Get the free self employment income form

Show details

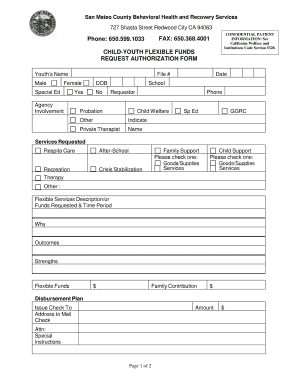

Form 149-Page 1 of 2 STATEMENT OF SELF-EMPLOYMENT INCOME DECLARED N DE INGRESS DEL NEGATION PRO PIO See Instructions on Page 2./Ve alas Instructions en la p Gina 2. Case Record Name Case Record Number

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your self employment income form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your self employment income form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing self employment income online

To use the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit self employment income form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

How to fill out self employment income form

How to fill out self employment income:

01

Gather all the necessary documents and receipts related to your self-employment income. This may include invoices, sales records, expense receipts, and any other relevant financial documents.

02

Calculate your total income by adding up all the revenue you have earned from your self-employment. Make sure to include not just the money you received but also any non-monetary compensation or bartered goods/services.

03

Deduct any allowable business expenses from your total income. This includes expenses directly related to your self-employment, such as office supplies, advertising costs, professional fees, and travel expenses. Keep in mind that these expenses should be legitimate and necessary for your business operations.

04

Track your self-employment taxes by keeping a record of your estimated quarterly tax payments. This ensures that you fulfill your tax obligations and avoid penalties for underpayment. Consult a tax professional or use online tools to determine the appropriate amount to set aside for self-employment taxes.

05

Fill out the relevant tax forms, such as Schedule C (Profit or Loss from Business) or Schedule C-EZ (Net Profit from Business). Provide accurate information regarding your self-employment income, expenses, and deductions. Double-check all the figures and ensure they are correctly entered onto the form.

06

If you have employees or hire independent contractors for your self-employment, ensure you complete the necessary tax forms and file them accordingly. This includes providing W-2 forms for employees or issuing 1099-MISC forms for independent contractors.

07

Submit your completed tax forms to the appropriate tax authorities, whether it is the Internal Revenue Service (IRS) in the United States or the tax agency in your respective country. Be aware of the filing deadline and any extensions that may be available.

08

Keep copies of all your tax forms, receipts, and supporting documents for future reference. It is essential to maintain proper records in case of an audit or any inquiries from tax authorities.

Who needs self-employment income:

01

Freelancers: Individuals who work independently and provide services to clients on a project basis, such as writers, graphic designers, or consultants.

02

Small business owners: Entrepreneurs who own and operate their own businesses, including sole proprietors, partnerships, or limited liability companies (LLCs).

03

Contractors: Individuals who work on a contractual basis for various companies or organizations, often in specialized fields like construction, IT, or engineering.

04

Gig economy workers: Those who earn income from multiple short-term or part-time jobs, such as rideshare drivers, delivery couriers, or freelance online workers.

05

Artists and performers: Musicians, actors, painters, photographers, and other creative professionals who generate income from their artistic endeavors.

06

Consultants and coaches: Professionals who provide expert advice, guidance, or training to individuals or organizations, typically on a self-employed basis.

07

Home-based business owners: Individuals who run businesses from their homes, such as online retailers, writers, or crafters.

Please note that individual circumstances may vary, and it is always recommended to consult with a tax professional or accountant to ensure accurate and compliant reporting of self-employment income.

Fill form : Try Risk Free

People Also Ask about self employment income

What should I put as income when self-employed?

How much can you make self-employed before paying tax?

Can I be exempt from self-employment tax?

What happens if you are self-employed and don't file taxes?

Do I have to pay taxes on self-employment income?

How much can you make self-employed without paying taxes?

What qualifies you as self-employed?

How much taxes do you pay on self-employment?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is self employment income?

Self-employment income is money that you earn from working for yourself, as opposed to being an employee of a company.

Who is required to file self employment income?

Individuals who are self-employed or have a business that generates income are required to file self-employment income.

How to fill out self employment income?

To fill out self-employment income, one must report all income earned from self-employment activities on the appropriate tax forms, such as Schedule C or Schedule SE.

What is the purpose of self employment income?

The purpose of self-employment income is to accurately report and pay taxes on income that is earned through self-employment activities.

What information must be reported on self employment income?

Information such as total income, expenses, deductions, and net profit or loss must be reported on self-employment income.

When is the deadline to file self employment income in 2024?

The deadline to file self-employment income in 2024 is April 15th, unless an extension is filed.

What is the penalty for the late filing of self employment income?

The penalty for the late filing of self-employment income is a percentage of the unpaid tax that is due, with a maximum penalty of 25%.

How do I modify my self employment income in Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your self employment income form and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How can I edit statement of self employment income from Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your self employment profit and loss statement into a dynamic fillable form that you can manage and eSign from anywhere.

How can I edit self employment income on a smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing self employment income form right away.

Fill out your self employment income form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Statement Of Self Employment Income is not the form you're looking for?Search for another form here.

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.