Get the free GAINES D

Show details

No. 0910761 IN THE UNITED STATES COURT OF APPEALS FOR THE FIFTH CIRCUIT RALPH S. JANE, Plaintiff AppellantCrossAppellee v. GAINES D. ADAMS; NEN FAMILY TRUST; JEFF P. PURPURA, JR; CHERRY WANDERER HODGES;

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your gaines d form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your gaines d form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit gaines d online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit gaines d. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

How to fill out gaines d

How to fill out gaines d?

01

Start by obtaining a copy of the Gaines D application form. This form can typically be found online on the official website of the relevant organization or institution.

02

Carefully read all the instructions provided on the application form. Make sure you understand the eligibility criteria and any specific requirements for filling out the form.

03

Begin by providing your personal information, such as your full name, date of birth, and contact details. Make sure to double-check the accuracy of the information before proceeding.

04

Next, provide any necessary information related to your educational background. This may include details about your previous schools, degrees earned, and relevant coursework.

05

If applicable, fill out the section related to any work experience you have. Provide details about your previous job positions, responsibilities, and achievements.

06

The Gaines D application may require you to write a personal statement or essay. Take your time to carefully draft your thoughts and clearly express your motivations, goals, and why you are deserving of the opportunity.

07

Gather any supporting documents that may be required, such as transcripts, letters of recommendation, or proof of residency. Make sure to attach these documents to your completed Gaines D application.

08

Finally, review your filled-out application form for any errors or omissions. It can be helpful to have someone else proofread your application as well, to catch any mistakes that you may have missed.

Who needs Gaines D?

01

Students who demonstrate exceptional academic achievements and show academic promise may benefit from the Gaines D program.

02

Individuals who come from disadvantaged backgrounds or have limited financial resources may find that Gaines D offers opportunities for financial aid or scholarships.

03

Students who have an interest in pursuing higher education or advanced studies, such as graduate school or professional programs, may find Gaines D to be a valuable resource or support system.

04

Gaines D may be beneficial for students who come from traditionally underrepresented communities and seek to overcome barriers and strive for educational excellence.

05

Individuals who are dedicated to their personal and intellectual growth and who are committed to making a positive impact in their communities may find Gaines D to be a fitting program to support their aspirations.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

