Get the free Credit Application Form - Template

Show details

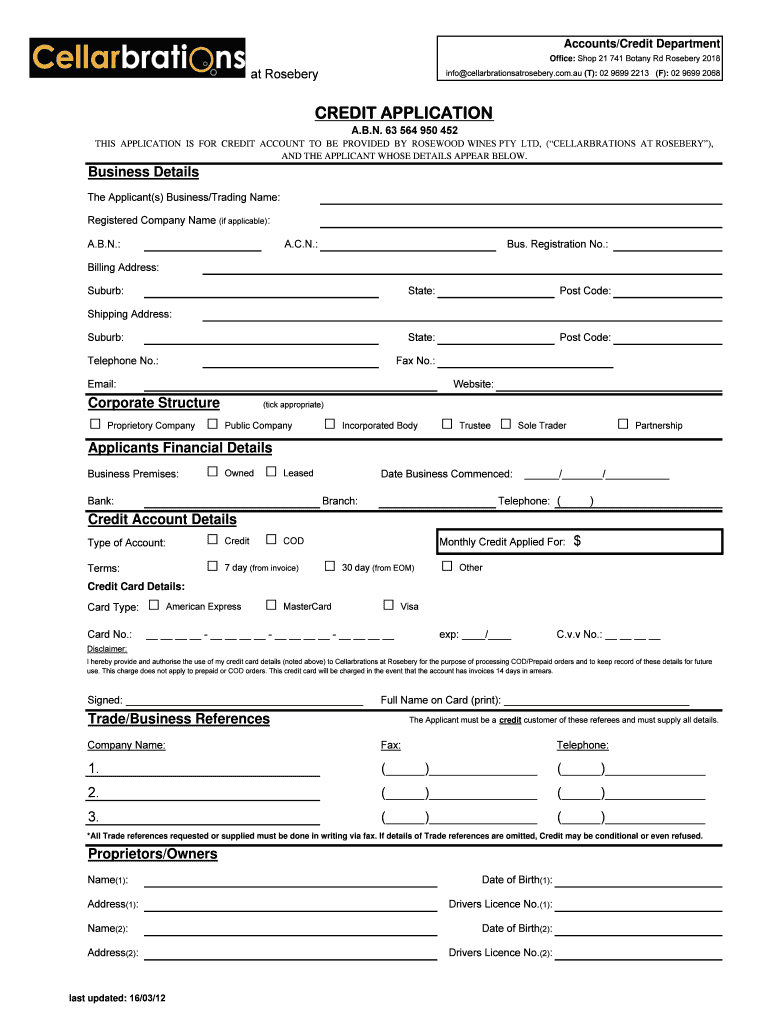

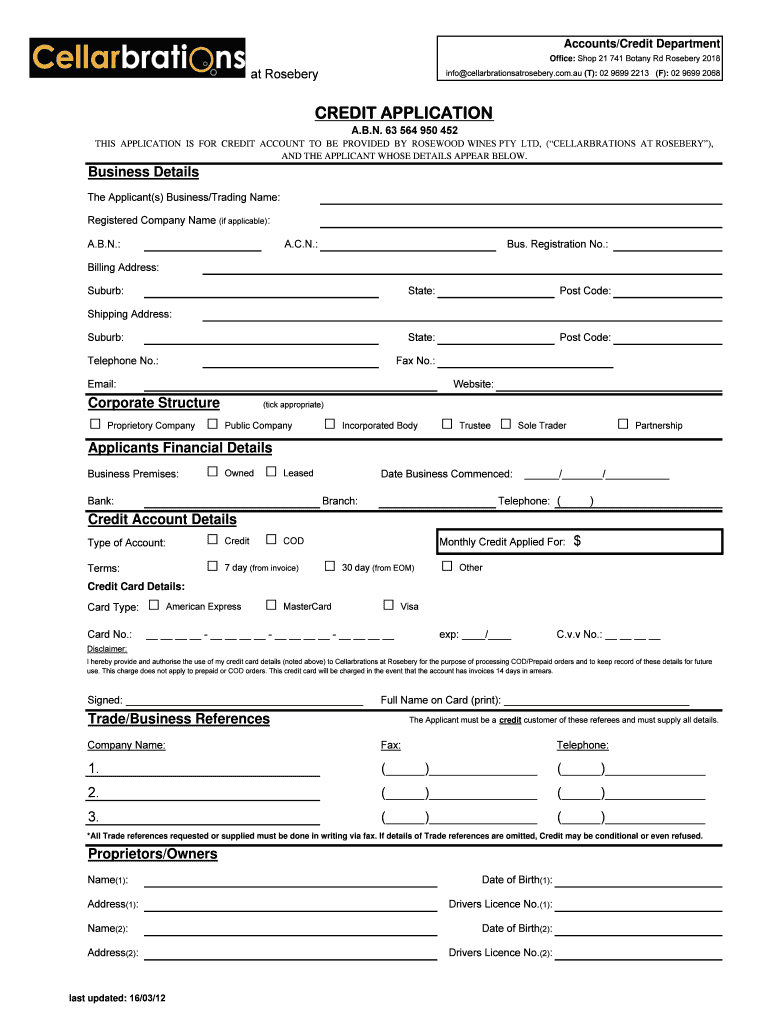

Accounts/Credit Department Office: Shop 21 741 Botany Rd Robbery 2018 at Robbery info cellarbrationsatrosebery.com.AU (T): 02 9699 2213 (F): 02 9699 2068 CREDIT APPLICATION A.B.N. 63 564 950 452 THIS

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign credit application form

Edit your credit application form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your credit application form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing credit application form online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit credit application form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out credit application form

How to fill out a credit application form:

01

Start by carefully reading all the instructions provided on the credit application form. Make sure you understand the purpose of each section and the information required.

02

Begin by providing your personal information, such as your full name, date of birth, social security number, and contact details. Ensure that you enter these details accurately to avoid any issues later on.

03

Fill in your current address, including your street address, city, state, and zip code. If you have been living at your current address for less than two years, you may need to include your previous address as well.

04

When asked about your employment information, provide details about your current job. Include your employer's name, your position, your length of employment, and your monthly income. If you have had multiple jobs in the past, you may need to provide information about them as well.

05

On the credit application form, there might be a section for listing your previous loan and credit card details. Fill in the requested information accurately, including the names of the institutions, account numbers, balances, and any outstanding payments.

06

If you have a joint applicant or co-signer, provide their personal information and employment details as well. This is typically required when applying for a joint credit card or loan.

07

Review all the information you have entered on the credit application form to ensure its accuracy and completeness. Double-check for any errors or missing details. Incorrect or incomplete information may lead to delays or rejections.

08

Finally, sign and date the credit application form. By signing, you are authorizing the lender to obtain and verify your credit information in the loan approval process.

