Get the free BIrsb form 1040ez tax table for 2012

Show details

Funds Kathmandu Kat Hacks bucket virtual families 2 2009 Kindle Fire need virus protection Ir's form 1040ez tax table for 2012 Keep your costs down examples of argumentative essays for middle school

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

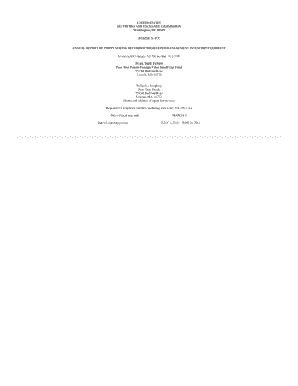

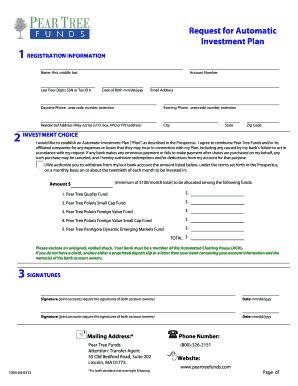

Edit your birsb form 1040ez tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your birsb form 1040ez tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit birsb form 1040ez tax online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit birsb form 1040ez tax. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents.

How to fill out birsb form 1040ez tax

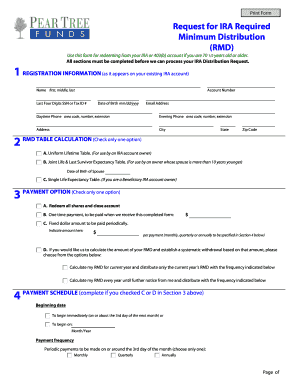

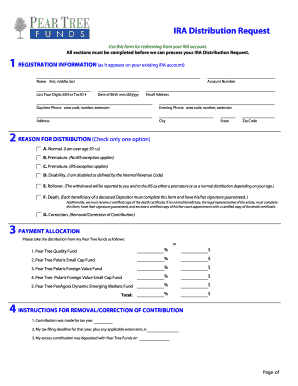

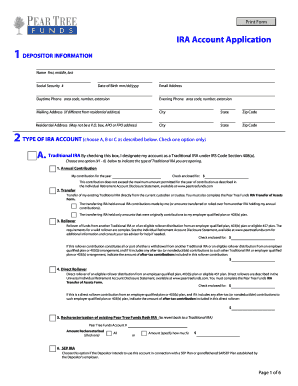

How to fill out BIRSB form 1040EZ tax:

01

Gather your necessary documents - Before starting to fill out the form, gather all the required documents including your W-2 form(s), any 1099 forms, and other income or deduction documents.

02

Fill out personal information - Provide your full name, mailing address, social security number, and other requested personal information accurately in the designated sections of the form.

03

Determine your filing status - Indicate your filing status, whether you are single, married filing jointly, married filing separately, or head of household. Choose the status that applies to your situation.

04

Report your income - In the appropriate sections of the form, enter the total amount of income you earned during the tax year. This includes wages, salaries, tips, interest, and any other income sources.

05

Claim deductions - If eligible, claim any deductions to reduce your taxable income. This can include deductions for student loan interest, educator expenses, or contributions to retirement accounts.

06

Calculate your tax liability - Use the provided tax table or the online tax software to determine your tax liability based on your income and filing status. If you are unsure, seek professional help or use tax software for accurate calculations.

07

Report your refund or balance due - After calculating your tax liability, indicate the amount of refund you are expecting or the amount you owe. If you owe taxes, arrange for payment options or consider any applicable penalties or interest.

Who needs BIRSB form 1040EZ tax?

01

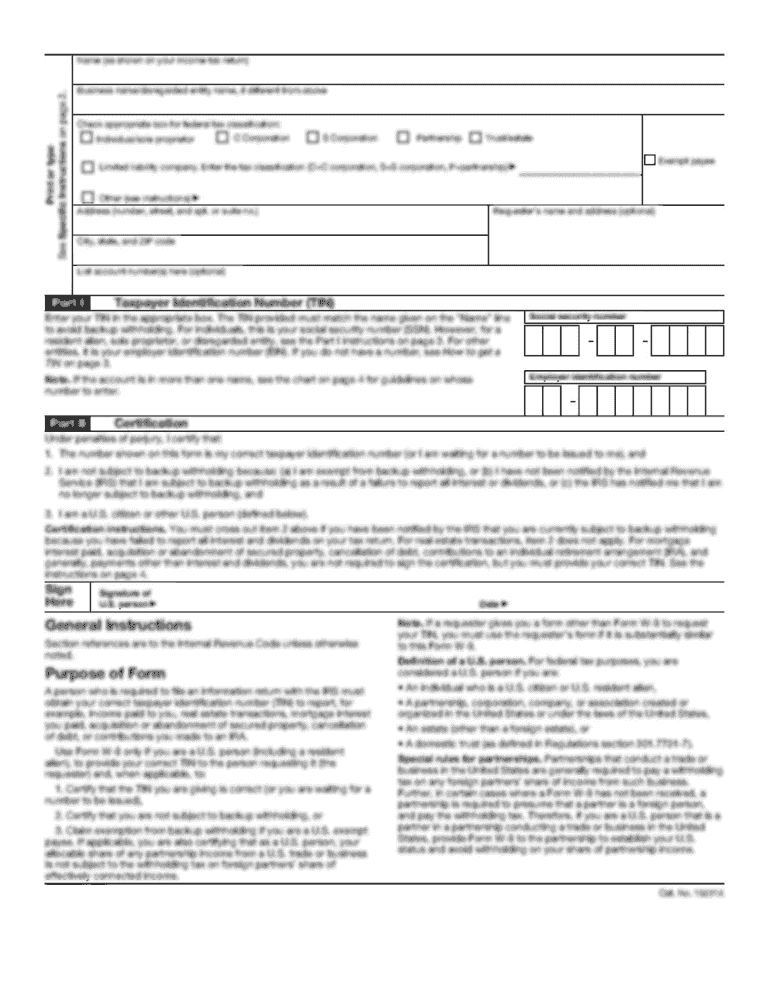

Individuals with simple tax situations - The BIRSB form 1040EZ tax is specifically designed for individuals with straightforward tax situations such as those with no dependents, no itemized deductions, and taxable income below a certain threshold.

02

Single or married filing jointly individuals - This form is suitable for single filers or married couples without dependents who meet the specific eligibility criteria for using the form, including income limits and straightforward tax situations.

03

Individuals without complex financial affairs - Those who do not have complex financial affairs such as investments, business income, or rental income may find the BIRSB form 1040EZ tax appropriate for their tax filing needs.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my birsb form 1040ez tax directly from Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your birsb form 1040ez tax and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How do I complete birsb form 1040ez tax online?

pdfFiller has made it simple to fill out and eSign birsb form 1040ez tax. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How do I edit birsb form 1040ez tax online?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your birsb form 1040ez tax to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

Fill out your birsb form 1040ez tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.