Get the free Restaurant and Bar Tax Form Instructions - City of DeKalb

Show details

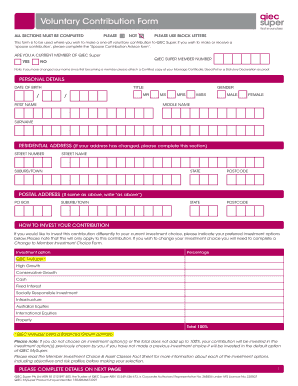

Instructions for Completing Your Restaurant, Bar & Package Liquor Tax Form Step One: Calculating Your Tax on Receipts Line 1: Food would include those food items whether sold at a restaurant, deli

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your restaurant and bar tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your restaurant and bar tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit restaurant and bar tax online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit restaurant and bar tax. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

How to fill out restaurant and bar tax

Point by point, here is how to fill out restaurant and bar tax:

01

Begin by gathering all the necessary financial documents related to your restaurant or bar business. This may include income statements, expense records, sales reports, and receipts.

02

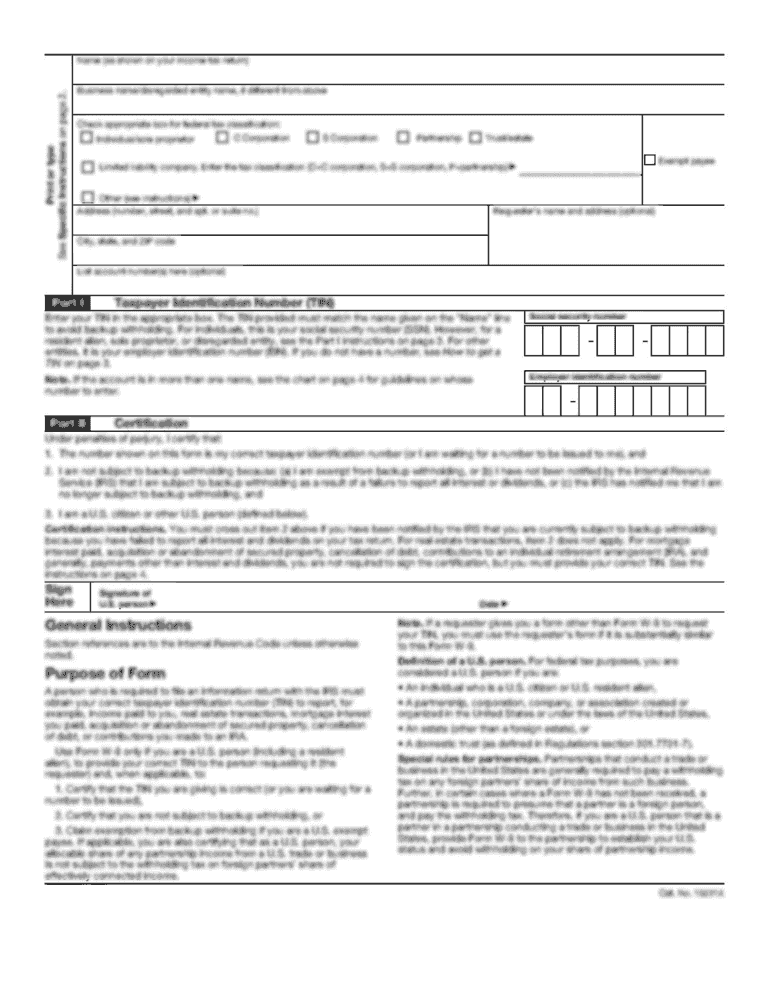

Familiarize yourself with the specific tax forms required for reporting restaurant and bar taxes. These forms may vary depending on the jurisdiction and type of business entity. Common forms include Schedule C (Profit or Loss from Business) and Form 1040 (U.S. Individual Income Tax Return).

03

Ensure that you have accurate records of all taxable sales, including both food and beverage sales. Different jurisdictions may have different tax rates for these items, so it is crucial to maintain detailed records.

04

Deduct any relevant business expenses that are allowed by the tax code. This may include expenses related to food and beverage purchases, labor costs, rent, utilities, marketing, and equipment.

05

Report any tips earned by your employees accurately. Tips are considered taxable income and should be reported accordingly. Ensure that you adhere to the regulations regarding tip reporting, as failing to do so can lead to penalties and audits.

06

Determine and calculate the appropriate sales tax owed based on the tax rates applicable in your jurisdiction. This may involve collecting sales tax from customers and remitting it to the relevant tax authorities.

07

Fill out the tax forms accurately and thoroughly, ensuring that all necessary information is provided. Double-check your calculations and review the forms for any errors or omissions.

08

Submit the completed tax forms along with any required payments to the appropriate tax authorities by the designated deadline. Be mindful of any specific filing deadlines and payment schedules to avoid penalties or interest charges.

Who needs restaurant and bar tax?

01

Restaurant and bar owners: As the owner of a restaurant or bar, you are required to report and pay taxes on the income generated by your business. This includes declaring sales revenue, deducting allowable business expenses, and remitting any applicable sales tax.

02

Self-employed individuals in the food and beverage industry: If you work as a self-employed individual in the food and beverage industry, such as a caterer or food truck operator, you are also subject to restaurant and bar tax regulations. You need to accurately report your income and expenses, as well as comply with sales tax requirements.

03

Employees who earn tips: Employees who receive tips while working in a restaurant or bar must report these earnings as taxable income. They are expected to keep accurate records and file their taxes accordingly, following the tip reporting guidelines provided by the tax authorities.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is restaurant and bar tax?

Restaurant and bar tax is a tax imposed on businesses in the food and beverage industry, specifically those operating restaurants and bars.

Who is required to file restaurant and bar tax?

Any business that operates a restaurant or bar is required to file restaurant and bar tax.

How to fill out restaurant and bar tax?

To fill out restaurant and bar tax, businesses need to gather all necessary financial information, such as sales records, expenses, and receipts. This information is then used to complete the tax forms provided by the tax authority.

What is the purpose of restaurant and bar tax?

The purpose of restaurant and bar tax is to generate revenue for the government and regulate the food and beverage industry.

What information must be reported on restaurant and bar tax?

Businesses must report their sales revenue, expenses, employee wages, and any applicable deductions or credits on their restaurant and bar tax forms.

When is the deadline to file restaurant and bar tax in 2023?

The deadline to file restaurant and bar tax in 2023 has not been specified. Please consult the tax authority or refer to official guidelines for the specific deadline.

What is the penalty for the late filing of restaurant and bar tax?

The penalty for the late filing of restaurant and bar tax varies depending on the jurisdiction and specific regulations. It is best to check with the tax authority or refer to official guidelines for accurate penalty information.

How can I get restaurant and bar tax?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the restaurant and bar tax. Open it immediately and start altering it with sophisticated capabilities.

How do I edit restaurant and bar tax straight from my smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing restaurant and bar tax right away.

How do I complete restaurant and bar tax on an Android device?

Use the pdfFiller mobile app to complete your restaurant and bar tax on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

Fill out your restaurant and bar tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.