Get the free Lynnette T Riley Revenue Commissioner State of Georgia

Show details

1 Jan 2016 ... Forms (included in tax booklet): Form 500, Form 500EZ, and Form IND-CR ... Visit HTTP://for.Georgia.gov for more information about these and other topics of interest. CREDIT CARD ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your lynnette t riley revenue form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your lynnette t riley revenue form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit lynnette t riley revenue online

To use the services of a skilled PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit lynnette t riley revenue. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

How to fill out lynnette t riley revenue

How to fill out lynnette t riley revenue:

01

Start by gathering all the necessary financial documents, such as income statements, expense receipts, and tax forms.

02

Review the instructions and guidelines provided by lynnette t riley revenue carefully to understand the specific requirements and procedures.

03

Begin filling out the revenue form by entering your personal information, such as your name, contact details, and any relevant identification numbers.

04

Provide accurate information regarding your income, including wages, salaries, tips, investments, or any other sources of revenue.

05

Deduct any eligible expenses, such as business-related costs or deductible personal expenses, according to the guidelines provided.

06

Ensure that all calculations are correct and supported by proper documentation. Double-check for any errors or missing information.

07

Once the form is completed, sign and date it as required.

08

Make a copy of the filled-out form for your records before submitting it to lynnette t riley revenue.

Who needs lynnette t riley revenue:

01

Individuals who have earned income from various sources, such as employment, investments, or self-employment, and are required to report it for taxation purposes.

02

Businesses or self-employed individuals who need to report their revenue and expenses accurately to comply with tax regulations and ensure proper financial management.

03

Anyone who has received a request or notification from lynnette t riley revenue, requesting them to submit their revenue information.

Please note that the specific requirements and procedures may vary depending on the jurisdiction and the nature of the revenue being reported. It is always advisable to consult with a tax professional or refer to the official guidelines provided by lynnette t riley revenue for accurate and up-to-date information.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

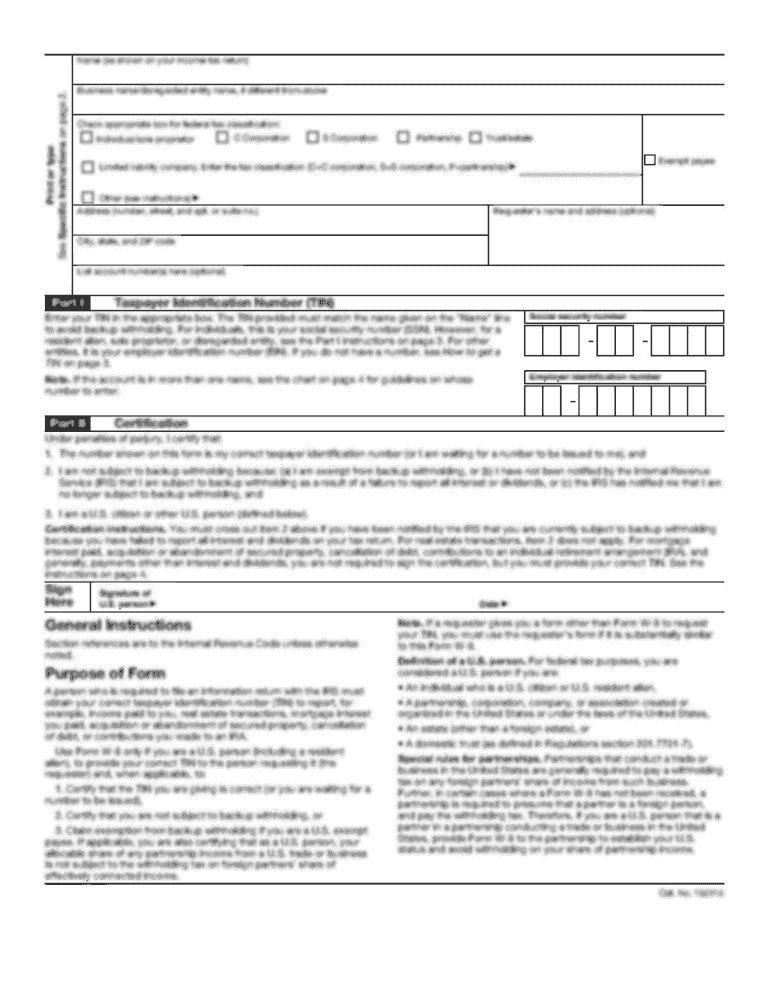

What is lynnette t riley revenue?

Lynnette T. Riley revenue is the income generated or earned by Lynnette T. Riley.

Who is required to file lynnette t riley revenue?

Lynnette T. Riley or any individual or entity named Lynnette T. Riley who has generated income is required to file Lynnette T. Riley revenue.

How to fill out lynnette t riley revenue?

To fill out Lynnette T. Riley revenue, one must accurately report all income earned by Lynnette T. Riley during the specified period.

What is the purpose of lynnette t riley revenue?

The purpose of Lynnette T. Riley revenue is to document and report the income generated by Lynnette T. Riley for tax or accounting purposes.

What information must be reported on lynnette t riley revenue?

Information such as sources of income, amounts earned, deductions, and any other relevant financial details related to Lynnette T. Riley must be reported on Lynnette T. Riley revenue.

When is the deadline to file lynnette t riley revenue in 2024?

The deadline to file Lynnette T. Riley revenue in 2024 is typically April 15th for most individuals.

What is the penalty for the late filing of lynnette t riley revenue?

The penalty for late filing of Lynnette T. Riley revenue may include fines, interest charges, or other consequences as determined by tax authorities.

Can I sign the lynnette t riley revenue electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your lynnette t riley revenue in seconds.

How can I edit lynnette t riley revenue on a smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing lynnette t riley revenue.

How can I fill out lynnette t riley revenue on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your lynnette t riley revenue. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

Fill out your lynnette t riley revenue online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.