Get the free 2015 Form 3520-A Annual Information Return of Foreign Trust With a US Owner

Show details

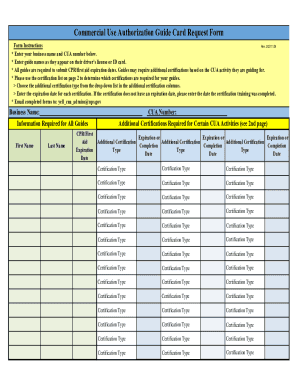

Form 3520A (2015) Page 3 2015 Foreign Granter Trust Owner Statement (see instructions) Important: Trustee must prepare a separate statement for each U.S. owner and include a copy of each statement

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your 2015 form 3520-a annual form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2015 form 3520-a annual form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 2015 form 3520-a annual online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit 2015 form 3520-a annual. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

How to fill out 2015 form 3520-a annual

How to fill out 2015 form 3520-a annual:

01

Start by reading the instructions carefully: The instructions provided with the form will guide you through the process of completing it. Make sure to read and understand all the instructions before you begin.

02

Provide accurate personal information: Begin by filling out the personal information section of the form. This includes your name, address, social security number, and any other required identification details. Double-check that all the information provided is accurate and up-to-date.

03

Report foreign trust: If you are reporting a foreign trust, provide the necessary details about the trust, such as its name, country of establishment, and identification number, if applicable.

04

Report grantor and beneficiaries: Indicate the information about the grantor of the trust, including their name, address, and identification number. Also, provide the names and addresses of all beneficiaries of the trust.

05

Complete the summary section: Fill out the summary section of the form, which includes information about the type of trust, its value, and any distributions made during the year. Ensure that you accurately report all the required details.

06

Provide additional information, if necessary: If there are any additional details or explanations you need to provide, utilize the space provided on the form or attach any relevant schedules or documents as specified in the instructions.

07

Sign and date the form: Finally, sign and date the form to certify that the information provided is true and accurate to the best of your knowledge.

Who needs 2015 form 3520-a annual?

01

U.S. taxpayers with foreign trusts: Individuals who have established or are beneficiaries of foreign trusts during the tax year need to file form 3520-a annually to report information about these trusts.

02

U.S. citizens living abroad: American citizens residing outside the United States who have foreign trusts will also need to file this form to comply with tax reporting requirements.

03

Non-resident aliens with U.S. assets: Non-resident aliens who have established a foreign trust but also have assets or income in the United States may be required to file form 3520-a to report their trust activities.

It is important to consult a tax professional or refer to the Internal Revenue Service (IRS) guidelines to determine your specific filing requirements and ensure compliance with the tax laws.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is form 3520-a annual information?

Form 3520-A is an information return required to be filed by foreign trust with at least one U.S. owner.

Who is required to file form 3520-a annual information?

The U.S. owner of a foreign trust is required to file form 3520-A annually.

How to fill out form 3520-a annual information?

Form 3520-A must be completed with information regarding the foreign trust's income, distributions, and beneficiaries.

What is the purpose of form 3520-a annual information?

The purpose of form 3520-A is to report the existence of a foreign trust with U.S. beneficiaries and ensure compliance with U.S. tax laws.

What information must be reported on form 3520-a annual information?

Information regarding the foreign trust's income, distributions, and beneficiaries must be reported on form 3520-A.

When is the deadline to file form 3520-a annual information in 2024?

The deadline to file form 3520-A in 2024 is April 15th.

What is the penalty for the late filing of form 3520-a annual information?

The penalty for late filing of form 3520-A is 5% of the trust assets, with a minimum penalty of $1,000.

How can I edit 2015 form 3520-a annual from Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including 2015 form 3520-a annual, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How do I execute 2015 form 3520-a annual online?

Filling out and eSigning 2015 form 3520-a annual is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

Can I edit 2015 form 3520-a annual on an iOS device?

Create, modify, and share 2015 form 3520-a annual using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

Fill out your 2015 form 3520-a annual online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.