Get the free CREDITORS SECURED BY REAL PROPERTY Trust Deeds Mortgages

Show details

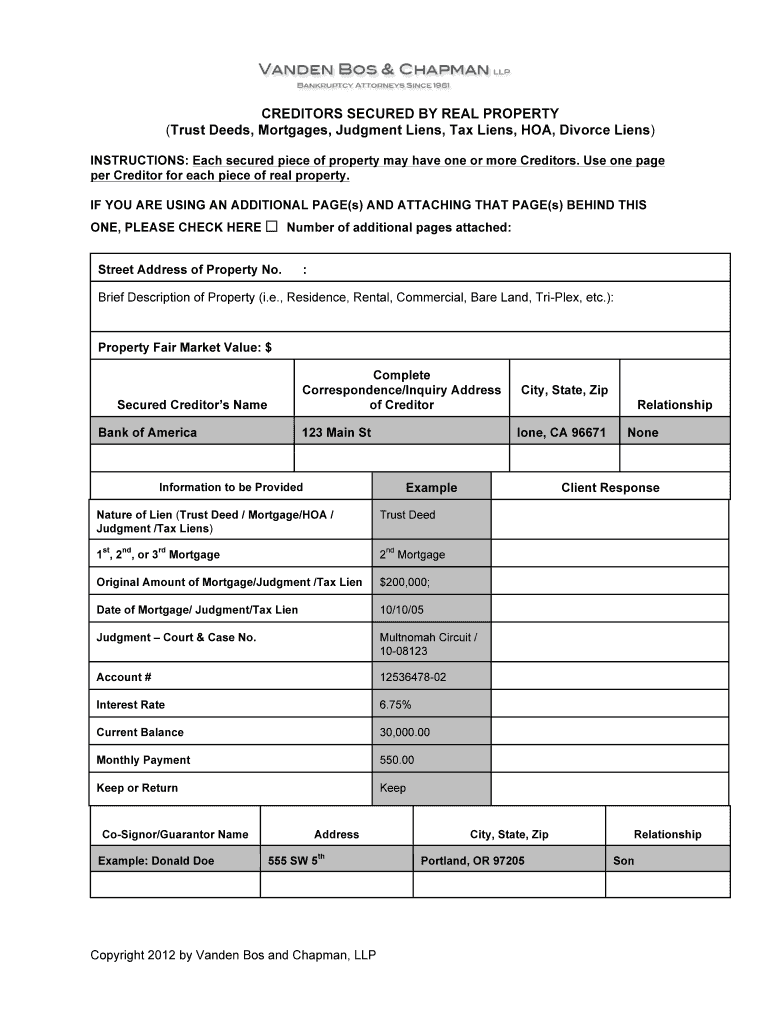

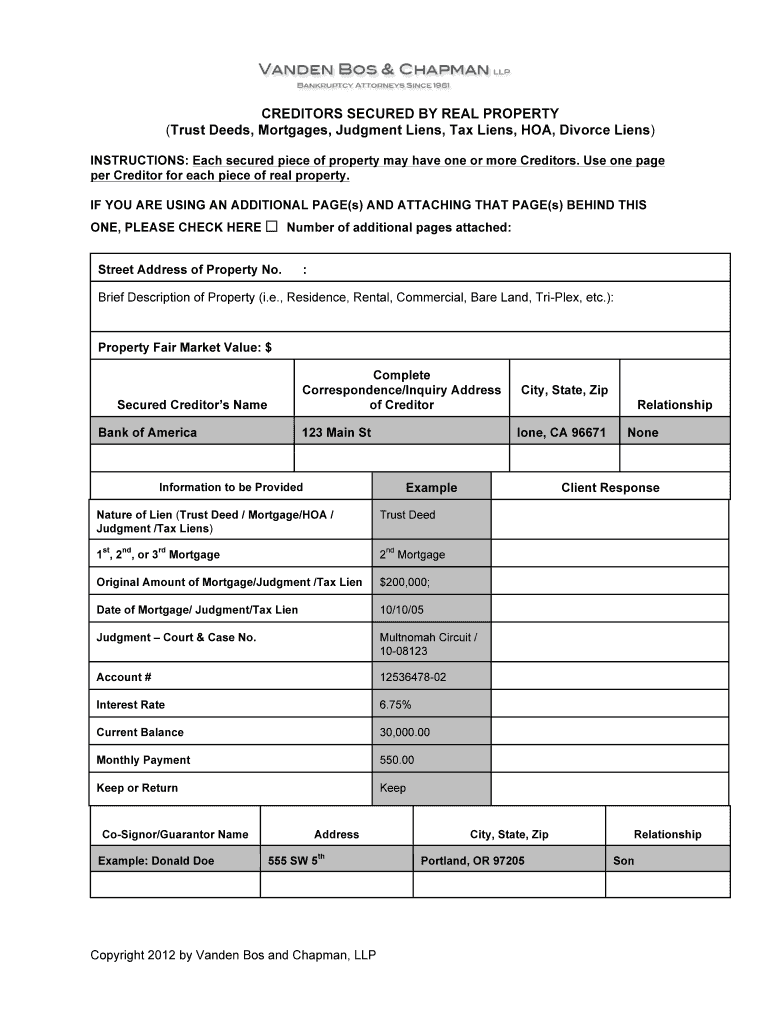

CREDITORS SECURED BY REAL PROPERTY (Trust Deeds, Mortgages, Judgment Liens, Tax Liens, HOA, Divorce Liens) INSTRUCTIONS: Each secured piece of property may have one or more Creditors. Use one page

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign creditors secured by real

Edit your creditors secured by real form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your creditors secured by real form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing creditors secured by real online

Use the instructions below to start using our professional PDF editor:

1

Sign into your account. It's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit creditors secured by real. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out creditors secured by real

How to fill out creditors secured by real:

01

Start by gathering all the necessary information related to the real estate property that will be used as collateral for the loan. This includes property documents, titles, deeds, and any other relevant paperwork.

02

Proceed to the creditor's application form, which will require personal information such as your name, address, contact details, and social security number. Fill in these details accurately and legibly to avoid any errors or delays in the process.

03

Next, provide details about the real estate property being used as collateral. This includes the property address, its current market value, and any outstanding mortgages or liens on the property.

04

Specify the amount of the loan being requested and the purpose of the loan. Clearly state whether it is for a specific project or general finance needs.

05

Include information about any existing creditors or lenders that already have a secured interest in the property. This is crucial for transparency and ensuring that all parties involved are aware of the existing claims.

06

Attach any supporting documents required by the creditor, such as income statements, bank statements, tax returns, or appraisals of the property. These documents help evaluate the borrower's financial capacity and the value of the collateral.

07

Review the completed application form thoroughly for accuracy and completeness. Make sure all relevant sections are filled out and signed appropriately.

08

Submit the completed application form and supporting documents to the creditor through the designated channels, such as online submission, mail, or in-person delivery. Keep copies of all submitted documents for future reference.

Who needs creditors secured by real?

01

Property buyers: Individuals or businesses looking to acquire real estate properties often seek creditors secured by real to finance their purchase. This allows them to use the property as collateral and secure favorable loan terms.

