Get the free Event Sales Tax Form - Festival On Ponce

Show details

FORM FS-32 (rev. 12/2014) Georgia Department of Revenue Compliance Division Rome Regional Office 1401 Dean Street. Suite E P.O. Box 1777 Rome, GA 30162-1777 MISCELLANEOUS EVENTS SALES TAX RETURN VENDOR

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your event sales tax form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your event sales tax form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing event sales tax form online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Click Start Free Trial and register a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit event sales tax form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents.

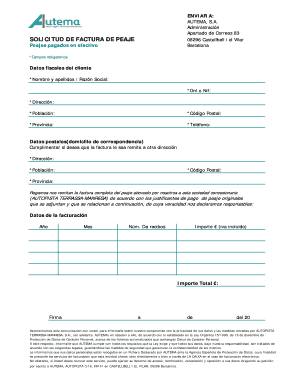

How to fill out event sales tax form

How to fill out event sales tax form:

01

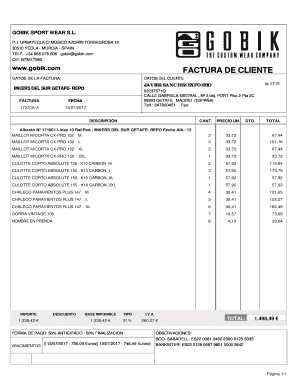

Begin by gathering all the necessary information and documents for your event, such as receipts, invoices, and financial records.

02

Make sure you have the appropriate event sales tax form for your jurisdiction. The form can usually be obtained from your local tax authority or downloaded from their website.

03

Start by filling out your personal information, including your name, address, and contact details.

04

Provide details about your event, such as the name, date, and location.

05

Indicate the type of event you are organizing, whether it's a conference, trade show, concert, or any other type of gathering.

06

Enter the total sales made during the event. This includes ticket sales, merchandise sales, sponsorship revenue, and any other income generated from the event.

07

Calculate the total sales tax due by multiplying the taxable sales by the applicable tax rate. This rate may vary depending on your jurisdiction, so make sure to consult the tax authority for the correct rate.

08

Include any applicable exemptions or deductions that may apply to your event. This could include exempt sales for certain types of organizations or exemptions for specific products or services.

09

Double-check all the information you have entered to ensure accuracy and completeness.

10

Sign and date the form, then submit it to the appropriate tax authority along with any required payment or supporting documentation.

Who needs event sales tax form:

01

Event organizers who are making taxable sales at their events are typically required to fill out an event sales tax form.

02

This includes individuals or businesses that are hosting conferences, trade shows, concerts, festivals, or any other type of event where goods or services are sold.

03

The specific requirements may vary depending on the jurisdiction, so it's important to consult the local tax authority to determine if you need to fill out an event sales tax form. Additionally, exemptions or thresholds for small-scale events may also be applicable, so it's important to be aware of the specific rules in your area.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is event sales tax form?

Event sales tax form is a form used to report sales tax collected from events or sales at events.

Who is required to file event sales tax form?

Any individual or business that sells taxable items at events is required to file event sales tax form.

How to fill out event sales tax form?

Event sales tax form can be filled out by providing information on the taxable items sold, amount of sales tax collected, and other relevant details.

What is the purpose of event sales tax form?

The purpose of event sales tax form is to report and remit sales tax collected from sales at events to the relevant tax authorities.

What information must be reported on event sales tax form?

The information that must be reported on event sales tax form includes details of taxable sales, amount of sales tax collected, and any exemptions or deductions claimed.

When is the deadline to file event sales tax form in 2024?

The deadline to file event sales tax form in 2024 is typically the end of the reporting period, which is usually monthly or quarterly.

What is the penalty for the late filing of event sales tax form?

The penalty for the late filing of event sales tax form may vary depending on the tax jurisdiction, but common penalties include monetary fines or interest charges on the unpaid tax amount.

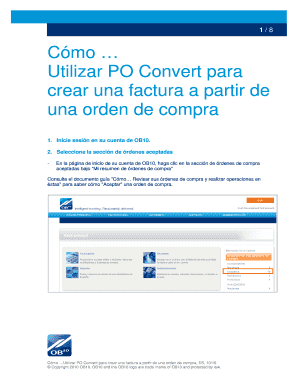

How do I edit event sales tax form online?

With pdfFiller, the editing process is straightforward. Open your event sales tax form in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

Can I create an electronic signature for the event sales tax form in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your event sales tax form in seconds.

Can I edit event sales tax form on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute event sales tax form from anywhere with an internet connection. Take use of the app's mobile capabilities.

Fill out your event sales tax form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.