Get the free Correspondent Mortgage Bulletin

Show details

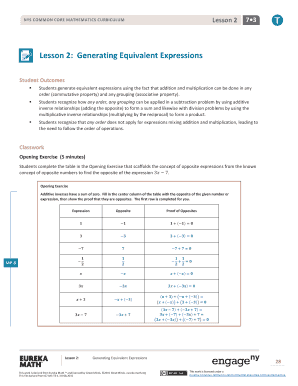

This bulletin provides guidance for correspondent lenders regarding the procedures for borrower removal from multi-borrower loan applications in non-delegated underwriting transactions, effective

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign correspondent mortgage bulletin

Edit your correspondent mortgage bulletin form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your correspondent mortgage bulletin form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit correspondent mortgage bulletin online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to account. Click Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit correspondent mortgage bulletin. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out correspondent mortgage bulletin

How to fill out Correspondent Mortgage Bulletin

01

Begin by gathering all necessary borrower and loan information.

02

Input the loan type, property address, and loan amount in the designated fields.

03

Provide the borrower's personal details such as name, address, and social security number.

04

Include information about the employment and income of the borrower.

05

Enter the details regarding the co-borrower, if applicable.

06

Fill in the property details, including type, occupancy status, and appraised value.

07

Specify the loan terms, including interest rate, amortization period, and loan program.

08

Check compliance with underwriting guidelines and provide any additional required documentation.

09

Review and verify all entered details are accurate before submission.

10

Submit the Correspondent Mortgage Bulletin to the lender for processing.

Who needs Correspondent Mortgage Bulletin?

01

Correspondent Mortgage Bulletin is needed by lenders, mortgage brokers, and financial institutions who are engaging in mortgage transactions and need to communicate loan details effectively.

Fill

form

: Try Risk Free

People Also Ask about

What is the difference between TPO and correspondent?

Third-party originators (TPO) include broker wholesale and correspondent lenders. Correspondent lenders acquire closed loans from other lenders that originate loans via some combination of retail, consumer direct or wholesale channels.

What is the difference between a mortgage broker and an intermediary?

When it comes to responsible lending, lenders often rely on a mortgage broker to accurately detail the financials, income and expenses of each client. While the lender is the one responsible, an intermediary will often help a client get documents in order that prove they can afford a mortgage.

What does correspondent mean in a mortgage?

Correspondent lending is an arrangement between a smaller company and a larger company that connects consumers with mortgages: The smaller company originates, closes and funds mortgages under its own name. This company might be a bank, credit union or independent mortgage company.

What is a correspondent broker?

Correspondent Broker means any member or participant of an Exchange and/or Clearing House of which the Company may not be a member or participant who, as the Company's agent, enters into a Contract on such Exchange and/or clears the same, as the case be.

What is the difference between a correspondent mortgage and a mortgage broker?

Correspondent lenders benefit consumers by offering competitive mortgage options and streamlined processing. Unlike mortgage brokers, they work directly with borrowers deeper into the origination process, which can reduce associated fees.

What are the disadvantages of using a mortgage broker?

Disadvantages of Mortgage Brokers Not every lender works with mortgage brokers, so you may still find a better product and rate by shopping around. Securing a mortgage through a broker may take longer and may require more paperwork, since you don't have an existing relationship with them like you may have with a bank.

What is the difference between a correspondent mortgage and a wholesale mortgage?

A correspondent lender may continue servicing a loan even after selling it, maintaining a connection with the borrower for tasks like collecting payments or managing escrow accounts. In contrast, wholesale mortgage lenders do not retain ownership of loans for an extended period.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Correspondent Mortgage Bulletin?

The Correspondent Mortgage Bulletin is a communication tool used by mortgage lenders to provide updates, guidelines, and changes in policies to correspondent lenders who originate and fund loans on behalf of the primary lender.

Who is required to file Correspondent Mortgage Bulletin?

Correspondent lenders who engage in origination and funding of mortgage loans on behalf of a primary lender are required to file the Correspondent Mortgage Bulletin.

How to fill out Correspondent Mortgage Bulletin?

To fill out the Correspondent Mortgage Bulletin, lenders should provide accurate and relevant information, including the loan details, updates on policies, and any changes in underwriting or pricing guidelines as specified by the primary lender.

What is the purpose of Correspondent Mortgage Bulletin?

The purpose of the Correspondent Mortgage Bulletin is to keep correspondent lenders informed of any changes, updates, or important information related to mortgage lending practices and policies to ensure compliance and efficient operation.

What information must be reported on Correspondent Mortgage Bulletin?

The Correspondent Mortgage Bulletin must report information related to policy changes, new products, pricing adjustments, underwriting guidelines, and any critical updates impacting the correspondent lending process.

Fill out your correspondent mortgage bulletin online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Correspondent Mortgage Bulletin is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.