Who needs a credit application form?

01

Individuals seeking to apply for a credit card or loan from a financial institution or lender will usually need to complete a credit application form. This includes individuals looking for personal loans, mortgages, auto loans, or credit lines.

02

Small business owners who want to apply for business loans or lines of credit may also be required to complete a credit application form. This helps the lender assess the creditworthiness of the business and its owners.

03

Landlords or property owners may ask potential tenants to complete a credit application form as part of their rental application process. This helps them evaluate the tenant's financial stability and assess the risk of renting to them.

In summary, anyone looking to apply for credit, whether it is a personal loan, credit card, or rental agreement, may need to fill out a credit application form. It is essential to provide accurate and complete information to increase the chances of approval.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send credit application form to be eSigned by others?

When your credit application form is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I edit credit application form online?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your credit application form to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

How do I fill out credit application form on an Android device?

Use the pdfFiller mobile app and complete your credit application form and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is credit application form?

Credit application form is a document used by individuals or businesses to apply for credit from a lender.

Who is required to file credit application form?

Individuals or businesses seeking credit from a lender are required to fill out and file a credit application form.

How to fill out credit application form?

To fill out a credit application form, one must provide personal or business information, financial details, and consent to a credit check.

What is the purpose of credit application form?

The purpose of a credit application form is to assess the creditworthiness of an individual or business applying for credit.

What information must be reported on credit application form?

Information such as name, address, contact details, financial information, employment history, and references must be reported on a credit application form.

Fill out your credit application form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Credit Application Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.