Get the free LOAN AGREEMENT AND DISCLOSURE

Show details

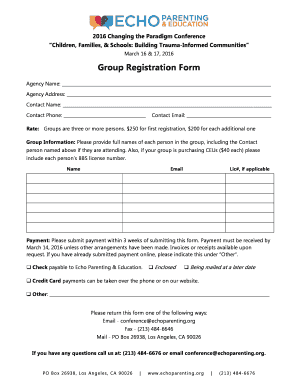

LOAN AGREEMENT AND DISCLOSURE Transaction Number: This Financing and Security Agreement (Agreement”) is made between: Terry James 11 Wood Ct., Folsom, Ca 95630 Name Owner-Borrower Mailing Address,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your loan agreement and disclosure form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your loan agreement and disclosure form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing loan agreement and disclosure online

Follow the steps below to take advantage of the professional PDF editor:

1

Log in to account. Click on Start Free Trial and sign up a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit loan agreement and disclosure. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

How to fill out loan agreement and disclosure

How to fill out loan agreement and disclosure:

01

Gather all necessary information: Before starting to fill out the loan agreement and disclosure, gather all the required information such as the names and addresses of both parties involved, the loan amount, the interest rate, the repayment terms, and any other relevant details.

02

Read the agreement and disclosure thoroughly: Take your time to carefully read through the loan agreement and disclosure. Pay attention to the terms and conditions, interest rates, fees, and any other clauses or provisions. It is crucial to understand all the terms before signing the agreement.

03

Provide accurate information: Fill out the loan agreement and disclosure accurately and truthfully. Provide all the required information, making sure to double-check for any errors or missing details. Providing accurate information is essential to avoid any legal issues in the future.

04

Seek legal advice if needed: If you have any concerns or doubts about the loan agreement and disclosure, it is advisable to seek legal advice. A lawyer or legal professional can review the documents and provide guidance to ensure that your rights and interests are protected.

05

Sign and date the agreement: Once you are confident that you have understood the loan agreement and disclosure, and have accurately filled out all the required information, sign and date the agreement. By doing so, you are acknowledging that you have read and agreed to the terms and conditions outlined in the agreement.

Who needs loan agreement and disclosure?

01

Individuals borrowing money: If you are an individual borrowing money from a lender, you will need a loan agreement and disclosure. This document sets out the terms and conditions of the loan, including the repayment terms, interest rates, and any other pertinent details.

02

Lenders providing the loan: Lenders also need a loan agreement and disclosure to ensure that the borrower understands their responsibilities and the terms of the loan. It protects the lender's rights and provides clarity on the repayment terms, interest rates, and any other relevant provisions.

03

Businesses involved in lending or borrowing: Businesses that are either providing loans or borrowing money also require loan agreements and disclosures. This applies to both businesses acting as lenders or borrowers, ensuring that all parties have a clear understanding of the loan terms and conditions.

In summary, anyone borrowing or providing a loan, whether it be an individual or a business, will need a loan agreement and disclosure. It is a legally binding document that outlines the terms of the loan and protects the rights and interests of both parties involved.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is loan agreement and disclosure?

A loan agreement is a formal agreement between a lender and a borrower that outlines the terms and conditions of a loan. It includes information about the loan amount, interest rate, repayment schedule, and any additional fees. A loan disclosure is a document that provides detailed information about the loan, including its terms, costs, and potential risks.

Who is required to file loan agreement and disclosure?

Lenders are generally required to provide and file loan agreements and disclosures. However, specific regulations may vary depending on the jurisdiction and type of loan.

How to fill out loan agreement and disclosure?

To fill out a loan agreement and disclosure, both the lender and borrower need to provide accurate and complete information. The lender should include all the necessary terms and conditions, while the borrower should carefully review and understand the document before signing it.

What is the purpose of loan agreement and disclosure?

The purpose of a loan agreement and disclosure is to ensure transparency and provide legal protection for both the lender and borrower. It helps establish the terms of the loan, protects the borrower from unfair practices, and allows both parties to understand their rights and obligations.

What information must be reported on loan agreement and disclosure?

A loan agreement and disclosure typically include information such as the loan amount, interest rate, repayment schedule, any fees or charges, late payment penalties, and the consequences of defaulting on the loan.

When is the deadline to file loan agreement and disclosure in 2023?

The deadline to file loan agreement and disclosure in 2023 may vary depending on the jurisdiction and specific regulations. It is important to consult the applicable laws or seek professional advice to determine the exact deadline.

What is the penalty for the late filing of loan agreement and disclosure?

The penalty for the late filing of a loan agreement and disclosure may vary depending on the jurisdiction and regulations in place. It can range from monetary fines to other legal consequences. It is advisable to consult the applicable laws or seek legal advice to understand the specific penalties.

Can I create an electronic signature for the loan agreement and disclosure in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your loan agreement and disclosure in seconds.

Can I create an eSignature for the loan agreement and disclosure in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your loan agreement and disclosure and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How do I edit loan agreement and disclosure on an iOS device?

Create, modify, and share loan agreement and disclosure using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

Fill out your loan agreement and disclosure online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.