Get the free Accept and File Treasurers Report for the month of March, 2016

Show details

AGENDA

REGULAR BOARD MEETING

FAIR OAKS WATER DISTRICT OFFICE

10326 FAIR OAKS BLVD, FAIR OAKS

April 11, 2016

6:30 PM

The Board of Directors of the Fair Oaks Water District holds its Regular Board Meetings

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your accept and file treasurers form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your accept and file treasurers form via URL. You can also download, print, or export forms to your preferred cloud storage service.

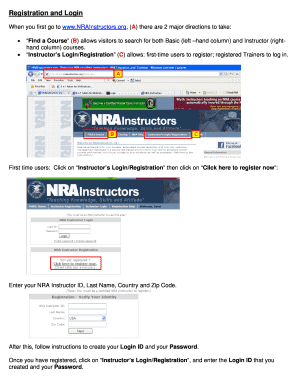

How to edit accept and file treasurers online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit accept and file treasurers. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

How to fill out accept and file treasurers

How to fill out accept and file treasurers:

01

Obtain the necessary forms: Start by obtaining the accept and file treasurers forms from the relevant authority or organization. These forms can usually be found online or by contacting the appropriate department.

02

Read the instructions: Carefully read through the instructions provided with the forms. It is important to understand the requirements and guidelines before filling out the forms.

03

Provide accurate information: Fill out the forms accurately, making sure to provide all the required information. This may include details such as name, address, contact information, and any other relevant information as specified in the instructions.

04

Attach supporting documents: Check if there are any supporting documents that need to be submitted along with the filled-out forms. These documents could include financial statements, receipts, or any other documentation as required.

05

Review and double-check: Before submitting the forms, thoroughly review all the information provided. Double-check for any errors or missing details. It is crucial to ensure all the information is accurate and complete.

06

Submit the forms: Once you are confident that everything is filled out correctly, submit the forms as per the instructions provided. This may involve mailing them to a specific address, submitting them electronically, or visiting the appropriate office in person.

07

Keep a copy for your records: Make sure to keep a copy of the filled-out forms, as well as any supporting documents, for your records. This will serve as proof of submission and can be helpful for future reference if needed.

Who needs accept and file treasurers?

01

Individuals: Individuals who are obligated to report their financial activities, such as income, expenses, or assets, may need to fill out accept and file treasurers. This could include self-employed individuals, freelancers, or those with complex financial situations.

02

Businesses: Companies of all sizes may be required to fill out accept and file treasurers. This could be for purposes of tax reporting, compliance with legal requirements, or providing financial information to stakeholders.

03

Non-profit organizations: Non-profit organizations, including charities, foundations, and community groups, may also need to fill out accept and file treasurers. These organizations often have specific reporting requirements to maintain transparency and accountability.

Overall, anyone who is required to report their financial activities, whether as an individual, business, or non-profit organization, may need to fill out accept and file treasurers. It is essential to understand the specific requirements applicable to your situation and ensure compliance with any relevant regulations.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I edit accept and file treasurers on an iOS device?

Create, modify, and share accept and file treasurers using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

How can I fill out accept and file treasurers on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your accept and file treasurers by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

How do I complete accept and file treasurers on an Android device?

Complete your accept and file treasurers and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

Fill out your accept and file treasurers online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.