IN Form 51766 2006 free printable template

Show details

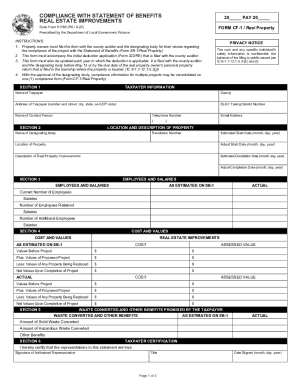

COMPLIANCE WITH STATEMENT OF BENEFITS REAL ESTATE IMPROVEMENTS FORM CF-1 / RE State Form 51766 (R / 1-06) PRIVACY NOTICE Prescribed by the Department of Local Government Finance The cost and any specific

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign IN Form 51766

Edit your IN Form 51766 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IN Form 51766 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit IN Form 51766 online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit IN Form 51766. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IN Form 51766 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IN Form 51766

How to fill out IN Form 51766

01

Start by downloading the IN Form 51766 from the official website.

02

Carefully read the instructions provided with the form.

03

Fill in your personal information in the designated sections, including your name, address, and contact details.

04

Provide any required identification numbers, such as your social security number or tax identification number.

05

Answer all questions truthfully and provide any additional information as requested.

06

Review your completed form to ensure all information is accurate and complete.

07

Sign and date the form where indicated.

08

Submit the completed form as instructed, whether electronically or by mail.

Who needs IN Form 51766?

01

Individuals applying for certain governmental benefits or services.

02

Applicants who need to verify their eligibility for specific programs requiring IN Form 51766.

Fill

form

: Try Risk Free

People Also Ask about

Who pays the transfer tax at closing in Ohio?

The tax shall be levied upon the grantor named in the deed and shall be paid by the grantor for the use of the county to the county auditor at the time of the delivery of the deed as provided in section 319.202 of the Revised Code and prior to the presentation of the deed to the recorder of the county for recording.

What is the property tax in Clermont County Ohio?

Real Property Tax For taxation purposes, real property in the State of Ohio is taxed at 35% of the appraised value of the property.

What is the transfer tax in Clermont County Ohio?

Transfer fee is $. 50 (fifty cents) per parcel.

Who is the auditor in Clermont County Ohio?

Linda Fraley - Auditor - Clermont County, Ohio -- Government | LinkedIn.

What is the transfer tax rate in Ohio?

A statewide mandatory tax of 1 mill ($1 per $1,000 dollars of the value of property sold or transferred) applies in all 88 of Ohio's coun ties. In addition, counties may also impose a permissive real property transfer tax of up to 3 additional mills.

How much is transfer tax in Clermont County Ohio?

Conveyance Fees and Title Transfer: The conveyance fee in Clermont County is $1.00 per $1000 of the sale price rounded to the nearest one hundred dollars and the transfer fee is $. 50 per title.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify IN Form 51766 without leaving Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your IN Form 51766 into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How can I get IN Form 51766?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the IN Form 51766 in seconds. Open it immediately and begin modifying it with powerful editing options.

How can I fill out IN Form 51766 on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your IN Form 51766 from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

What is IN Form 51766?

IN Form 51766 is a tax form used in the state of Indiana for reporting certain financial information to the Department of Revenue.

Who is required to file IN Form 51766?

Individuals and businesses that have specific tax obligations or income types defined by Indiana tax regulations are required to file IN Form 51766.

How to fill out IN Form 51766?

To fill out IN Form 51766, obtain the form from the Indiana Department of Revenue website, complete the required fields with accurate financial information, and submit it by the designated deadline.

What is the purpose of IN Form 51766?

The purpose of IN Form 51766 is to provide the Indiana Department of Revenue with detailed information needed to assess tax liabilities and ensure compliance with state tax laws.

What information must be reported on IN Form 51766?

IN Form 51766 requires reporting information such as income earned, deductions, credits, and other financial details relevant to the taxpayer's situation.

Fill out your IN Form 51766 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IN Form 51766 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.