Get the free mortgagee consent form

Show details

THE PRESERVATION ALLIANCE FOR GREATER PHILADELPHIA Form of MORTGAGEE'S CONSENT TO DEED OF PRESERVATION EASEMENT THIS CONSENT is given and executed this day of by (the Mortgage”). WITNESSED: A. are

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

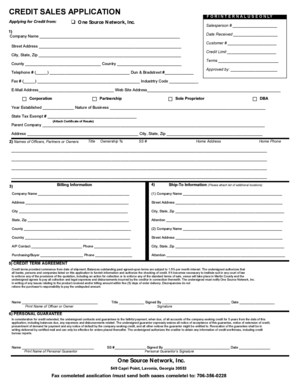

Edit your mortgagee consent form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mortgagee consent form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit mortgagee consent form online

Use the instructions below to start using our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit mortgage consent examples form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

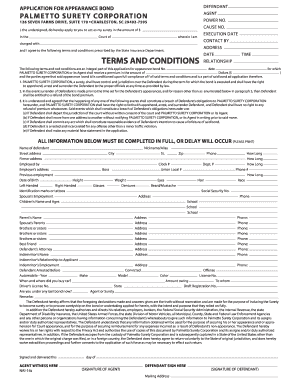

How to fill out mortgagee consent form

How to fill out mortgagee consent form:

01

Start by entering the name and contact information of the mortgagee (lender) who needs to provide consent.

02

Provide the details of the mortgagor (borrower), including their name, contact information, and the address of the property in question.

03

Indicate the type of consent being granted, such as consent for refinancing, transfer of ownership, or major renovations.

04

Include any additional documents or information required by the mortgagee, such as proof of insurance, architectural plans, or financial statements.

05

Read through the form carefully and ensure that all the necessary fields are filled out accurately and completely.

06

Sign and date the form, and have it notarized if required by the mortgagee.

Who needs mortgagee consent form:

01

Borrowers who are seeking to refinance their mortgage.

02

Borrowers who are transferring the ownership of the property to another party.

03

Borrowers who are planning to make significant renovations or alterations to the property that may impact its value or use.

Fill form : Try Risk Free

People Also Ask about mortgagee consent form

What is a letter of consent from a lender?

Who signs occupiers consent form?

What is the consent for a mortgage?

What is the consent of a loan?

How do I write a consent letter for a loan?

What is owner consent?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is mortgagee consent form?

A mortgagee consent form is a document signed by the mortgage lender or mortgagee, giving their consent or approval for certain actions or changes that the borrower or mortgagor intends to make. These actions or changes typically relate to the property that is subject to the mortgage.

Some common situations where a mortgagee consent form may be required include:

1. Subleasing or renting out the mortgaged property

2. Making alterations or modifications to the property

3. Transferring ownership or selling the property

4. Changing the use or zoning of the property

The mortgagee consent form ensures that the lender is aware of and agrees to these actions, as they have a vested interest in the property until the mortgage is fully paid off. It protects the lender's financial interests and helps ensure that the borrower does not take actions that may negatively impact the property's value or affect the lender's ability to recover their investment.

Who is required to file mortgagee consent form?

The mortgagee consent form is typically required to be filed by the lender or mortgagee.

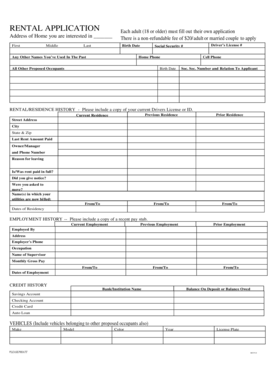

How to fill out mortgagee consent form?

To fill out a mortgagee consent form, follow the steps below:

1. Review the form: Read the form carefully to understand its purpose and requirements. Ensure you have all the necessary information and documents before starting to fill it out.

2. Provide borrower's information: Enter the borrower's full name, address, contact details, and loan account number at the top of the form.

