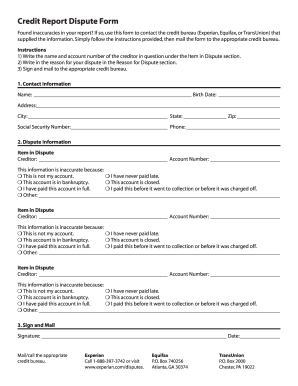

PrivacyGuard Credit Report Dispute Form free printable template

Show details

Credit Report Dispute Form If you feel there are inaccuracies in your Credit Report, you must contact each of the three major credit reporting agencies in whose report the information appears. Please

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign privacyguard credit dispute download form

Edit your privacyguard report dispute fill form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 609 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 609 form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit PrivacyGuard Credit Report Dispute Form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out PrivacyGuard Credit Report Dispute Form

How to fill out PrivacyGuard Credit Report Dispute Form

01

Obtain the PrivacyGuard Credit Report Dispute Form from the PrivacyGuard website or customer service.

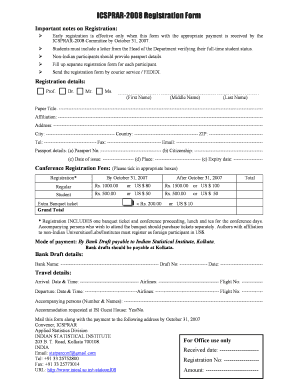

02

Fill in your personal information, including your name, address, and Social Security number.

03

Specify the account that you are disputing by including the creditor's name and account number.

04

Clearly describe the error in the credit report, providing any necessary details to support your claim.

05

Include any documents that may support your dispute, such as bank statements or correspondence with the creditor.

06

Sign and date the form to authenticate your dispute.

07

Submit the completed form via mail, email, or fax, according to the instructions provided.

Who needs PrivacyGuard Credit Report Dispute Form?

01

Individuals who find inaccuracies or discrepancies on their credit reports.

02

Consumers looking to correct errors that may affect their credit score.

03

Anyone who has been a victim of identity theft and needs to dispute fraudulent accounts.

Fill

form

: Try Risk Free

People Also Ask about

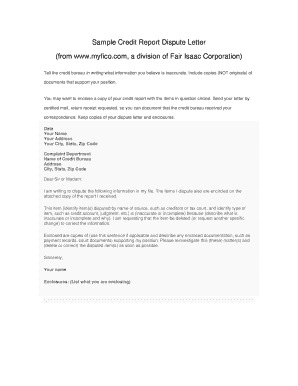

What is Section 609 credit repair loophole?

"The 609 loophole is a section of the Fair Credit Reporting Act that says that if something is incorrect on your credit report, you have the right to write a letter disputing it," said Robin Saks Frankel, a personal finance expert with Forbes Advisor.

What's the purpose of a 609 letter?

A 609 dispute letter points out some inaccurate, negative, or erroneous information on your credit report, forcing the credit company to change them.

Do credit removal letters work?

One possible solution: You may be able to remove late payments on your credit reports and start to improve your credit with a “goodwill letter.” A goodwill letter won't always work, but some consumers have reported success. It's worth trying because these derogatory marks on your credit can last seven years.

What is the 609 loophole?

A 609 Dispute Letter is often billed as a credit repair secret or legal loophole that forces the credit reporting agencies to remove certain negative information from your credit reports.

What is a 609 form?

A 609 letter is a credit repair method that requests credit bureaus to remove erroneous negative entries from your credit report. It's named after section 609 of the Fair Credit Reporting Act (FCRA), a federal law that protects consumers from unfair credit and collection practices. Written by Natasha Wiebusch, J.D..

Do 609 letters really work?

There's no evidence to suggest a 609 letter is more or less effective than the usual process of disputing an error on your credit report—it's just another method of gathering information and seeking verification of the accuracy of the report. If disputes are successful, the credit bureaus may remove the negative item.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my PrivacyGuard Credit Report Dispute Form directly from Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your PrivacyGuard Credit Report Dispute Form along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How do I complete PrivacyGuard Credit Report Dispute Form online?

pdfFiller has made filling out and eSigning PrivacyGuard Credit Report Dispute Form easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

Can I create an electronic signature for signing my PrivacyGuard Credit Report Dispute Form in Gmail?

Create your eSignature using pdfFiller and then eSign your PrivacyGuard Credit Report Dispute Form immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

What is PrivacyGuard Credit Report Dispute Form?

The PrivacyGuard Credit Report Dispute Form is a document that allows individuals to formally contest inaccuracies or errors found in their credit report. It is used to communicate discrepancies to credit reporting agencies.

Who is required to file PrivacyGuard Credit Report Dispute Form?

Any individual who identifies inaccuracies in their credit report is required to file the PrivacyGuard Credit Report Dispute Form to seek correction of the errors.

How to fill out PrivacyGuard Credit Report Dispute Form?

To fill out the PrivacyGuard Credit Report Dispute Form, provide personal identifying information, clearly describe the inaccuracies, attach supporting documentation, and sign the form before submitting it to the relevant credit reporting agency.

What is the purpose of PrivacyGuard Credit Report Dispute Form?

The purpose of the PrivacyGuard Credit Report Dispute Form is to officially notify credit reporting agencies of errors in an individual's credit report and prompt investigation and correction of such discrepancies.

What information must be reported on PrivacyGuard Credit Report Dispute Form?

The information that must be reported on the PrivacyGuard Credit Report Dispute Form includes the individual's personal details, a description of the disputed information, the reason for the dispute, and any supporting documents that validate the claim.

Fill out your PrivacyGuard Credit Report Dispute Form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

PrivacyGuard Credit Report Dispute Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.