Get the free Corporate, LLC, Church and Government Application for Credit

Show details

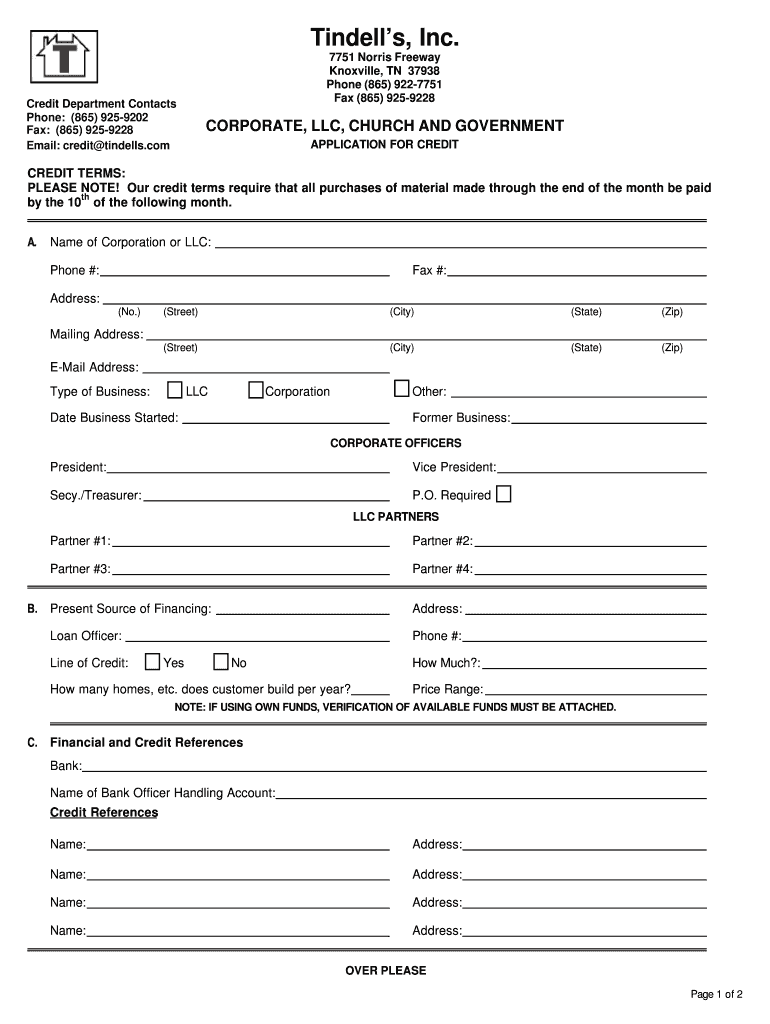

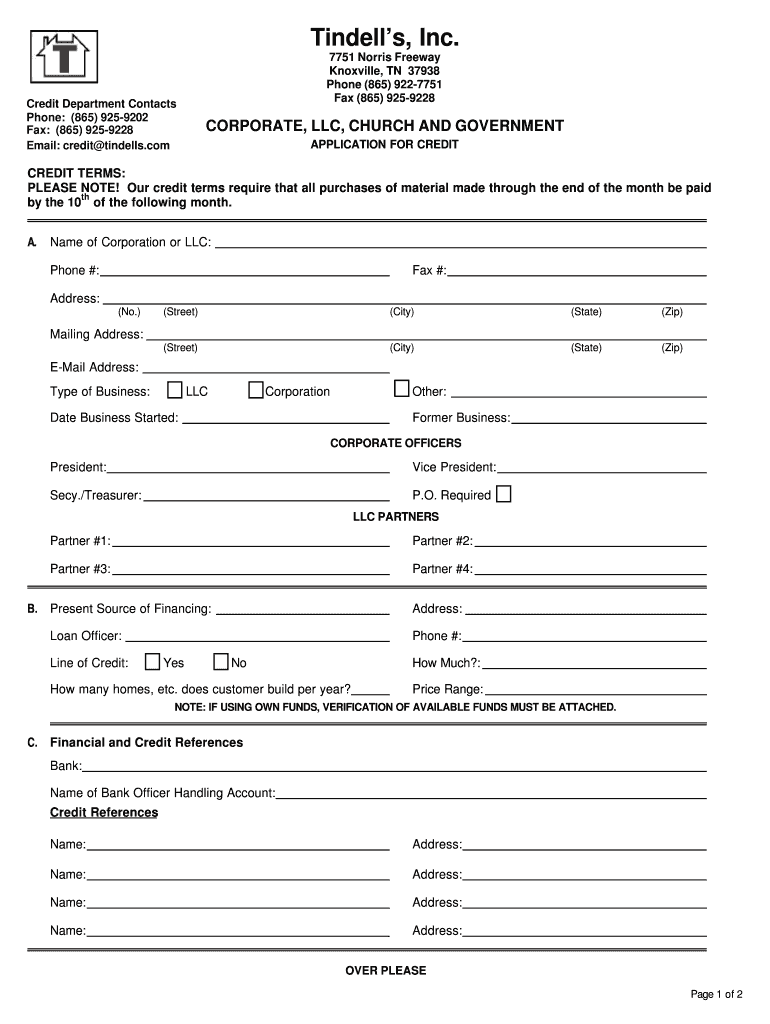

This document serves as an application for businesses such as corporations, LLCs, churches, and government entities to apply for credit with Tindell's, Inc., including details on credit terms, corporate

