Get the free INDIAN INCOME TAX RETURN Assessment Year FORM ITR-5 - voiceofca

Show details

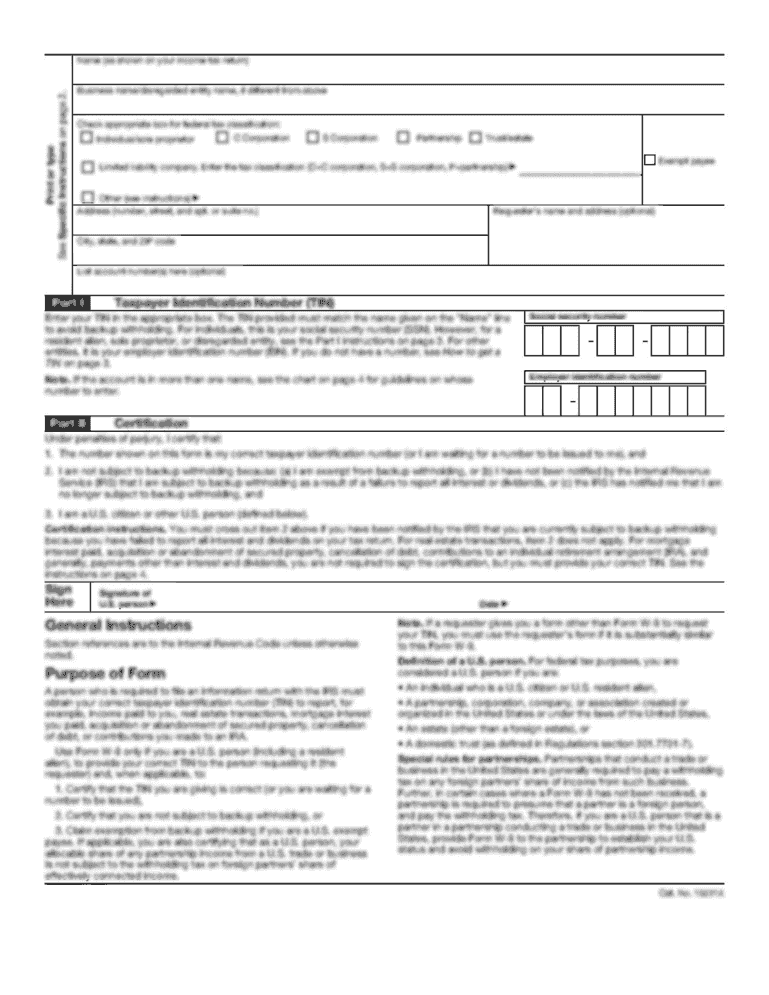

FORM INDIAN INCOME TAX RETURN Assessment Year For firms, Tops and Boys (Please see Rule 12 of the Income tax Rules,1962) 2 0 1 1 1 2 ITR5 (Also see attached instructions) Part A GEN GENERAL Name PAN

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your indian income tax return form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your indian income tax return form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing indian income tax return online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit indian income tax return. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is simple using pdfFiller. Try it now!

How to fill out indian income tax return

01

Gather all necessary documents: Before filling out your Indian income tax return, make sure you have gathered all the required documents such as PAN card, Form 16, salary slips, bank statements, investment proofs, and other relevant financial records.

02

Choose the correct income tax return form: Depending on your income sources and category, select the appropriate income tax return form. For example, if you are a salaried individual with no business income, you would typically use ITR-1 or ITR-2 form.

03

Provide personal and income details: Begin by filling out your personal information including your name, address, PAN number, and contact details. Then, provide details about your income sources such as salary, rental income, interest income, capital gains, or any other applicable sources.

04

Declare deductions and exemptions: Deductions and exemptions can help reduce your taxable income. Make sure to accurately declare any deductions or exemptions you are eligible for under various sections such as 80C (for investments), 80D (health insurance premium), or 24(b) (home loan interest).

05

Compute your total income and tax liability: Once you have filled in all the necessary information, calculate your total income and tax liability using the tax slabs applicable for the current financial year. Consider any applicable deductions and exemptions to accurately determine your tax liability.

06

Pay any outstanding taxes: If you have any pending tax payments, make sure to pay them before filing your income tax return. Otherwise, you may incur penalties or interest for late payment.

07

Verify and file your return: After completing all the necessary sections and computations, verify your return for accuracy and completeness. You can choose to file your return online through the Income Tax Department's e-filing portal or offline by submitting a physical copy to the relevant tax authority.

Who needs Indian income tax return?

01

All individuals with a total income exceeding the basic exemption limit specified by the Income Tax Department are required to file an income tax return.

02

Additionally, individuals who wish to claim tax refunds or benefits under various provisions of the Income Tax Act should also file their income tax returns, even if their income falls within the exemption limit.

03

It is important to note that even if you are not required to file an income tax return, it is still advisable to do so if you have any income from foreign sources, possess foreign assets, or if you anticipate any future financial transactions that may require income tax compliance. Filing a tax return helps establish a clear financial record and can facilitate various financial transactions in the future.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is indian income tax return?

Indian income tax return is a form filed with the Income Tax Department of India by individuals or entities to declare their taxable income and pay the corresponding taxes.

Who is required to file indian income tax return?

Individuals and entities whose income exceeds the specified limit set by the Income Tax Department of India are required to file Indian income tax return.

How to fill out indian income tax return?

Indian income tax return can be filled out online on the official website of the Income Tax Department of India by providing all the necessary information related to income, deductions, and taxes paid.

What is the purpose of indian income tax return?

The purpose of Indian income tax return is to report taxable income, calculate the tax liability, and pay the taxes owed to the government.

What information must be reported on indian income tax return?

Information such as income earned, deductions claimed, taxes paid, and any other relevant financial details must be reported on Indian income tax return.

When is the deadline to file indian income tax return in 2024?

The deadline to file Indian income tax return in 2024 is usually July 31st or August 31st, however, it is advisable to check for any updates on the official website of the Income Tax Department of India.

What is the penalty for the late filing of indian income tax return?

The penalty for the late filing of Indian income tax return can be up to Rs. 10,000, depending on the duration of the delay and the amount of tax payable.

How can I send indian income tax return to be eSigned by others?

To distribute your indian income tax return, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

Can I create an eSignature for the indian income tax return in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your indian income tax return right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

Can I edit indian income tax return on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign indian income tax return. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

Fill out your indian income tax return online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.