3. Identity verification: Provide the mortgagee or lender's information, including their full legal name, address, contact details, and any identification numbers required.

4. Loan details: Fill in the loan details section, including the amount of the loan, the terms of repayment, interest rate, and any other relevant information.

5. Consent section: The mortgagee consent form typically contains a section where the mortgagee agrees to certain actions or conditions. Read this section carefully and check the appropriate boxes to indicate your consent.

6. Sign and date: At the end of the form, there will be space for both the borrower and the mortgagee/lender to sign and date the document. Sign the form in accordance with your legal name and date it on the designated lines.

7. Attach any required documents: If the form requires additional supporting documents, such as a copy of the mortgage agreement or identification documents, make sure to attach them securely.

8. Review and submit: Before submitting the form, review the entire document to ensure all the information provided is accurate and complete. Make any necessary corrections if required. Once you are satisfied, send the form to the appropriate party or organization as instructed.

9. Keep a copy: It is essential to keep a copy of the filled-out mortgagee consent form for your records. You may need it for reference or future communication related to the loan.

Note: This guide provides general instructions, but the specific requirements for filling out a mortgagee consent form may vary depending on the lender or jurisdiction. It is advisable to refer to any accompanying instructions or guidelines provided with the form or consult a professional if needed.

What is the purpose of mortgagee consent form?

The purpose of a mortgagee consent form is to obtain the consent of the mortgage lender or holder to certain actions or transactions related to the mortgaged property. This form is typically used when the property owner wants to make changes to the property that may affect the mortgage, such as adding a new structure, making substantial renovations, or transferring ownership. The purpose of obtaining the mortgagee's consent is to ensure that the lender is aware of and agrees to these changes, as they have a financial interest in the property. This form helps protect the rights and interests of both the property owner and the mortgage lender.

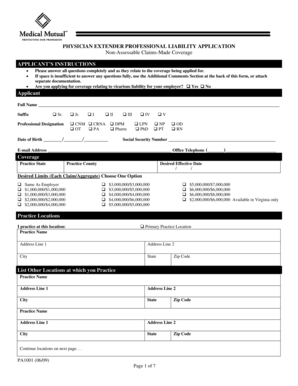

What information must be reported on mortgagee consent form?

The exact information that needs to be reported on a mortgagee consent form may vary depending on the specific requirements of the mortgage lender and the jurisdiction in which the property is located. However, some common information that is typically included in a mortgagee consent form may include:

1. Borrower's full name and contact information.

2. Property address and legal description.

3. Mortgage lender's name and contact information.

4. Mortgage loan number and details of the mortgage agreement.

5. Purpose or reason for seeking mortgagee consent, such as requesting permission for a specific action related to the property (e.g., refinancing, modification, transfer of ownership, or construction).

6. Proposed terms and conditions of the requested action, including any changes to the existing mortgage terms.

7. Necessary documentation supporting the request, such as appraisals, property plans, financial statements, or legal agreements.

8. Signatures of all involved parties, including the borrower and the mortgage lender or their authorized representatives.

9. Date of the consent.

It is important to review the specific requirements and forms provided by the mortgage lender to ensure that all necessary information is accurately reported.

What is the penalty for the late filing of mortgagee consent form?

The penalty for the late filing of a mortgagee consent form may vary depending on the specific jurisdiction and regulations in place. In some cases, there may be a financial penalty or late fee imposed for any delayed submission. It is recommended to consult with local authorities or legal professionals to determine the specific penalties that may apply in your situation.

How can I manage my mortgagee consent form directly from Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your mortgage consent examples form and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How do I complete consent of mortgagee online?

pdfFiller makes it easy to finish and sign consent of mortgagee form online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How can I edit mortgagee consent on a smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing mortgagee consent form.

Fill out your mortgagee consent form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Consent Of Mortgagee is not the form you're looking for?Search for another form here.

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.