Get the free Skyline Investments

Show details

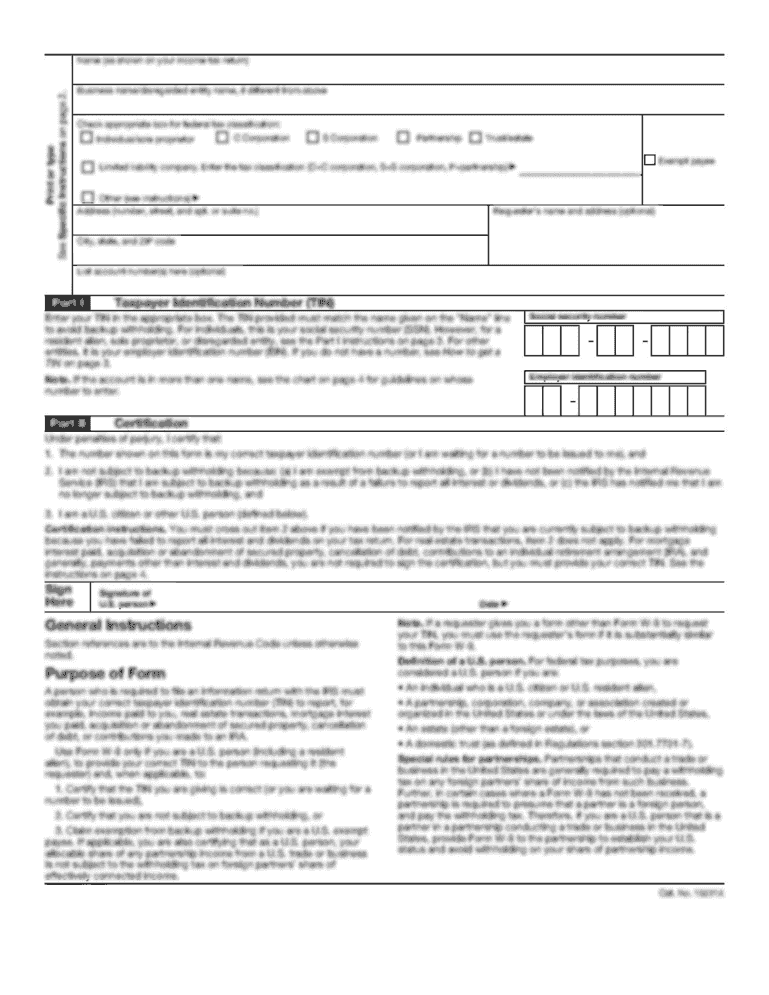

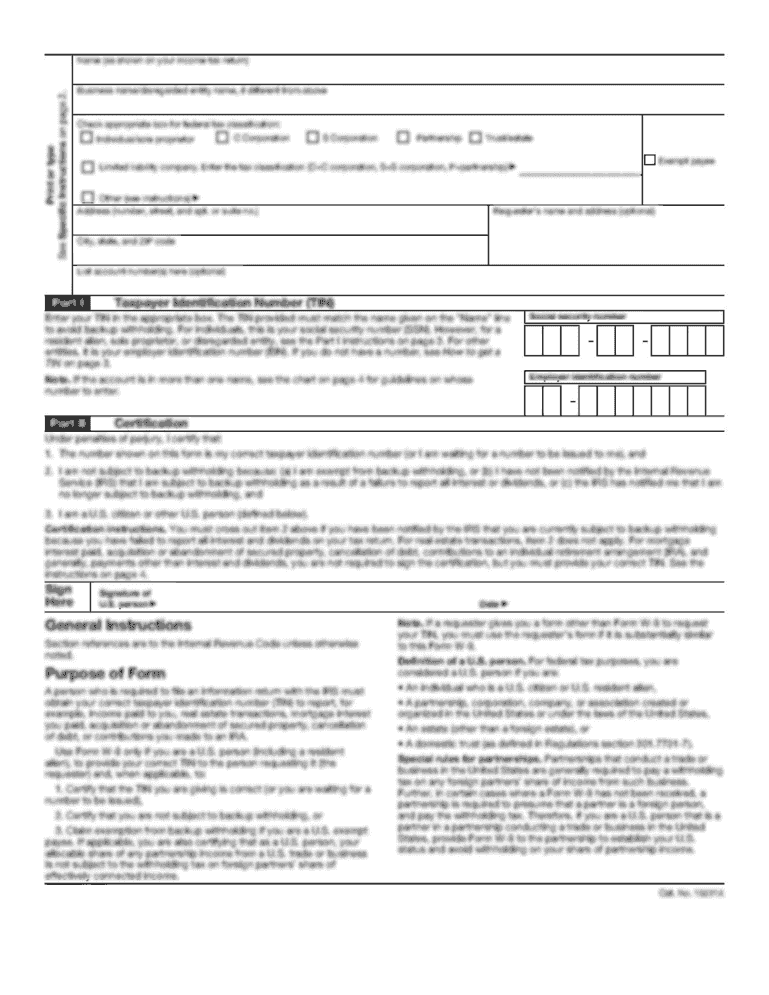

W-9 Form (Rev. December 2011) Department of the Treasury Internal Revenue Service Request for Taxpayer Identification Number and Certification Give Form to the requester. Do not send to the IRS. Name

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your skyline investments form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your skyline investments form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit skyline investments online

To use our professional PDF editor, follow these steps:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit skyline investments. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller.

How to fill out skyline investments

How to fill out skyline investments?

01

Start by gathering all the necessary information about skyline investments, such as the required forms and documents.

02

Carefully read through the instructions provided on the skyline investments application or form, making sure to understand all the requirements and guidelines.

03

Complete the application or form accurately, providing all the requested information. Double-check for any errors or missing details before submitting it.

04

If required, attach any additional supporting documents or evidence to substantiate your skyline investments application.

05

Review the completed application one final time to ensure everything is filled out correctly and nothing is overlooked.

06

Submit the filled-out skyline investments application or form through the designated submission method, such as online submission or mailing it to the relevant authority.

Who needs skyline investments?

01

Individuals who are looking for potential long-term financial growth and diversification may find skyline investments beneficial.

02

Business owners and entrepreneurs who require additional funding for their ventures or expansion projects.

03

People who want to secure their retirement savings and build a strong financial future may consider skyline investments as a viable option.

04

Any individual or entity seeking professional assistance and guidance to make informed investment decisions can benefit from skyline investments.

05

