Get the free EE send Savings Bonds enrollment form to Payroll Office Set up the ... - ofm wa

Show details

EE send Savings Bonds enrollment form to Payroll Office Set up the Bond Purchases in PA30 NO More than one beneficiary? YES To purchase a Savings Bond with a single owner/beneficiary To purchase Savings

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your ee send savings bonds form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ee send savings bonds form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ee send savings bonds online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit ee send savings bonds. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

How to fill out ee send savings bonds

Point by point, here is how to fill out ee send savings bonds:

01

Obtain the necessary forms: To fill out ee send savings bonds, you will need to obtain the appropriate forms. These forms can typically be found on the official website of the U.S. Department of the Treasury or obtained from a financial institution.

02

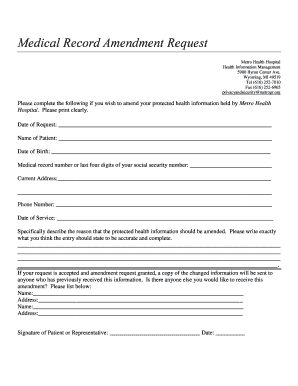

Provide personal information: Start by filling out your personal information on the form. This may include your name, social security number, address, and other relevant details. Make sure to provide accurate and up-to-date information to avoid any delays or issues in the process.

03

Identify the bonds: If you already have the savings bonds that you want to send, you will need to identify them on the form. This may involve providing the bond serial numbers, issue dates, face values, and other relevant details. If you don't have the bonds yet, you may need to follow the instructions on the form to obtain them.

04

Determine the recipient: Decide who you want to send the ee savings bonds to. This could be yourself, a family member, a friend, or anyone else you choose. Keep in mind that there may be restrictions or limitations on who can be listed as the recipient, so be sure to review the guidelines mentioned on the form.

05

Specify the delivery method: Choose how you would like the ee savings bonds to be delivered. This may include options such as electronic delivery or physical mailing. Select the method that works best for you and follow the instructions provided on the form to complete this step.

06

Complete any additional requirements: Depending on the circumstances, there may be additional requirements or forms that need to be filled out. For example, if you are sending ee savings bonds as a gift, you may need to provide additional information or fill out a separate gifting form. Make sure to carefully review the instructions and fulfill any additional requirements mentioned.

Who needs ee send savings bonds?

01

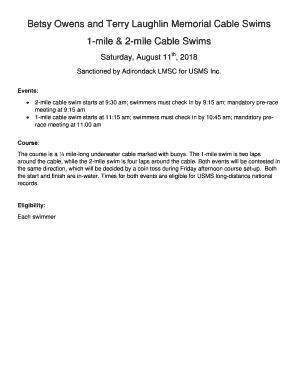

Individuals looking for a long-term savings option: EE savings bonds can be beneficial for individuals who are seeking a safe and reliable long-term savings option. These bonds earn interest over time and can be redeemed after a specific maturity period.

02

Those interested in supporting their financial goals: EE savings bonds can be utilized to support various financial goals, such as saving for education, retirement, or other future expenses. They provide a low-risk investment option that can help individuals grow their savings over time.

03

Gift givers and recipients: EE savings bonds can be a thoughtful and meaningful gift option for special occasions like birthdays, weddings, or the birth of a child. Individuals who want to give a gift that holds value and has the potential to appreciate over time may consider purchasing and sending ee savings bonds.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is ee send savings bonds?

EE Savings Bonds are a type of savings bond issued by the United States Treasury. They are typically purchased at a discount to their face value and accrue interest over time.

Who is required to file ee send savings bonds?

Individuals who have purchased EE Savings Bonds and meet the eligibility criteria are required to file EE Savings Bonds.

How to fill out ee send savings bonds?

To fill out EE Savings Bonds, you need to provide the necessary information such as your personal details, bond details, and payment information. This can be done through online platforms or by completing paper forms.

What is the purpose of ee send savings bonds?

The purpose of EE Savings Bonds is to provide individuals with a safe and secure investment option that helps them save money for the future. These bonds offer competitive interest rates and can be redeemed after a certain period of time.

What information must be reported on ee send savings bonds?

When filing EE Savings Bonds, you are required to report information such as the bondholder's name, social security number, bond serial number, and the bond issue date.

When is the deadline to file ee send savings bonds in 2023?

The exact deadline to file EE Savings Bonds in 2023 has not been specified yet. It is advisable to check with the United States Treasury or consult a tax professional for the most accurate and up-to-date information.

What is the penalty for the late filing of ee send savings bonds?

The penalty for the late filing of EE Savings Bonds can vary depending on the specific circumstances. It is advisable to consult the guidelines provided by the United States Treasury or seek professional tax advice to understand the penalties associated with late filing.

How do I edit ee send savings bonds in Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your ee send savings bonds, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

Can I create an eSignature for the ee send savings bonds in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your ee send savings bonds directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

How do I complete ee send savings bonds on an Android device?

Complete ee send savings bonds and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

Fill out your ee send savings bonds online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.