Get the free CASH FLOW FORM

Show details

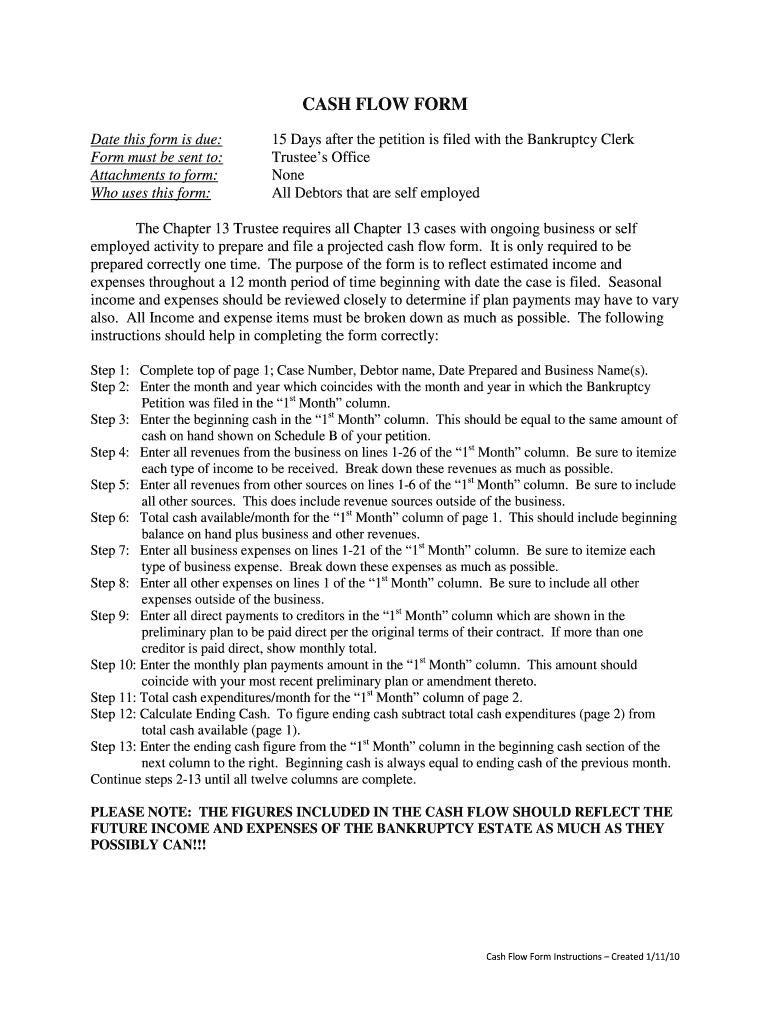

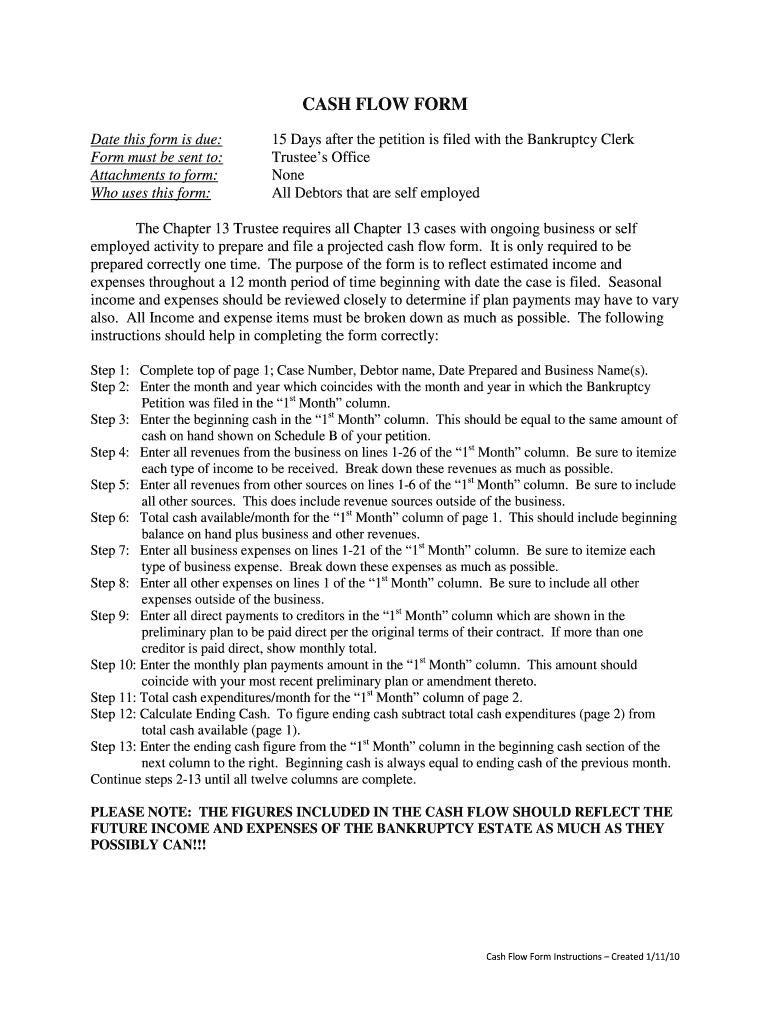

The form is required by the Chapter 13 Trustee for debtors that are self-employed to file a projected cash flow to reflect estimated income and expenses over a 12-month period following the bankruptcy