Those who believe in the potential of real estate investments and want to capitalize on opportunities in the property market.

06

Investors who are interested in taking advantage of tax benefits and incentives associated with certain skyline investments.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is skyline investments?

Skyline Investments is a financial company that specializes in real estate investments and property management.

Who is required to file skyline investments?

Any individual or entity that has invested in Skyline Investments or owns properties managed by the company may need to report their investments.

How to fill out skyline investments?

To fill out Skyline Investments, you need to provide information about your investments, such as the amount invested, property details, and any income or losses incurred.

What is the purpose of skyline investments?

The purpose of Skyline Investments is to provide individuals and entities with opportunities to invest in real estate and receive financial returns.

What information must be reported on skyline investments?

The information that needs to be reported on Skyline Investments includes investment amounts, property addresses, income generated, and any related expenses.

When is the deadline to file skyline investments in 2023?

The deadline to file Skyline Investments in 2023 is typically April 15th, but it is always recommended to check with the relevant tax authorities for the exact deadline.

What is the penalty for the late filing of skyline investments?

The penalty for late filing of Skyline Investments may vary depending on the jurisdiction, but it can include monetary fines and potential consequences for tax assessments.

How can I manage my skyline investments directly from Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your skyline investments and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How do I complete skyline investments online?

Completing and signing skyline investments online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How do I edit skyline investments on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute skyline investments from anywhere with an internet connection. Take use of the app's mobile capabilities.

Fill out your skyline investments online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.