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign corporate llc church and

Edit your corporate llc church and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your corporate llc church and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing corporate llc church and online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log in to account. Start Free Trial and register a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit corporate llc church and. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out corporate llc church and

How to fill out Corporate, LLC, Church and Government Application for Credit

01

Gather necessary documents such as identification, financial statements, and organizational structure.

02

Obtain the specific application form for Corporate, LLC, Church, or Government credit.

03

Fill out the application form with accurate information about your organization, including name, address, and tax identification number.

04

Provide details about the purpose of credit and your organization's financial needs.

05

Complete the financial section of the application, including income, expenses, and assets.

06

Include any additional documentation that may be required, such as business licenses or bylaws.

07

Review the application for accuracy and completeness before submission.

08

Submit the application through the specified channel, which may include online submission, postal mail, or in-person delivery.

09

Follow up as needed to ensure that the application is being processed.

Who needs Corporate, LLC, Church and Government Application for Credit?

01

Corporations seeking financing for business operations or expansion.

02

Limited Liability Companies (LLCs) that need credit for purchases or investments.

03

Churches looking for funding to support their activities, programs, or capital projects.

04

Government entities requiring financial assistance for public projects or services.

Fill

form

: Try Risk Free

People Also Ask about

Who is the responsible party when applying for a trust in the EIN?

For trusts, the responsible party is a grantor, owner, or trustor. For decedent estates, the responsible party is the executor, administrator, personal representative, or other fiduciary.

What happens if you start an LLC and do nothing?

Fear not, the IRS recognizes your LLC as a living, breathing entity regardless of the amount of activity, gains or losses it experiences. It's absolutely acceptable for your company to ebb and flow through trepidation, solid footing and full- fledged confidence, then back to trepidation on a quarterly or annual basis.

How to fill out an EIN application for LLC?

Step by Step: How to Apply for an EIN Go to the IRS website. Identify the legal and tax structure of your business entity. If your business is an LLC, provide information about the members. State why you are requesting an EIN. Identify and describe a contact person for the business. Provide the business' location.

Can you have an LLC that doesn't make money?

An LLC does not need to earn income to maintain its legal status, but it may still have tax obligations. LLCs can be taxed as pass-through entities, C corporations, or S corporations, depending on the chosen tax classification.

What are the four types of LLC?

Common Types Of LLCs Single Member LLC. As the name suggests, single-member LLCs have one member (aka owner). Multi-Member LLC. Multi-member LLCs have—you guessed it—two or more members. Member-Managed LLC. Manager-Managed LLC. Professional LLC (PLLC) Series LLC. Low-Profit LLC (L3C) Non-Profit LLC.

How much money should you have before starting an LLC?

If your business already earns a profit or if it carries any risk of liability, you should start an LLC immediately. Many folks say you should form an LLC once you earn over $100,000. However, many lawyers insist you start an LLC from the get-go.

Can I start an LLC with no money?

The short answer is that financial self-sufficiency isn't a legal requirement to become an LLC. But the LLC does need enough money to survive. To do that, you'll do two things: make sure the LLC starts off with 3-6 months of expenses in your accounts.

Do you need money for an LLC?

You can fund an LLC startup by contributing your own money, applying for a business loan, seeking investors or crowdfunding, or applying for grants.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Corporate, LLC, Church and Government Application for Credit?

The Corporate, LLC, Church and Government Application for Credit is a formal request submitted by corporations, limited liability companies (LLCs), churches, and government entities seeking credit from financial institutions or vendors.

Who is required to file Corporate, LLC, Church and Government Application for Credit?

Entities such as corporations, LLCs, churches, and government organizations that wish to establish or maintain credit accounts are required to file the Corporate, LLC, Church and Government Application for Credit.

How to fill out Corporate, LLC, Church and Government Application for Credit?

To fill out the application, provide necessary details such as the legal name of the entity, type of organization, contact information, financial statements, and any required tax identification numbers. Ensure all information is accurate and complete.

What is the purpose of Corporate, LLC, Church and Government Application for Credit?

The purpose of the application is to assess the creditworthiness of the entity, allowing lenders or vendors to determine the risk involved in extending credit and to establish credit limits.

What information must be reported on Corporate, LLC, Church and Government Application for Credit?

The application must report the entity's legal name, business address, type of entity, tax identification number, financial information, banking references, and any additional details requested by the creditor.

Fill out your corporate llc church and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Corporate Llc Church And is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.