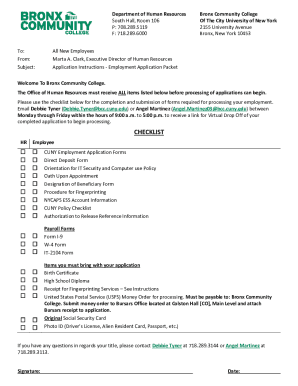

Print out of both print copies and fill out both PDF copies of form PHR1036. Mail or deliver the completed PDF to:

PharmRetro

P.O. Box 679

Merrillville, Indiana 47150, USA

You are encouraged to download the Form PHR1036 electronically because of the significant savings.

Returning Pharmacy Returns and the Current Federal Poverty Guidelines

As of September 1, 2017, the Federal Poverty Guidelines have changed. The new guidelines have been used as of Jan. 1, 2018, to calculate the Pharmacy Return amount. This will mean a large change, and you should make sure that your account is prepared accordingly. For more information, please refer to the following: How to Report the Prescription Drug Payment Correction (PDP)

How to Report the Prescription Drug Acquisition Program (PAC)

Reporting the Current Federal Poverty Guidelines in the Federal Income Tax Application Process

The following links may help you in determining your tax liability for your 2017 returns.

Federal Income Tax

Federal Railroad Retirement Tax Act

State Disability Insurance Tax Act Forms

PharmRetro, LLC & Associates, LLC & Pharmacy Returns and Refunds

Please also make sure you are aware of our Return and Refund Policy.

Tax Rates & Penalties

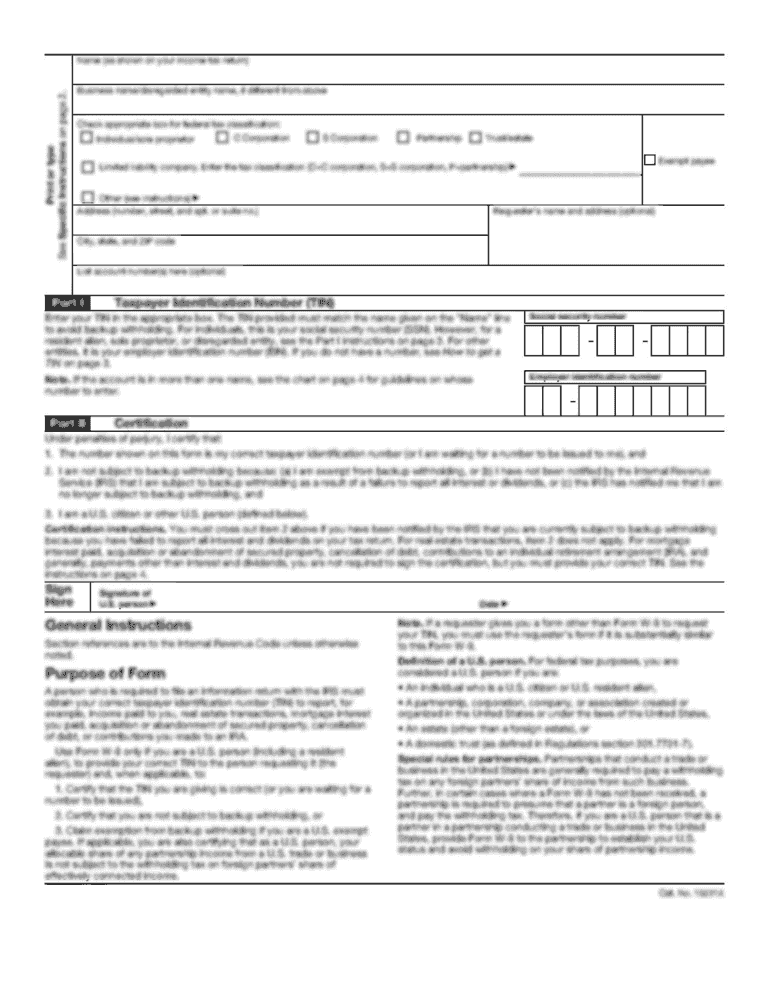

There are two additional tax-related provisions that apply to returns and returns that relate to a return issued from a pharmacy. Under the “Return-Free” Program administered by the U.S. Department of Health and Human Services (HHS), the IRS will collect taxes owed, without regard to whether funds have been deposited into an account. The program is called “return-free” because it is intended to benefit patients who may not want to pay additional tax because they received prescriptions or equipment in response to an insurance prescription refills. The Taxpayer Identification Number (TIN) of a patient who receives free prescriptions is required to collect the taxes due under the law. Individuals who have had Medicare Advantage drugs for which a valid TIN has been issued will not be required to provide additional identification to complete a return and pay Federal taxes. Non-Medicare Advantage patients must provide identification (and not the name of the patient) to submit a return and to the IRS to establish the amounts of the insurance premiums and any refunds due.

Get the free Report theft or loss of Controlled Substances

Show details

Register for PharmReturns.net ... PDF Download ... You may also print the PDF version of the form and manually fill it out for use with your schedule III-V return.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your report formft or loss form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your report formft or loss form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing report formft or loss online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit report formft or loss. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, dealing with documents is always straightforward.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is report formft or loss?

Report form or loss is a document that is used to report losses or damages incurred by a company or individual.

Who is required to file report formft or loss?

Any company or individual who has experienced losses or damages and wants to document and report them is required to file a report form or loss.

How to fill out report formft or loss?

To fill out a report form or loss, you need to provide detailed information about the losses or damages, including the date, description, and value of the loss. You may also need to provide supporting documents such as receipts or photographs.

What is the purpose of report formft or loss?

The purpose of a report form or loss is to document and report any losses or damages that have occurred. This helps individuals or companies to claim insurance or seek compensation for the losses.

What information must be reported on report formft or loss?

The information that must be reported on a report form or loss includes the date of the loss, a detailed description of the incident, the estimated value of the loss, and any supporting evidence or documentation.

When is the deadline to file report formft or loss in 2023?

The specific deadline to file a report form or loss in 2023 may vary depending on the jurisdiction and the specific circumstances of the loss. It is advisable to check with the relevant authorities or consult legal counsel for the exact deadline in your case.

What is the penalty for the late filing of report formft or loss?

The penalty for the late filing of a report form or loss can vary depending on the jurisdiction and the specific regulations in place. It may include fines, penalties, or limitations on the ability to claim insurance or seek compensation for the losses. It is important to comply with the filing deadlines to avoid any potential penalties.

How do I modify my report formft or loss in Gmail?

report formft or loss and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How do I complete report formft or loss online?

Completing and signing report formft or loss online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How do I complete report formft or loss on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your report formft or loss from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

Fill out your report formft or loss online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.