Get the free U.S. USDA Form usda-fsa-153

Show details

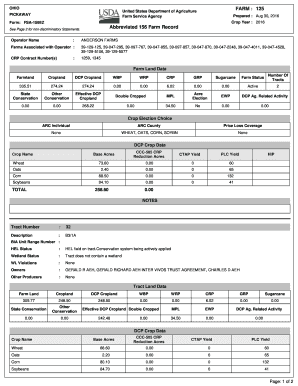

U.S. USDA Form usda-fsa-153 This form is available electronically. U.S. DEPARTMENT OF AGRICULTURE Farm Service Agency 05-24-01 AMENDED FSA-153 Form Approved - OMB No. 0560-0097 1. You are a foreign person under the provisions of Pub. L. 95-460 and must complete the front side of this form FSA-153 if your answer is NO to all the statements in Items 1 2 and 3 below YES NO 1. DO NOT SEND THIS FORM DIRECTLY TO WASHINGTON D.C. UNLESS GRANTED PERMISSIO...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your us usda form usda-fsa-153 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your us usda form usda-fsa-153 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing us usda form usda-fsa-153 online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit us usda form usda-fsa-153. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is us usda form usda-fsa-153?

USDA Form USDA-FSA-153 is a form used by the United States Department of Agriculture (USDA) to collect financial information from farmers and ranchers for the purpose of assessing their eligibility for certain agricultural programs and services.

Who is required to file us usda form usda-fsa-153?

Farmers and ranchers who want to apply for certain agricultural programs and services offered by the USDA are required to file USDA Form USDA-FSA-153. The specific eligibility requirements may vary depending on the program or service being sought.

How to fill out us usda form usda-fsa-153?

To fill out USDA Form USDA-FSA-153, you need to provide accurate and detailed information about your financial situation as a farmer or rancher. The form typically includes sections for reporting income, assets, liabilities, and other relevant financial information. It is important to carefully review the instructions provided with the form and ensure all required fields are completed accurately.

What is the purpose of us usda form usda-fsa-153?

The purpose of USDA Form USDA-FSA-153 is to collect financial information from farmers and ranchers in order to assess their eligibility for various agricultural programs and services offered by the USDA. The form helps the USDA determine the financial status and needs of applicants, and make informed decisions regarding program or service eligibility.

What information must be reported on us usda form usda-fsa-153?

USDA Form USDA-FSA-153 typically requires farmers and ranchers to report their income, assets, liabilities, and other pertinent financial information. The specific details and requirements may vary depending on the program or service being sought, but the form generally asks for information such as gross income from farming or ranching activities, debts, including loans and mortgages, and details about assets such as land, buildings, and equipment.

When is the deadline to file us usda form usda-fsa-153 in 2023?

The deadline to file USDA Form USDA-FSA-153 in 2023 may vary depending on the specific program or service being applied for. It is recommended to consult the USDA or relevant program guidelines for the most accurate and up-to-date deadline information.

What is the penalty for the late filing of us usda form usda-fsa-153?

The penalty for the late filing of USDA Form USDA-FSA-153 may vary depending on the specific program or service and the regulations in place at the time. It is important to consult the USDA or relevant program guidelines for information on potential penalties for late filing.

How can I modify us usda form usda-fsa-153 without leaving Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your us usda form usda-fsa-153 into a dynamic fillable form that you can manage and eSign from anywhere.

Where do I find us usda form usda-fsa-153?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific us usda form usda-fsa-153 and other forms. Find the template you need and change it using powerful tools.

Can I create an electronic signature for signing my us usda form usda-fsa-153 in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your us usda form usda-fsa-153 and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

Fill out your us usda form usda-fsa-153 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.