Get the free FORM 22 ANNUAL RETURN section 263. FORMULE 22 RAPPORT ANNUEL article 263

Show details

Vol. 7, No. 29 Summer, 2007 I Did Not Know That... by David Spencer Almost two years ago, I was contacted by a British writer named Sean Began. He was researching a biography of author James (A Chorus

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your form 22 annual return form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 22 annual return form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 22 annual return online

To use the services of a skilled PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit form 22 annual return. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents.

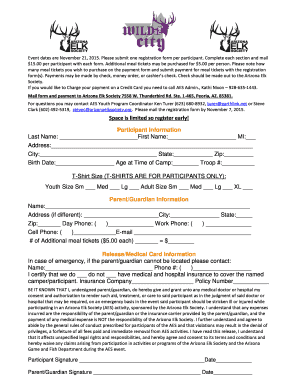

How to fill out form 22 annual return

How to fill out form 22 annual return:

01

Obtain a copy of form 22 annual return from the appropriate government agency or online portal.

02

Start by entering the necessary identification information, such as the business name, address, and taxpayer identification number.

03

Provide details about the income earned during the period covered by the annual return. This may involve listing different sources of revenue and calculating the total income.

04

Deduct any qualifying expenses or deductions to determine the taxable income. These expenses may include operating costs, salaries, and allowable deductions according to the relevant tax laws.

05

Calculate the amount of tax owed based on the taxable income and applicable tax rates. Enter this information in the appropriate section of the form.

06

Ensure all required schedules or attachments are accurately completed and attached to the form, if applicable.

07

Review the entire form thoroughly to check for any mistakes or omissions. Make corrections as necessary.

08

Sign the form and provide any additional required documents or declarations.

09

Submit the completed form 22 annual return to the appropriate government agency by the specified deadline.

Who needs form 22 annual return:

01

Businesses or organizations that are required to pay income tax or report their financial activities to the tax authorities.

02

This form may be required by corporations, partnerships, sole proprietorships, and other entities subject to taxation.

03

The specific requirements for filing form 22 annual return may vary by jurisdiction, so it is important to consult the relevant tax laws and regulations to determine if this form is required for a particular entity.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is form 22 annual return?

Form 22 annual return is a document that businesses and organizations are required to file with the appropriate authorities to report their financial information and activities for a specific period of time.

Who is required to file form 22 annual return?

All businesses and organizations, including corporations, partnerships, and sole proprietorships, are required to file form 22 annual return.

How to fill out form 22 annual return?

To fill out form 22 annual return, you will need to gather your financial information, including income, expenses, assets, and liabilities. Then, you can carefully complete the required sections of the form, providing accurate and complete information.

What is the purpose of form 22 annual return?

The purpose of form 22 annual return is to provide transparency and accountability in financial reporting. It allows the authorities and stakeholders to assess the financial health and compliance of businesses and organizations.

What information must be reported on form 22 annual return?

Form 22 annual return typically requires the reporting of financial statements, including income statements, balance sheets, and cash flow statements. Additionally, it may require disclosure of other financial information and supporting documentation.

When is the deadline to file form 22 annual return in 2023?

The deadline to file form 22 annual return in 2023 may vary depending on the jurisdiction and specific regulations. It is advisable to consult the relevant authorities or seek professional advice to determine the exact deadline.

What is the penalty for the late filing of form 22 annual return?

The penalty for the late filing of form 22 annual return may vary depending on the jurisdiction and specific regulations. It is advisable to consult the relevant authorities or seek professional advice to understand the potential penalties and consequences.

How do I make changes in form 22 annual return?

The editing procedure is simple with pdfFiller. Open your form 22 annual return in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How can I edit form 22 annual return on a smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing form 22 annual return.

How do I fill out form 22 annual return using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign form 22 annual return and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

Fill out your form 22 annual return online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.