Get the free CBDT announces Safe Harbour Rules for Specified Domestic Transactions of Government

Show details

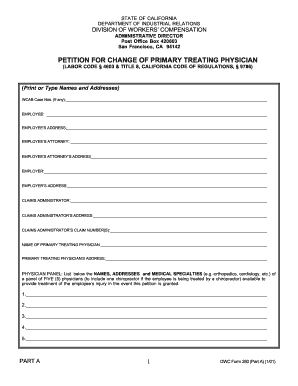

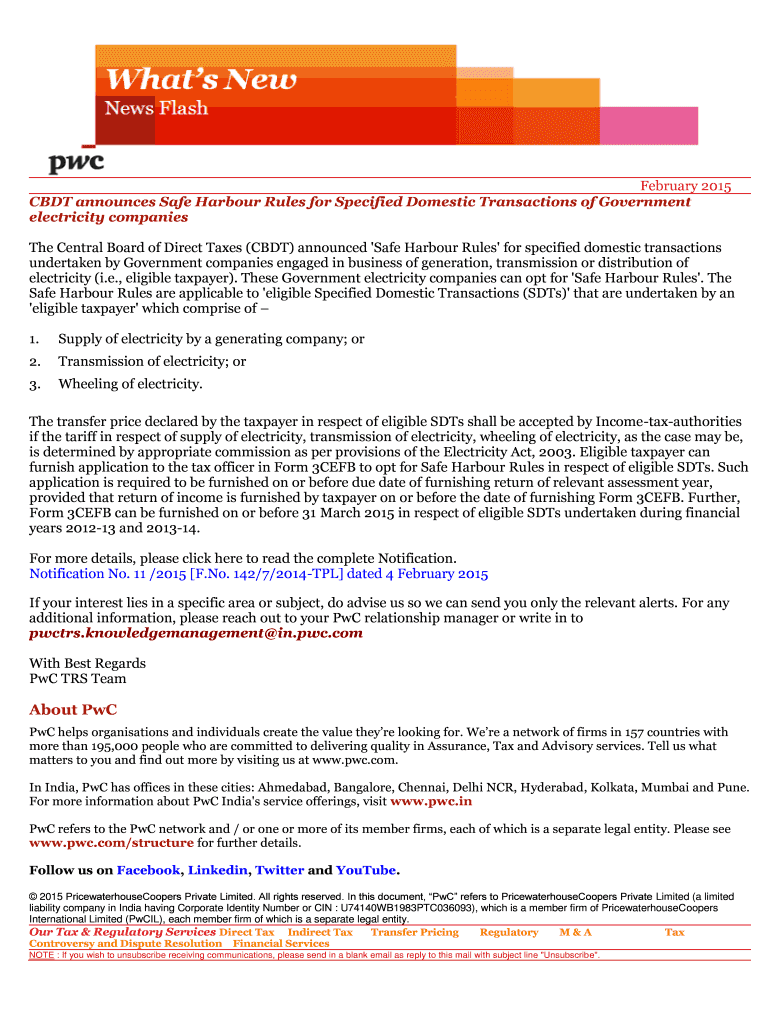

February 2015 CBT announces Safe Harbor Rules for Specified Domestic Transactions of Government electricity companies The Central Board of Direct Taxes (CBT) announced 'Safe Harbor Rules for specified

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign cbdt announces safe harbour

Edit your cbdt announces safe harbour form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your cbdt announces safe harbour form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit cbdt announces safe harbour online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to account. Click Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit cbdt announces safe harbour. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out cbdt announces safe harbour

How to fill out cbdt announces safe harbour:

01

Read the guidelines: Start by thoroughly reading the guidelines provided by the Central Board of Direct Taxes (CBDT) regarding the safe harbour provisions. It is essential to understand the requirements and criteria for availing the safe harbour benefits.

02

Assess eligibility: Next, evaluate whether your company meets the eligibility criteria specified by the CBDT. This may involve analyzing your past financial statements, revenue, and other relevant factors to determine if you qualify for safe harbour provisions.

03

Gather required information: Collect all the necessary information and documents needed to support your safe harbour claim. This might include financial records, transfer pricing documentation, and any other relevant data required by the CBDT.

04

Prepare the safe harbour application: Create a well-structured application that includes all the necessary details. It should address the specific requirements mentioned in the guidance provided by the CBDT. Make sure your application clearly demonstrates how your company meets the safe harbour provisions.

05

Submit the application: Once the application is complete, submit it to the appropriate authority or department as specified by the CBDT. Follow the designated procedure and ensure that all the required documents are attached.

Who needs cbdt announces safe harbour?

01

Companies involved in international transactions: The CBDT announces safe harbour provisions primarily to provide certainty and reduce transfer pricing disputes for companies engaged in international transactions. These may include transactions related to provision of services, software development, contract manufacturing, or any other cross-border dealings.

02

Companies seeking transfer pricing certainty: Safe harbour provisions are particularly beneficial for companies looking to minimize the transfer pricing risks and challenges associated with determining arm's length pricing. They provide a simplified framework that offers certainty and reduces the chances of tax litigation.

03

Companies aiming for streamlined compliance: By opting for the CBDT's safe harbour provisions, companies can streamline their compliance processes. These provisions offer predefined margins and standardized approaches for determining transfer prices, making it easier for companies to comply with transfer pricing regulations.

Note: It is important to consult with tax advisors or professionals who are well-versed in transfer pricing regulations and the CBDT's safe harbour provisions to ensure accurate interpretation and implementation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in cbdt announces safe harbour?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your cbdt announces safe harbour to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

How do I make edits in cbdt announces safe harbour without leaving Chrome?

Install the pdfFiller Google Chrome Extension to edit cbdt announces safe harbour and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

How do I complete cbdt announces safe harbour on an Android device?

Use the pdfFiller app for Android to finish your cbdt announces safe harbour. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is cbdt announces safe harbour?

CBDT announces safe harbour to provide taxpayers with certainty on transfer pricing methods.

Who is required to file cbdt announces safe harbour?

Taxpayers engaged in cross-border transactions and international companies are required to file under CBDT announces safe harbour.

How to fill out cbdt announces safe harbour?

CBDT announces safe harbour form must be completed with accurate financial and transfer pricing information.

What is the purpose of cbdt announces safe harbour?

The purpose of CBDT announces safe harbour is to streamline transfer pricing compliance and reduce disputes between taxpayers and tax authorities.

What information must be reported on cbdt announces safe harbour?

Taxpayers must report detailed financial information, transfer pricing method used, and related party transactions on CBDT announces safe harbour.

Fill out your cbdt announces safe harbour online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Cbdt Announces Safe Harbour is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.