02

Real estate investors: Investors who specialize in buying, renovating, or developing properties may require creditors secured by real to fund their projects. The collateral helps mitigate the risks for lenders while providing investors with the necessary capital to grow their real estate portfolios.

03

Homeowners seeking loans: Homeowners who need to access funds for home improvement projects, debt consolidation, or other financial needs may opt for creditors secured by real. By leveraging their property as collateral, they can potentially secure lower interest rates and higher loan amounts compared to unsecured loans.

04

Businesses in need of capital: Startups, small businesses, or established companies often require additional capital for expansion, equipment purchases, or working capital. Creditors secured by real offer these businesses an opportunity to use their property as collateral, providing lenders with greater security and more favorable loan terms.

Remember, the specific requirements and eligibility criteria for creditors secured by real may vary depending on the lender and jurisdiction. It's important to consult with a financial advisor or relevant professionals to ensure compliance and make informed decisions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send creditors secured by real for eSignature?

When your creditors secured by real is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

Can I create an electronic signature for the creditors secured by real in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your creditors secured by real in seconds.

How do I fill out the creditors secured by real form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign creditors secured by real and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

What is creditors secured by real?

Creditors secured by real refers to creditors who have a security interest in real property owned by a debtor.

Who is required to file creditors secured by real?

The creditors who have a security interest in real property are required to file creditors secured by real.

How to fill out creditors secured by real?

Creditors secured by real can be filled out by providing information about the creditor, the debtor, the real property, and the security interest.

What is the purpose of creditors secured by real?

The purpose of creditors secured by real is to provide a public record of creditors who have a security interest in real property.

What information must be reported on creditors secured by real?

Information such as the creditor's name, address, the debtor's name, description of the real property, and details of the security interest must be reported on creditors secured by real.

Fill out your creditors secured by real online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Creditors Secured By Real is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.