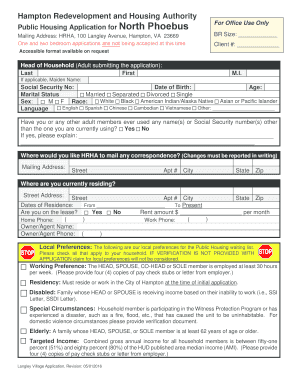

Get the free Gift Aid Form - Halesworth Arts Festival - halesworthartsfestival org

Show details

HAYWORTH ARTS FESTIVAL Gift Aid Declaration Using Gift Aid means that for every pound you give to the Hales worth Arts Festival, we can claim an additional 25p from HM Revenue & Customs helping your

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your gift aid form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your gift aid form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit gift aid form online

To use our professional PDF editor, follow these steps:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit gift aid form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

How to fill out gift aid form

How to fill out a gift aid form?

Start by obtaining the gift aid form:

01

Visit the website of the organization or charity that you wish to donate to.

02

Look for the "Gift Aid" or "Donation" section where you can find the form.

03

Alternatively, you can visit the organization's office or contact them directly to request a form.

Provide your personal information:

01

Begin by writing your full name and address in the designated fields on the form.

02

Ensure that the information you provide is accurate and up to date to avoid any issues with the donation.

Tick the declaration box:

01

Tick the box which states that you are a UK taxpayer and understand that the charity can claim an additional 25% on top of your donation from the government.

02

This declaration is important as it allows the charity to maximize the impact of your donation.

Confirm if you want to backdate your declaration (if applicable):

01

If you have been donating to the same charity regularly and want to backdate your declaration, indicate the start date of your contributions.

02

This step is optional and is useful if you want the charity to claim gift aid on your previous donations from up to four years ago.

Specify the donation details:

01

Write down the date and the amount of your donation.

02

If you have made multiple donations, you can include a summary of your donations on the same form or attach separate sheets if necessary.

Sign and date the form:

01

Once you have completed filling out the form, sign and date it at the bottom.

02

This signature confirms that the information provided is accurate and you understand the implications of the gift aid declaration.

Who needs a gift aid form?

01

Donors: Gift aid forms are required by individuals or organizations who wish to donate to a registered UK charity.

1.1

If you are making a charitable donation and want the charity to claim gift aid on your behalf, you need to fill out a gift aid form.

02

Registered UK charities: Charities need gift aid forms to collect the necessary information from donors to claim gift aid on their donations.

2.1

The forms help charities ensure that they have accurate donor information to comply with the regulations set by HM Revenue and Customs.

03

HM Revenue and Customs: Although not directly needing the gift aid form, HM Revenue and Customs relies on the information provided in these forms to determine the eligibility of the charity for the gift aid scheme.

3.1

By completing and submitting gift aid forms, charities enable HM Revenue and Customs to track and verify their eligibility for claiming gift aid.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get gift aid form?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the gift aid form. Open it immediately and start altering it with sophisticated capabilities.

How do I complete gift aid form online?

pdfFiller has made filling out and eSigning gift aid form easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

Can I edit gift aid form on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign gift aid form. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

Fill out your gift aid form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.