Get the free CORRECTIVE AFFIDAVIT - payeanytimeie

Show details

The Expression The State throughout this form is to be interpreted, having regard to Article 3 of the Constitution, as referable to the area to which the laws of Ireland have application. PPS No.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your corrective affidavit - payeanytimeie form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your corrective affidavit - payeanytimeie form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing corrective affidavit - payeanytimeie online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit corrective affidavit - payeanytimeie. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

How to fill out corrective affidavit - payeanytimeie

How to fill out corrective affidavit - payeanytimeie:

01

First, gather all the necessary information and documentation required for the corrective affidavit. This may include details such as your personal information, tax identification number, and any relevant supporting documents.

02

Next, visit the official payeanytimeie website and locate the correct form for the corrective affidavit. Ensure that you are using the most up-to-date version of the form to avoid any complications.

03

Carefully read the instructions provided on the form and familiarize yourself with the specific requirements for completing the corrective affidavit.

04

Begin filling out the form by entering your personal information in the designated fields. Make sure to double-check the accuracy of all the details provided before proceeding.

05

Follow the instructions on the form to indicate the reason for filing the corrective affidavit. Provide a detailed explanation of the error or mistake that needs to be corrected.

06

If necessary, attach any supporting documents or evidence that substantiate your claim and help rectify the error. Ensure that these documents are securely attached to the form to prevent them from getting lost.

07

Review the completed form once again, paying close attention to any sections that require a signature or date. Sign the form and enter the current date to validate your submission.

08

Make copies of the completed corrective affidavit and any supporting documents for your records. It is advisable to store these copies in a safe and easily accessible location.

09

Submit the filled-out corrective affidavit to the appropriate authority as specified on the payeanytimeie website. Follow any additional instructions provided to ensure the correct submission process.

10

Keep track of the progress and status of your corrective affidavit to ensure that it is processed correctly. Follow up with the relevant authority if there are any delays or issues that need to be resolved.

Who needs corrective affidavit - payeanytimeie:

01

Individuals who have identified errors or mistakes in their previously filed tax information may require a corrective affidavit from payeanytimeie.

02

Those who have received notification or communication from payeanytimeie regarding discrepancies in their tax records may also need to submit a corrective affidavit.

03

Any taxpayer who wishes to rectify inaccuracies or update their tax details to ensure compliance with the payeanytimeie system should consider filling out a corrective affidavit.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

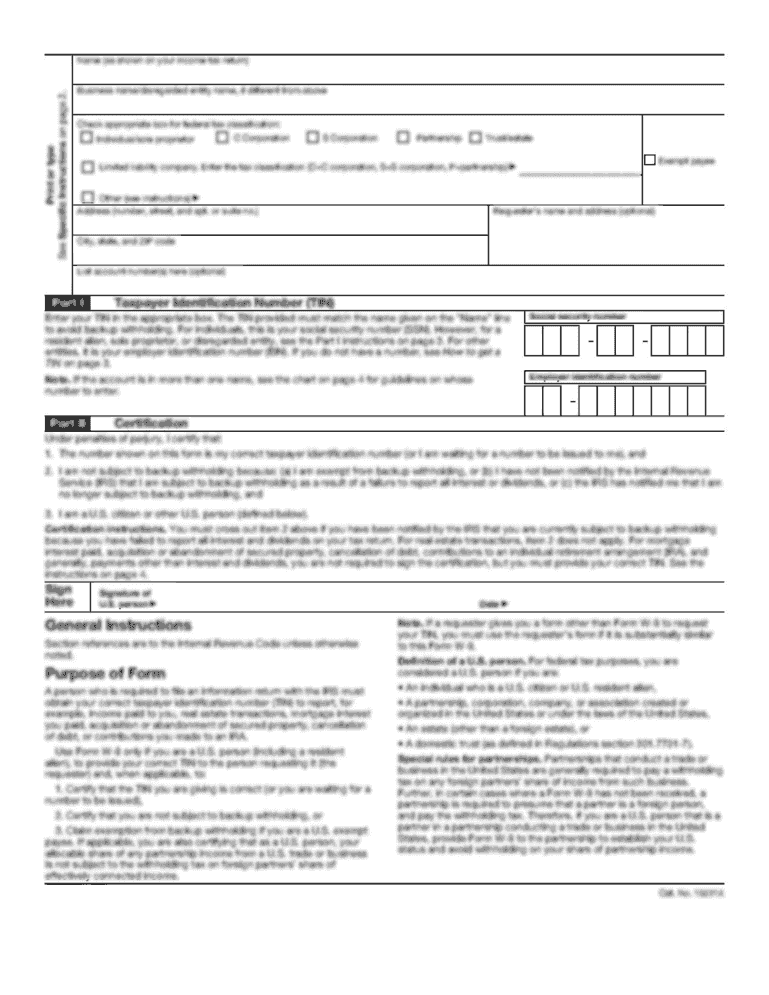

What is corrective affidavit - payeanytimeie?

Corrective affidavit on payeanytimeie is a form that allows taxpayers to correct any errors or discrepancies in their PAYE (Pay As You Earn) information submitted to the Revenue Commissioners in Ireland.

Who is required to file corrective affidavit - payeanytimeie?

Any taxpayer who needs to correct errors or discrepancies in their PAYE information submitted to the Revenue Commissioners in Ireland is required to file a corrective affidavit on payeanytimeie.

How to fill out corrective affidavit - payeanytimeie?

To fill out a corrective affidavit on payeanytimeie, taxpayers can log in to their PAYE Anytime account, navigate to the section for corrections, and follow the prompts to enter and submit the corrected information.

What is the purpose of corrective affidavit - payeanytimeie?

The purpose of a corrective affidavit on payeanytimeie is to ensure that taxpayers can rectify any errors or discrepancies in their PAYE information submitted to the Revenue Commissioners accurately and promptly.

What information must be reported on corrective affidavit - payeanytimeie?

The corrective affidavit on payeanytimeie may require taxpayers to report specific details such as corrected income amounts, tax deductions, employee details, and any other relevant information necessary to rectify the errors or discrepancies.

When is the deadline to file corrective affidavit - payeanytimeie in 2024?

The deadline to file a corrective affidavit on payeanytimeie in 2024 may vary, and taxpayers are advised to check with the Revenue Commissioners or visit the official website for the most up-to-date information.

What is the penalty for the late filing of corrective affidavit - payeanytimeie?

The penalty for the late filing of a corrective affidavit on payeanytimeie may include fines or interest charges imposed by the Revenue Commissioners in Ireland. It is advisable for taxpayers to file the corrective affidavit promptly to avoid such penalties.

How can I modify corrective affidavit - payeanytimeie without leaving Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including corrective affidavit - payeanytimeie, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How can I send corrective affidavit - payeanytimeie to be eSigned by others?

When you're ready to share your corrective affidavit - payeanytimeie, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I complete corrective affidavit - payeanytimeie on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your corrective affidavit - payeanytimeie. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

Fill out your corrective affidavit - payeanytimeie online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.