Get the free Correspondent Mortgage Bulletin

Show details

This bulletin provides updates and clarifications regarding the Desktop Underwriter (DU) Version 8.3 release, including changes in credit risk assessment, effective dates for new loan casefiles, income

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign correspondent mortgage bulletin

Edit your correspondent mortgage bulletin form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your correspondent mortgage bulletin form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing correspondent mortgage bulletin online

To use the services of a skilled PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit correspondent mortgage bulletin. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

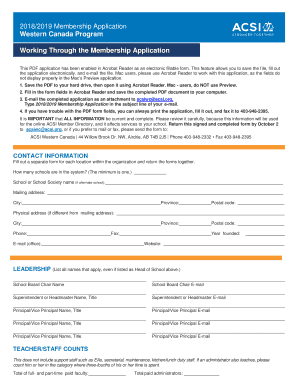

How to fill out correspondent mortgage bulletin

How to fill out Correspondent Mortgage Bulletin

01

Obtain the Correspondent Mortgage Bulletin form from your lender's website or office.

02

Read through the instructions provided to understand the requirements.

03

Fill in the borrower's personal information, including name, address, and contact details.

04

Provide details about the mortgage loan, including loan amount, interest rate, and term.

05

Include pertinent property information, such as property address and type.

06

Enter the correspondent lender's information and any necessary license numbers.

07

Attach required documentation, such as credit reports and income verification.

08

Review the entire form for accuracy and completeness before submission.

09

Submit the filled-out Correspondent Mortgage Bulletin to the lender as instructed.

Who needs Correspondent Mortgage Bulletin?

01

Correspondent lenders participating in a mortgage lending program.

02

Mortgage brokers who facilitate loans between borrowers and lenders.

03

Real estate agents aiding clients in securing financing for properties.

04

Individuals or entities looking to originate mortgage loans through a correspondent relationship.

Fill

form

: Try Risk Free

People Also Ask about

What is a correspondent in a mortgage?

Correspondent lending is an arrangement between a smaller company and a larger company that connects consumers with mortgages: The smaller company originates, closes and funds mortgages under its own name. This company might be a bank, credit union or independent mortgage company.

What does correspondent mean in a mortgage?

Correspondent lending is an arrangement between a smaller company and a larger company that connects consumers with mortgages: The smaller company originates, closes and funds mortgages under its own name. This company might be a bank, credit union or independent mortgage company.

What is the difference between TPO and correspondent?

Third-party originators (TPO) include broker wholesale and correspondent lenders. Correspondent lenders acquire closed loans from other lenders that originate loans via some combination of retail, consumer direct or wholesale channels. Wholesale lenders source loans from mortgage brokers.

What is the difference between a correspondent mortgage and a wholesale mortgage?

A correspondent lender may continue servicing a loan even after selling it, maintaining a connection with the borrower for tasks like collecting payments or managing escrow accounts. In contrast, wholesale mortgage lenders do not retain ownership of loans for an extended period.

What is the difference between a correspondent mortgage and a mortgage broker?

Correspondent lenders benefit consumers by offering competitive mortgage options and streamlined processing. Unlike mortgage brokers, they work directly with borrowers deeper into the origination process, which can reduce associated fees.

What's the difference between a broker and a correspondent?

A correspondent lender handles all the functions associated with mortgage origination. They can take your application, underwrite your loan to make sure you qualify and fund the loan. A mortgage broker will take your application and collect all necessary documentation from you.

What is the difference between TPO and correspondent?

Third-party originators (TPO) include broker wholesale and correspondent lenders. Correspondent lenders acquire closed loans from other lenders that originate loans via some combination of retail, consumer direct or wholesale channels.

What is a correspondent underwriter?

A Correspondent Underwriter is responsible for reviewing and assessing mortgage loan applications submitted by correspondent lenders to ensure they meet investor and company guidelines. They analyze creditworthiness, income, assets, and property evaluations to mitigate risk.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Correspondent Mortgage Bulletin?

The Correspondent Mortgage Bulletin is a communication document used by mortgage correspondents to report loan performance, updates, or changes in policies to lenders or investors.

Who is required to file Correspondent Mortgage Bulletin?

Mortgage correspondents who originate, underwrite, or sell loans to lenders or investors are typically required to file the Correspondent Mortgage Bulletin.

How to fill out Correspondent Mortgage Bulletin?

To fill out the Correspondent Mortgage Bulletin, one should provide relevant loan information, updates on loan performance, and any changes to procedures or requirements as specified by the lender or investor.

What is the purpose of Correspondent Mortgage Bulletin?

The purpose of the Correspondent Mortgage Bulletin is to ensure clear communication between mortgage correspondents and lenders regarding loan performance, compliance updates, and other important information.

What information must be reported on Correspondent Mortgage Bulletin?

The Correspondent Mortgage Bulletin must report information related to loan performance metrics, compliance issues, policy changes, and any relevant updates that could affect the lender or investor's interests.

Fill out your correspondent mortgage bulletin online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Correspondent Mortgage Bulletin is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.