GA DoR G-1003 2006 free printable template

Show details

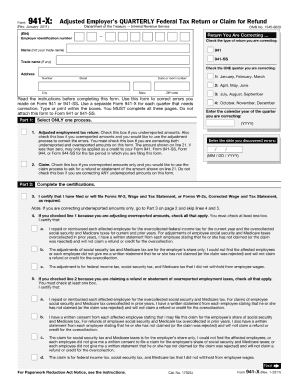

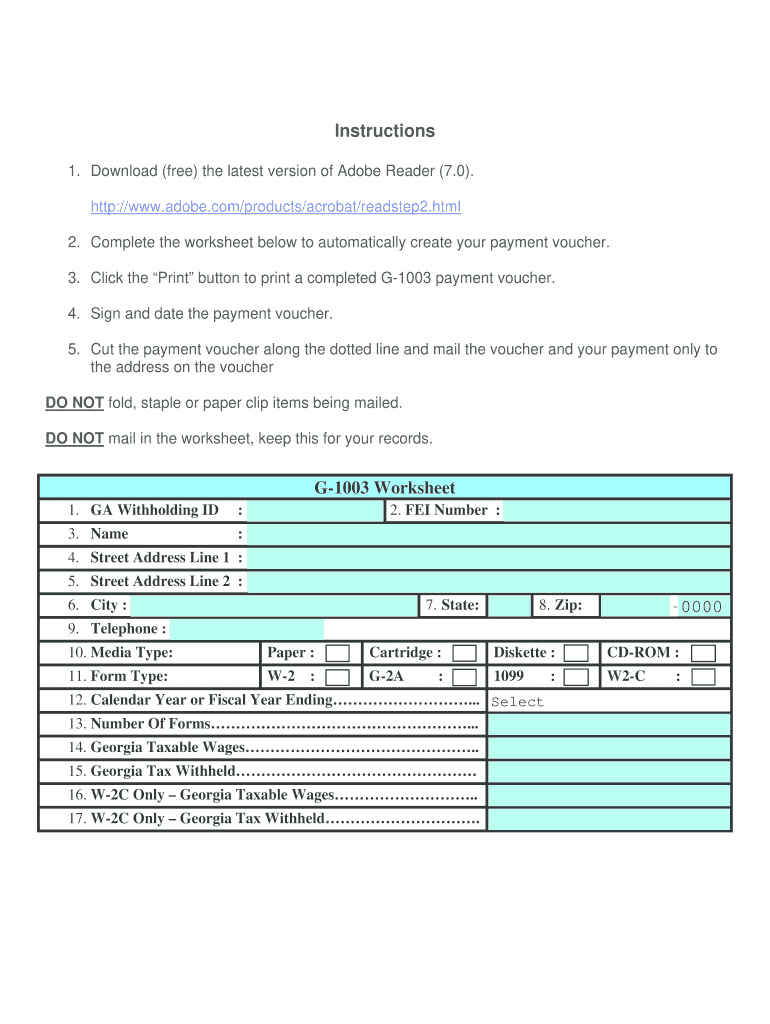

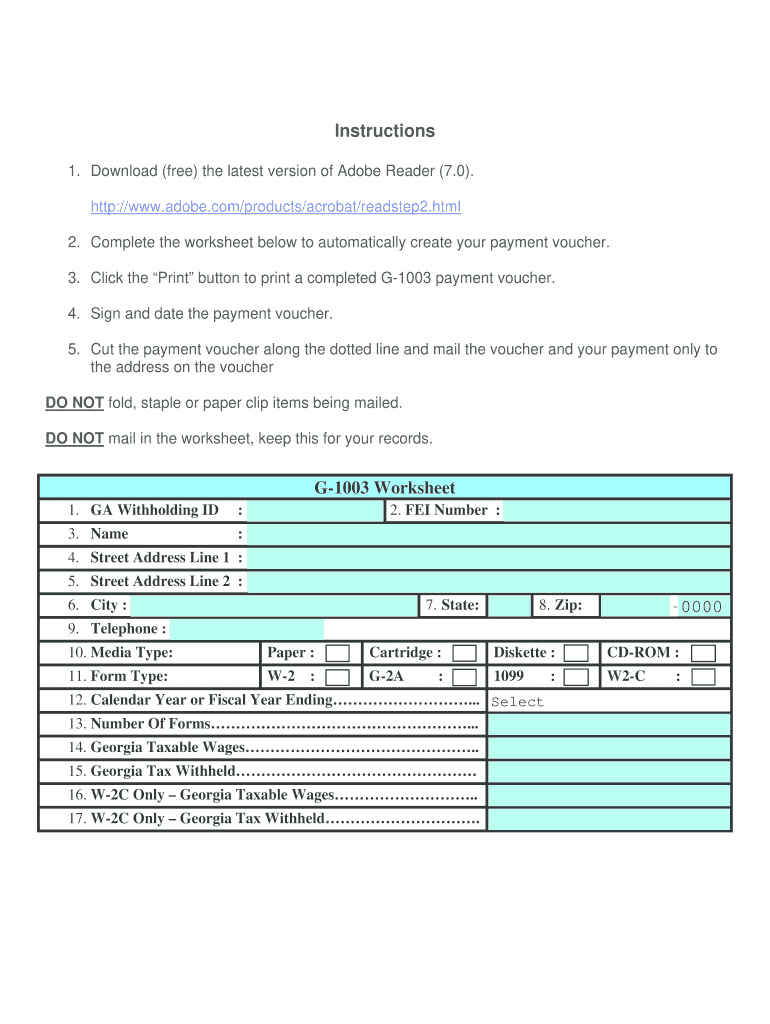

G-1003 Worksheet 1. GA Withholding ID 3. Name 2. FEI Number 4. Street Address Line 1 6. City 7. State 8. Zip -0000 9. Telephone 10. Media Type Paper Cartridge Diskette CD-ROM 11. Form Type W-2 G-2A W2-C 12. The Number of Forms Media Type Form Type Georgia Taxable Wages and Georgia Tax Withheld blocks must be completed. Submit Form G-1003 and magnetic media or paper copy income statements to Georgia Department of Revenue Processing Center P. PLEASE REMOVE ALL CHECK STUBS Cut on dotted line...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your form g 1003 instructions form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form g 1003 instructions form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form g 1003 instructions online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Log in to account. Click Start Free Trial and sign up a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit form g 1003 instructions. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

GA DoR G-1003 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out form g 1003 instructions

How to fill out form g 1003 instructions?

01

Start by reading the instructions carefully to understand the purpose and requirements of the form.

02

Gather all the necessary information and documents needed to complete the form, such as personal details, employment history, and financial information.

03

Fill in the personal information section, including your name, address, contact information, and Social Security number.

04

Provide accurate information about your employment history, including your current and previous employers, job titles, dates of employment, and income earned.

05

Complete the financial information section, which may include details about your assets, liabilities, expenses, and income sources.

06

If applicable, provide information about co-applicants or co-signers, including their personal and financial details.

07

Review the form for any errors or missing information before submitting it. Ensure that all the required fields are completed correctly.

08

Sign and date the form as required.

09

Submit the completed form g 1003 as directed by the instructions, whether it is electronically or by mail.

Who needs form g 1003 instructions?

01

Individuals who are applying for a mortgage loan or refinancing their current mortgage may need form g 1003 instructions.

02

Mortgage loan officers and lenders may also require form g 1003 instructions to properly process loan applications.

03