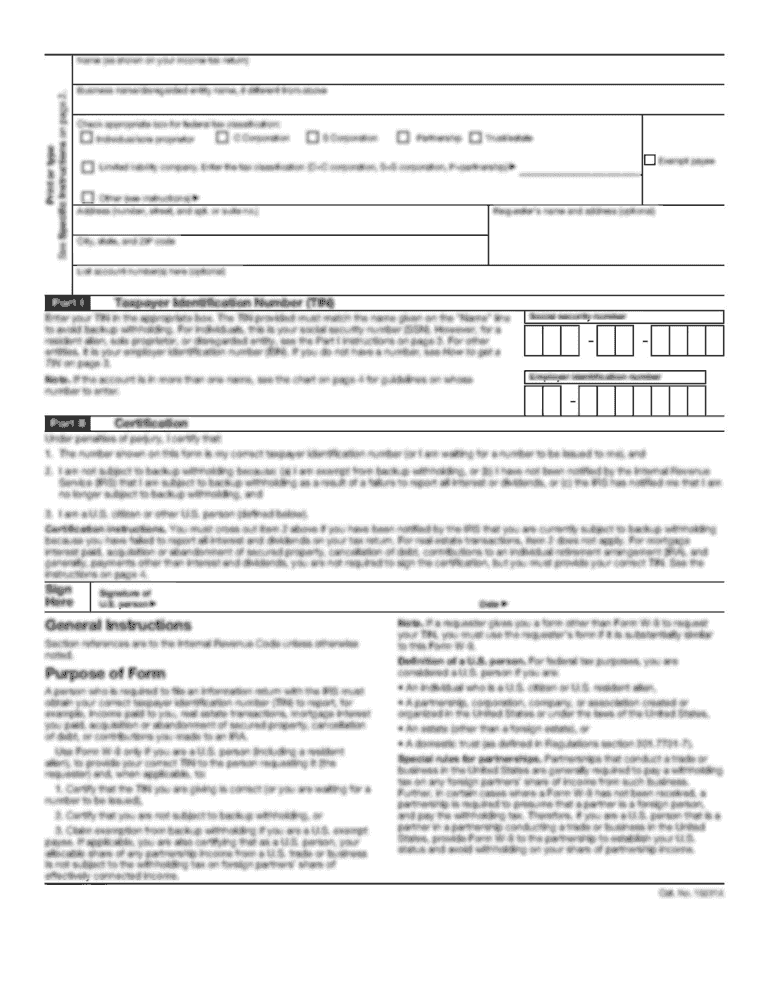

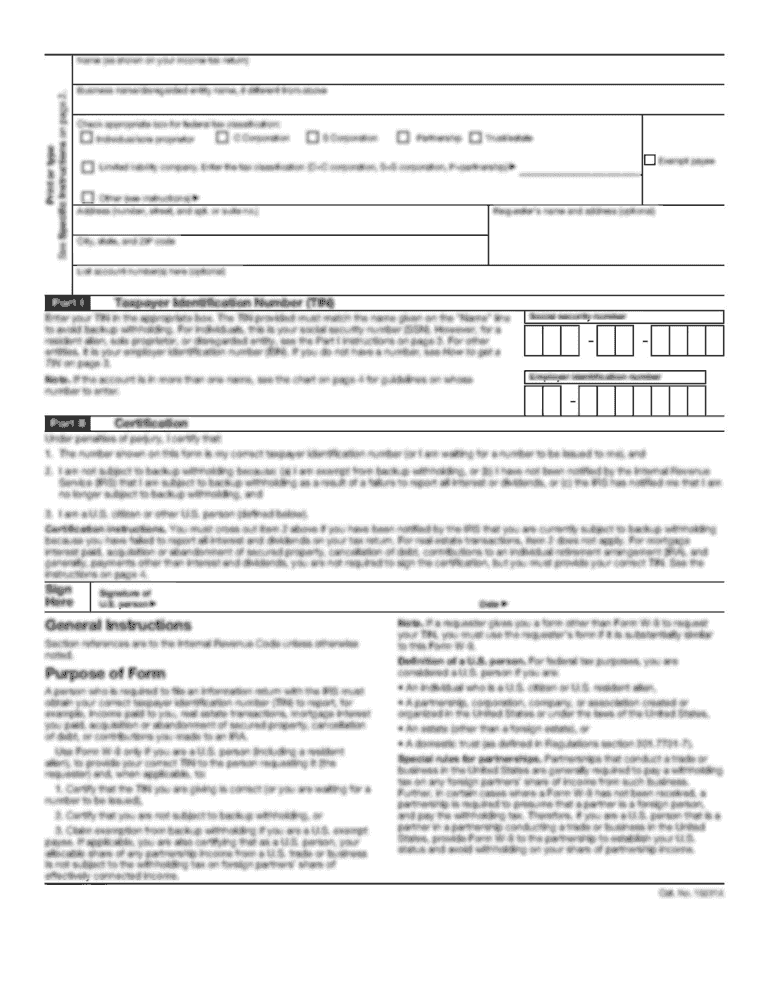

What is gaines d?

Gaines d is a tax form used to report gains from the sale of capital assets.

Who is required to file gaines d?

Individuals and businesses who have experienced gains from the sale of capital assets are required to file gaines d.

How to fill out gaines d?

Gaines d is typically filled out by providing information about the asset sold, the purchase price, the sale price, and calculating the gain.

What is the purpose of gaines d?

The purpose of gaines d is to report any gains made from the sale of capital assets to the relevant tax authorities.

What information must be reported on gaines d?

Information about the asset sold, purchase price, sale price, and calculated gain must be reported on gaines d.

When is the deadline to file gaines d in 2024?

The deadline to file gaines d in 2024 is April 15th.

What is the penalty for the late filing of gaines d?

The penalty for the late filing of gaines d is a percentage of the unpaid tax amount, typically ranging from 5% to 25% depending on the length of the delay.

How can I edit gaines d on a smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing gaines d right away.

How do I fill out gaines d using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign gaines d and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

How can I fill out gaines d on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your gaines d. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

Fill out your gaines d online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.