Get the free Credit Application Form Tuning USAMP2doc - tuning

Show details

Formula de Inregistrare a Clientele Va multi entry interest Arafat data DE company coast. Va rug am SA completed formulary de Mai job entry an intense procedure Internet ale firmer coaster. Cod Fiscal/T.V.A.:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign credit application form tuning

Edit your credit application form tuning form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your credit application form tuning form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit credit application form tuning online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit credit application form tuning. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out credit application form tuning

How to fill out credit application form tuning:

01

Start by carefully reading the instructions provided on the credit application form. Understand the purpose of each section and the information required.

02

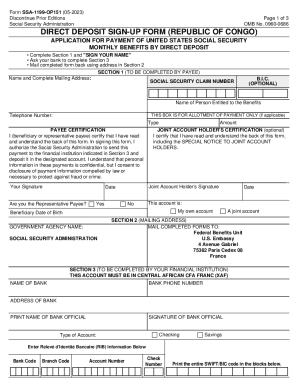

Begin by entering your personal information accurately, including your full name, contact details, and social security number or national identification number.

03

To demonstrate your financial stability and creditworthiness, provide information about your employment status, current job position, and monthly income. Include any additional sources of income that may strengthen your application.

04

Make sure to accurately list all your existing debts, such as loans, credit cards, or mortgages. This information helps the lender assess your ability to manage additional credit.

05

Provide details about your current living arrangement, including whether you rent or own your home, and the monthly rent or mortgage payment amount.

06

Indicate the purpose of the credit you are seeking, such as for a car purchase, home improvement, or debt consolidation.

07

Review your application form carefully and double-check for any errors or missing information. Any discrepancies or omissions could delay the processing of your application.

08

Sign and date the credit application form to certify the accuracy of the information provided.

09

Submit the completed form, along with any additional supporting documents that may be required by the lender.

Who needs credit application form tuning:

01

Individuals who want to improve their chances of credit approval: Filling out the credit application form accurately and providing all required information can enhance the likelihood of your application being approved.

02

Applicants with limited credit history: If you have a limited credit history, fine-tuning your credit application form by accurately documenting your financial stability and income sources can strengthen your case for credit approval.

03

Those seeking competitive interest rates: Complete and well-prepared credit application forms can demonstrate to lenders that you are a responsible borrower, which may lead to better interest rates and loan terms.

04

Individuals with existing debts: Properly disclosing and detailing your existing debts in the application form can help lenders assess your ability to manage additional credit and make timely loan payments.

05

Borrowers aiming to streamline the credit application process: By accurately completing the credit application form, you can help expedite the processing time of your application and potentially receive a quicker decision.

Remember, filling out a credit application form accurately and thoroughly is crucial to increase your chances of credit approval and secure favorable loan terms.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my credit application form tuning in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your credit application form tuning and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

How do I complete credit application form tuning on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your credit application form tuning, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

How do I fill out credit application form tuning on an Android device?

Use the pdfFiller app for Android to finish your credit application form tuning. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is credit application form tuning?

Credit application form tuning is the process of optimizing the information provided in a credit application form to increase the chances of approval.

Who is required to file credit application form tuning?

Credit applicants or individuals seeking credit approval are required to file credit application form tuning.

How to fill out credit application form tuning?

To fill out credit application form tuning, applicants must carefully review all the fields, provide accurate information, and make sure to include any relevant financial documents.

What is the purpose of credit application form tuning?

The purpose of credit application form tuning is to enhance the quality of the information provided in the form, ultimately improving the chances of credit approval.

What information must be reported on credit application form tuning?

Credit application form tuning must include personal information, financial details, credit history, and any other relevant information requested by the creditor.

Fill out your credit application form tuning online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Credit Application Form Tuning is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.