation. This may include proof of your academic qualifications, transcripts, certificates, and employment history. It's essential to ensure that all the required documents are up to date and meet the regulatory standards.

03

Complete the application form: Obtain the application form for certified public accountants revised licensing from the relevant authority. Carefully fill out the form, providing accurate and detailed information about your personal and professional background. Make sure to attach all the required documents as specified in the guidelines.

04

Pay the necessary fees: Review the licensing fees associated with the application process and make the required payment. Ensure that you include all the necessary fees, either by check or online payment as per the instructions provided by the regulatory body. Keep a copy of the payment receipt for future reference.

05

Submit the application: Once you have completed the application form and gathered all the required documents, submit them to the appropriate authority. Double-check that everything is in order and that you meet all the necessary criteria. Be sure to comply with any specified deadlines and submission guidelines.

Who needs certified public accountants revised licensing:

01

Accounting professionals: Certified public accountants revised licensing is primarily designed for accounting professionals who want to enhance their credentials and gain recognition in their field. It is essential for individuals who wish to provide accounting services to the public, especially in areas such as auditing, financial reporting, and taxation.

02

Finance and business professionals: Obtaining certified public accountants revised licensing can be beneficial for finance and business professionals who want to expand their knowledge and expertise in accounting. This can include individuals working in corporate finance, financial management, or business consulting roles.

03

Compliance and regulatory professionals: Professionals working in compliance and regulatory roles, such as compliance officers, internal auditors, or financial analysts, may also benefit from certified public accountants revised licensing. It provides them with a broader skill set and a deeper understanding of accounting principles, which is crucial in ensuring adherence to financial regulations and standards.

Overall, certified public accountants revised licensing is suitable for individuals who are committed to advancing their accounting knowledge and skills, seeking career progression opportunities, and demonstrating their professionalism and expertise in the field.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit certified public accountantsrevised licensing online?

The editing procedure is simple with pdfFiller. Open your certified public accountantsrevised licensing in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How do I make edits in certified public accountantsrevised licensing without leaving Chrome?

Install the pdfFiller Google Chrome Extension to edit certified public accountantsrevised licensing and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

How do I edit certified public accountantsrevised licensing straight from my smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing certified public accountantsrevised licensing.

What is certified public accountants revised licensing?

Certified public accountants revised licensing refers to the process of renewing and updating the license of certified public accountants to practice accounting.

Who is required to file certified public accountants revised licensing?

Certified public accountants who wish to continue practicing accounting are required to file for revised licensing.

How to fill out certified public accountants revised licensing?

To fill out certified public accountants revised licensing, one must provide updated information about their qualifications, work experience, and ongoing education.

What is the purpose of certified public accountants revised licensing?

The purpose of certified public accountants revised licensing is to ensure that certified public accountants are up-to-date with the latest regulations and standards in the field of accounting.

What information must be reported on certified public accountants revised licensing?

Certified public accountants must report their current contact information, license number, continuing education credits, and any disciplinary actions taken against them.

Fill out your certified public accountantsrevised licensing online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Certified Public Accountantsrevised Licensing is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.