Get the free C32006 - Notes to help you fill in form C1 Confirmation

Show details

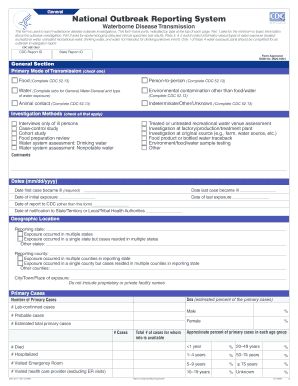

Notes to help you fill in form C1 Confirmation Inventory and form C5(2006) HM Revenue & Customs Return C3(2006) Contents Introduction 4 What to do when you have filled in the forms 28 Obtaining Confirmation

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign c32006 - notes to

Edit your c32006 - notes to form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your c32006 - notes to form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit c32006 - notes to online

To use the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit c32006 - notes to. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out c32006 - notes to

How to fill out c32006 - Notes To:

01

Begin by reviewing the purpose of c32006 - Notes To. This form is typically used to provide additional information or explanations regarding specific entries within a document or report.

02

Identify the specific entry or section within the document that requires additional clarification. This could be a line item, a table, or any other element that needs further explanation.

03

Clearly label the corresponding section in c32006 - Notes To with the same identifier as the entry in the main document. This will ensure that the reader can easily connect the notes with the relevant section.

04

Provide a concise and informative explanation or comment in the c32006 - Notes To section. Use clear language and avoid any unnecessary jargon or technical terms that may confuse the reader.

05

If necessary, include any supporting documentation or references to further enhance the understanding of the entry. This can include charts, graphs, or relevant excerpts from other documents.

06

Double-check the accuracy and completeness of the information provided in c32006 - Notes To. Ensure that all relevant details are included and that there are no errors or omissions.

07

Before finalizing the document, review c32006 - Notes To once again to ensure that the notes are consistent with the overall message and purpose of the document.

Who needs c32006 - Notes To:

01

Professionals in various industries who need to provide additional information or explanations for specific entries within a document or report.

02

Accountants and financial professionals who want to provide clarifications for certain financial statements, transactions, or line items.

03

Researchers and analysts who need to present further details or findings related to certain data or figures in their reports.

04

Compliance officers or auditors who require additional explanations or justifications for certain actions or decisions made.

05

Legal professionals who need to provide footnotes or annotations for specific sections of legal documents or contracts.

Note: The need for c32006 - Notes To may vary depending on the specific requirements of each industry or organization. It is important to consult the relevant guidelines or regulations to ensure proper compliance.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send c32006 - notes to to be eSigned by others?

Once you are ready to share your c32006 - notes to, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

Where do I find c32006 - notes to?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific c32006 - notes to and other forms. Find the template you need and change it using powerful tools.

How do I fill out c32006 - notes to on an Android device?

Use the pdfFiller app for Android to finish your c32006 - notes to. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is c32006 - notes to?

c32006 - notes to is a section of the financial statements that provides additional information and explanations to help users understand the numbers presented in the main financial statements.

Who is required to file c32006 - notes to?

c32006 - notes to must be filed by companies and organizations that are required to prepare financial statements.

How to fill out c32006 - notes to?

c32006 - notes to should be filled out by providing detailed explanations, clarifications, and additional information related to the items presented in the main financial statements.

What is the purpose of c32006 - notes to?

The purpose of c32006 - notes to is to provide transparency and clarity regarding the financial performance and position of the reporting entity.

What information must be reported on c32006 - notes to?

c32006 - notes to must include details about accounting policies, contingencies, subsequent events, related party transactions, and other relevant information that cannot be included in the main financial statements.

Fill out your c32006 - notes to online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

c32006 - Notes To is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.