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign cash flow form

Edit your cash flow form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your cash flow form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing cash flow form online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit cash flow form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out cash flow form

How to fill out CASH FLOW FORM

01

Gather your financial statements.

02

Start with your opening cash balance for the period.

03

List all cash inflows from operating activities (e.g., sales revenue).

04

Include cash inflows from investing activities (e.g., asset sales).

05

Record cash inflows from financing activities (e.g., loans, investments).

06

Subtract all cash outflows from operating activities (e.g., expenses, salaries).

07

Deduct cash outflows from investing activities (e.g., purchase of assets).

08

Subtract cash outflows from financing activities (e.g., repayments).

09

Calculate the net cash flow by adding total inflows and subtracting total outflows.

10

Sum the net cash flow with the opening cash balance to obtain the closing cash balance.

Who needs CASH FLOW FORM?

01

Businesses to monitor their cash management and profitability.

02

Investors to assess the financial health of a company.

03

Lenders to evaluate the ability of a business to repay loans.

04

Financial analysts for budgeting and forecasting purposes.

05

Accountants for preparing financial statements.

Fill

form

: Try Risk Free

People Also Ask about

What are the 7 steps to prepare a statement of cash flows?

We are going to learn how to prepare statement of cash flows by indirect method. Step 1: Prepare — Gather Basic Documents and Data. Step 2: Calculate Changes in the Balance Sheet. Step 3: Put Each Change in B/S to the Statement of Cash Flows.

What are the four forms of cash flow?

Cash Flows from Operating Activities. Cash flows from operating activities result from providing services and producing and delivering goods. Cash Flows from Noncapital Financing Activities. Cash Flows from Capital and Related Financing Activities. Cash Flows from Investing Activities.

How do you write a cash flow statement?

How to prepare a cash flow statement Gather your financial documents and data. Identify your opening cash balance. List incoming cash. Calculate your total incoming cash amount. List outgoing cash. Calculate your total outgoing cash amount. Adjust for non-cash items. Calculate your cash flow.

What is a cashflow document?

A cash flow statement tracks how much money your business brought in over a set period, and how much was spent. The figure at the bottom of the statement is your total net cash flow. If it is positive, cash flow increased over the period; if it's negative, more cash was spent than received.

What is cash flow in simple words?

Cash flow, in general, refers to payments made into or out of a business, project, or financial product. It can also refer more specifically to a real or virtual movement of money. Cash flow, in its narrow sense, is a payment (in a currency), especially from one central bank account to another.

What is OCF and FCF?

Operating cash flow measures cash generated by a company's business operations. Free cash flow is the cash left over after subtracting capital expenditures from operating cash flow. Operating cash flow indicates for investors whether a company has enough cash to pay its bills and turn a profit.

What is a cash flow form?

A cash flow statement is one of the financial statements that publicly traded companies prepare, along with the balance sheet and income statement. A cash flow statement is generally broken down into 3 main sections: operating activities, investing activities, and financing activities.

How to make a cash flow document?

How to Create a Cash Flow Statement Determine the Starting Balance. Calculate Cash Flow from Operating Activities. Calculate Cash Flow from Investing Activities. Calculate Cash Flow from Financing Activity. Determine the Ending Balance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is CASH FLOW FORM?

The CASH FLOW FORM is a financial document used to track the inflow and outflow of cash within a specific period, providing insights into a business's liquidity and cash management.

Who is required to file CASH FLOW FORM?

Typically, businesses and organizations that manage operational finances, especially those that require financial reporting for stakeholders, investors, or regulatory purposes, are required to file a CASH FLOW FORM.

How to fill out CASH FLOW FORM?

To fill out the CASH FLOW FORM, gather financial data related to cash receipts and cash payments, categorize them into operating, investing, and financing activities, and summarize the net cash flow for the period.

What is the purpose of CASH FLOW FORM?

The purpose of the CASH FLOW FORM is to provide an overview of cash generated and used during a period, helping businesses assess their liquidity, identify cash trends, and make informed financial decisions.

What information must be reported on CASH FLOW FORM?

The CASH FLOW FORM must report information regarding cash flows from operating activities, investing activities, and financing activities, along with changes in cash position and beginning and ending cash balances.

Fill out your cash flow form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Cash Flow Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.