Get the free G Gross receipts $ 4,575,522,870

Show details

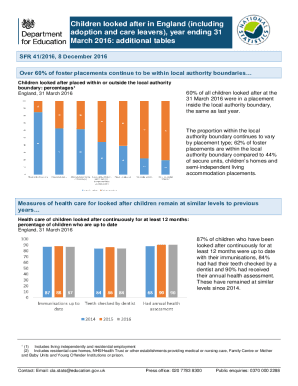

Le file Form GRAPHIC print DO NOT PROCESS As Filed Data DAN: 93493314006021 OMB No Return of Organization Exempt From Income Tax 990 Under section 501 (c), 527, or 4947(a)(1) of the Internal Revenue

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your g gross receipts 4575522870 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your g gross receipts 4575522870 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing g gross receipts 4575522870 online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit g gross receipts 4575522870. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

How to fill out g gross receipts 4575522870

How to fill out g gross receipts 4575522870:

01

Start by gathering all the necessary information, such as your business name, address, and taxpayer identification number.

02

Locate the g gross receipts form 4575522870. This form can usually be found on the website of your local tax authority or obtained directly from them.

03

Carefully read the instructions provided with the form to understand the required information and any specific guidelines for completion.

04

Begin filling out the form by entering your business's basic information, including its legal name, address, and taxpayer identification number, in the designated fields.

05

Proceed to the section where you report your gross receipts. This could include income from sales, services, or any other revenue sources for your business. Be sure to accurately report all applicable amounts.

06

Use the provided spaces or additional attachments, if necessary, to provide any further details or explanations required in the form.

07

Double-check all the information you have entered to ensure accuracy and completeness. Mistakes or omissions could cause delays or even lead to penalties.

08

Once you are satisfied with the accuracy of the form, sign and date it, as required.

09

Keep a copy of the filled-out form for your records before submitting it to the appropriate tax authority or following any specific instructions regarding submission.

Who needs g gross receipts 4575522870:

01

Business owners: Any individual or entity operating a business may need to fill out the g gross receipts form 4575522870. It is typically required to report the business's gross receipts for taxation or regulatory compliance purposes.

02

Tax authorities: The government tax authorities, at various levels (federal, state, or local), may require businesses to provide information on their gross receipts. This helps them assess taxes owed, monitor business activities, and ensure compliance with applicable laws and regulations.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is g gross receipts 4575522870?

Gross receipts 4575522870 refers to the total amount of money a business earns from its normal business activities before deducting any expenses.

Who is required to file g gross receipts 4575522870?

Businesses, self-employed individuals, and corporations are required to file gross receipts 4575522870 as part of their tax reporting obligations.

How to fill out g gross receipts 4575522870?

To fill out gross receipts 4575522870, you will need to calculate the total income earned by your business during a specific period, typically by adding up all sales revenue.

What is the purpose of g gross receipts 4575522870?

The purpose of reporting gross receipts 4575522870 is to provide accurate financial information to the relevant tax authorities and ensure compliance with tax laws.

What information must be reported on g gross receipts 4575522870?

Gross receipts 4575522870 typically requires reporting of all income earned by the business, including sales revenue, interest income, and any other sources of revenue.

When is the deadline to file g gross receipts 4575522870 in 2024?

The deadline to file gross receipts 4575522870 in 2024 is usually determined by the tax authorities and may vary depending on the jurisdiction.

What is the penalty for the late filing of g gross receipts 4575522870?

The penalty for the late filing of gross receipts 4575522870 may include additional fines or interest charges, depending on the specific tax regulations in place.

How can I edit g gross receipts 4575522870 from Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including g gross receipts 4575522870. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How do I edit g gross receipts 4575522870 online?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your g gross receipts 4575522870 to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How do I fill out g gross receipts 4575522870 on an Android device?

Complete your g gross receipts 4575522870 and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

Fill out your g gross receipts 4575522870 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.