Homebuyers or homeowners seeking to provide accurate and complete information to lenders and mortgage loan officers may need form g 1003 instructions.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is form g 1003 instructions?

Form G 1003 instructions provide guidance on how to complete and submit the Form G 1003, which is used for reporting specific information related to a certain process or procedure.

Who is required to file form g 1003 instructions?

Anyone who is required to submit the Form G 1003, as specified by the governing authority or organization, is required to file Form G 1003 instructions.

How to fill out form g 1003 instructions?

To fill out Form G 1003 instructions, you need to follow the instructions provided in the form itself. These instructions will guide you on how to complete each section and provide the necessary information.

What is the purpose of form g 1003 instructions?

The purpose of Form G 1003 instructions is to assist individuals in accurately and properly completing the Form G 1003 to ensure that the required information is reported correctly and in a timely manner.

What information must be reported on form g 1003 instructions?

The specific information that must be reported on Form G 1003 instructions may vary depending on the purpose or context of the form. It is important to carefully review the instructions provided with the form to ensure that all required information is reported.

When is the deadline to file form g 1003 instructions in 2023?

The deadline to file Form G 1003 instructions in 2023 will be specified by the governing authority or organization that requires its submission. It is recommended to check with the relevant authority or refer to the specific instructions for the form to determine the exact deadline.

What is the penalty for the late filing of form g 1003 instructions?

The penalty for the late filing of Form G 1003 instructions may vary depending on the rules and regulations set forth by the governing authority or organization. It is advisable to refer to the specific guidelines and instructions provided by the authority to determine the penalties for late filing.

How can I send form g 1003 instructions for eSignature?

form g 1003 instructions is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How can I get form g 1003 instructions?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific form g 1003 instructions and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I execute form g 1003 instructions online?

pdfFiller makes it easy to finish and sign form g 1003 instructions online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

Fill out your form g 1003 instructions online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.