Get the free COMMUNITY ASSOCIATION LOAN APPLICATION

Show details

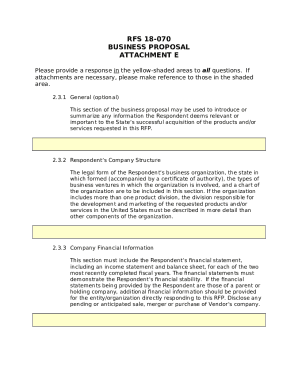

A document for applying for a loan, designed for community associations, requiring detailed information about the borrower and the associated property.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign community association loan application

Edit your community association loan application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your community association loan application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit community association loan application online

To use the services of a skilled PDF editor, follow these steps:

1

Log in to account. Start Free Trial and register a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit community association loan application. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out community association loan application

How to fill out COMMUNITY ASSOCIATION LOAN APPLICATION

01

Gather all necessary financial documents and information such as income statements, budgets, and tax returns.

02

Obtain a copy of the COMMUNITY ASSOCIATION LOAN APPLICATION form from the lender or online.

03

Fill out the application form, providing details about the community association including its name, address, and contact information.

04

Include information about the association's financial status, such as assets, liabilities, and cash flow.

05

Detail the purpose of the loan and how the funds will be used to benefit the community.

06

Provide signatures from authorized representatives of the association.

07

Review the application for completeness and accuracy.

08

Submit the application to the lender along with any required supporting documentation.

Who needs COMMUNITY ASSOCIATION LOAN APPLICATION?

01

Community associations looking to improve amenities or infrastructure.

02

Associations planning to undertake large projects that require funding.

03

Neighborhood groups needing financial assistance for developments or repairs.

Fill

form

: Try Risk Free

People Also Ask about

How long do you have to pay for HOA?

In California, Civil Code Section 5650 grants this authority to homeowners associations. The section states that fees turn delinquent 15 days after they become due. The exception to this rule is if an HOA's governing documents allow longer periods. The dollar amount depends on the association.

How to write loan application in English?

Include the following information: Your name. Your address. Your business name. Your business address. Name of loan agent or lender. Contact information of lender or loan agent. Subject line with the requested loan amount.

How long is the typical Hoa loan term?

A non-revolving line of credit may be used during the construction phase (typically six to 24 months long), with interest-only payments required. This line converts to a term loan once the project is complete, typically from five to 15 years in length.

How does an HOA loan work?

An HOA loan is a loan made directly to the association—not individuals—that can provide financing for projects and capital improvements within the community. The association is responsible for the repayment of the loan through the assessments collected from the owners of the community.

What are the risks of taking out an HOA loan?

If you take out an HOA loan, you might experience delays and issues when it comes to paying back the loan. This will put a bigger burden on the owners or the other homeowners. In some cases, the bank may even tap your reserve funds for the monthly loan payments.

How long are Hoa loans?

A non-revolving line of credit may be used during the construction phase (typically six to 24 months long), with interest-only payments required. This line converts to a term loan once the project is complete, typically from five to 15 years in length.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is COMMUNITY ASSOCIATION LOAN APPLICATION?

The COMMUNITY ASSOCIATION LOAN APPLICATION is a financial document that community associations, such as homeowner associations (HOAs) or condo associations, use to apply for loans to fund various community projects and improvements.

Who is required to file COMMUNITY ASSOCIATION LOAN APPLICATION?

Typically, the board of directors or authorized representatives of the community association are required to file the COMMUNITY ASSOCIATION LOAN APPLICATION.

How to fill out COMMUNITY ASSOCIATION LOAN APPLICATION?

To fill out the COMMUNITY ASSOCIATION LOAN APPLICATION, one needs to provide basic information about the association, the purpose of the loan, financial statements, and any required documentation to support the application.

What is the purpose of COMMUNITY ASSOCIATION LOAN APPLICATION?

The purpose of the COMMUNITY ASSOCIATION LOAN APPLICATION is to secure financing for renovations, repair projects, or other necessary improvements within the community.

What information must be reported on COMMUNITY ASSOCIATION LOAN APPLICATION?

Information that must be reported includes the association's financial details, the amount of loan requested, the intended use of funds, and any existing debts or obligations of the association.

Fill out your community association loan application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Community Association Loan Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.