Get the free Chapter 13 Alive and Alone - webjerichoschoolsorg

Show details

E JERICHO HIGH SCHOOL Name Date Period MRS. McDermott EXTREMELYLOUD& INCREDIBLYCLOSE JONATHANSAFRANFOER Chapter13:AliveandAlone 1. WhydoesMr. Blacksayheisstoppingthesearch? HowdoesOskarfeelaboutthis?

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign chapter 13 alive and

Edit your chapter 13 alive and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your chapter 13 alive and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

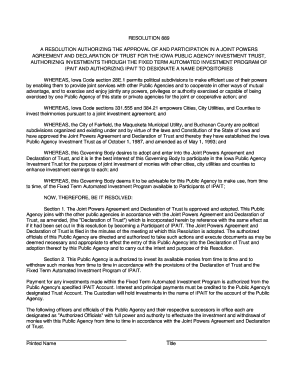

Editing chapter 13 alive and online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit chapter 13 alive and. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

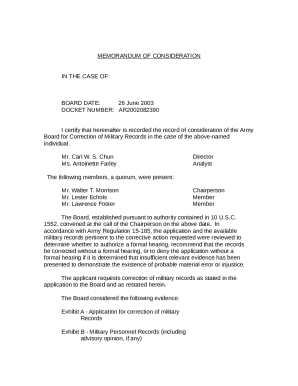

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

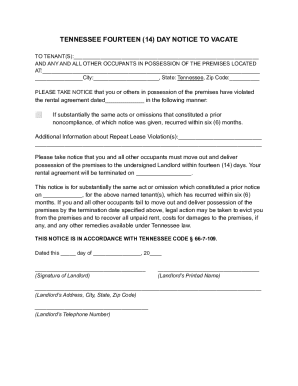

How to fill out chapter 13 alive and

How to fill out chapter 13 alive and:

01

Gather all necessary financial information: Start by collecting all your financial documents such as bank statements, pay stubs, tax returns, and any other relevant paperwork.

02

Complete the required forms: Fill out the necessary forms for filing chapter 13 bankruptcy, such as the petition, schedules, and a proposed repayment plan. These forms will ask for details about your income, debts, assets, and expenses.

03

Calculate your disposable income: Determine your disposable income by subtracting your allowed expenses from your monthly income. This will help you determine how much you can afford to repay your creditors.

04

Create a feasible repayment plan: Develop a repayment plan that outlines how you will repay your debts over a three to five-year period. This plan should prioritize secured debts, such as mortgages or car loans, followed by priority debts like tax obligations or child support. Any remaining income should be allocated to nonpriority debts.

05

Submit your forms and repayment plan: File your completed bankruptcy forms and proposed repayment plan with the bankruptcy court. Make sure to pay any required filing fees. Keep copies of all documents for your records.

06

Attend the creditors' meeting: After filing, you will be required to attend a meeting of creditors, also known as a 341 meeting. During this meeting, your bankruptcy trustee and creditors may ask you questions about your financial situation and repayment plan.

07

Follow the court-approved plan: Once your repayment plan is approved by the court, be sure to make the scheduled payments on time and in full. Failure to comply with the plan may result in the dismissal of your bankruptcy case.

Who needs chapter 13 alive and:

01

Individuals with a regular income: Chapter 13 bankruptcy is designed for individuals who have a steady source of income and can afford to repay a portion of their debts over time.

02

Debtors with assets they want to retain: Chapter 13 allows debtors to keep their assets, such as homes or vehicles, by creating a manageable repayment plan. This can be beneficial for individuals who want to protect their property from being liquidated in a chapter 7 bankruptcy.

03

Those facing foreclosure or repossession: Chapter 13 can help debtors prevent foreclosure or repossession by providing a way to catch up on missed mortgage or car payments through the repayment plan.

04

Individuals with priority debts: Chapter 13 allows debtors to prioritize certain debts, such as tax obligations or child support, and repay them over time.

Overall, chapter 13 bankruptcy can be a suitable option for individuals who have a regular income and want to repay their debts while keeping their assets. However, it is important to consult with a bankruptcy attorney to assess your specific situation and determine if chapter 13 is the right choice for you.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get chapter 13 alive and?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the chapter 13 alive and in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I make changes in chapter 13 alive and?

With pdfFiller, it's easy to make changes. Open your chapter 13 alive and in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

Can I create an electronic signature for signing my chapter 13 alive and in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your chapter 13 alive and directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

What is chapter 13 alive and?

Chapter 13 bankruptcy allows individuals with a regular income to create a plan to repay all or part of their debts.

Who is required to file chapter 13 alive and?

Individuals with a regular income who have unsecured debts less than $419,275 and secured debts less than $1,257,850 are eligible to file for Chapter 13 bankruptcy.

How to fill out chapter 13 alive and?

To fill out Chapter 13 bankruptcy forms, individuals must gather information about their debts, income, expenses, and assets, and then work with an attorney to complete and file the necessary paperwork.

What is the purpose of chapter 13 alive and?

The purpose of Chapter 13 bankruptcy is to provide individuals with a way to reorganize their debts and create a repayment plan to satisfy creditors over a period of 3 to 5 years.

What information must be reported on chapter 13 alive and?

Chapter 13 bankruptcy forms require individuals to report information about their income, expenses, debts, assets, and any recent financial transactions.

Fill out your chapter 13 alive and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Chapter 13 Alive And is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.