Get the free SA 5243 Rev. Form SA908 UTC-SAC Standard Terms and Conditions of Purchase - Rev 01OC...

Show details

DISCLOSURE STATEMENT

COST ACCOUNTING STANDARDS NOTICES AND CERTIFICATION

Note: This notice does not apply to small businesses or foreign governments.

Offers shall provide the requested information

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your sa 5243 rev form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sa 5243 rev form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing sa 5243 rev form online

To use our professional PDF editor, follow these steps:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit sa 5243 rev form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Dealing with documents is simple using pdfFiller.

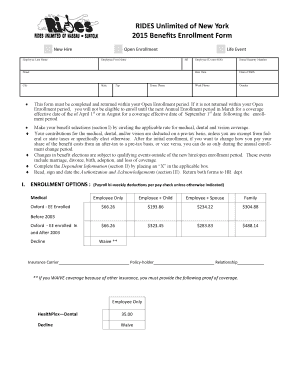

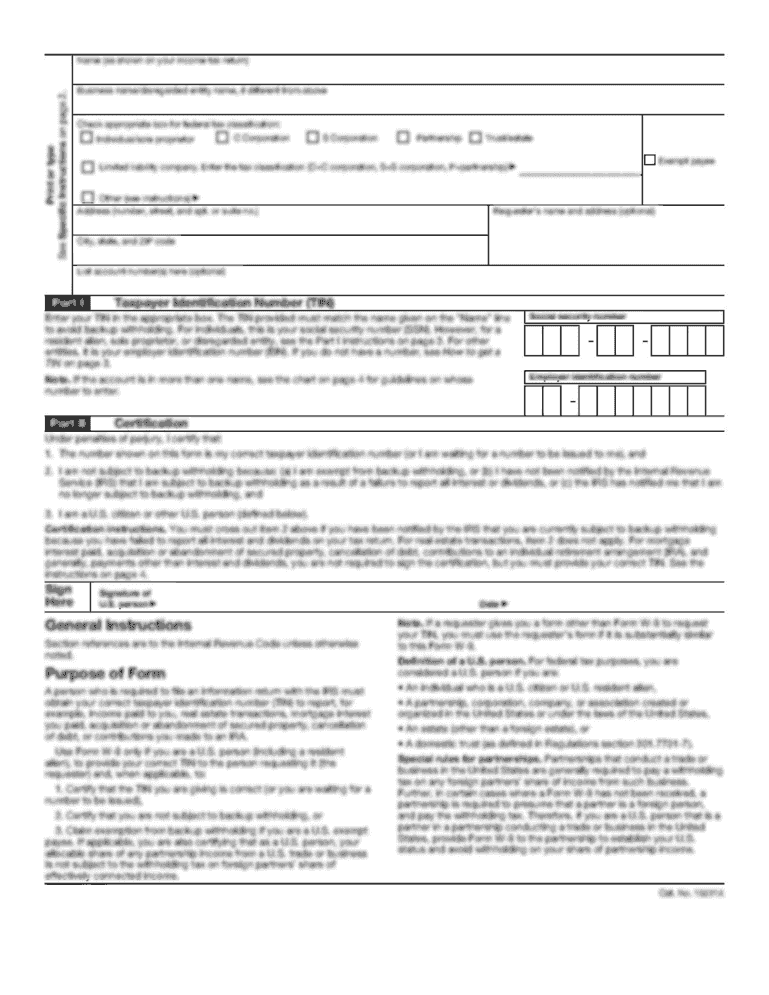

How to fill out sa 5243 rev form

How to fill out sa 5243 rev form:

01

Begin by gathering all the necessary information and documents required for filling out the form, such as personal details, financial records, and any supporting documentation.

02

Carefully read the instructions provided with the form to ensure you understand the requirements and any specific guidelines for completing each section.

03

Start with the first section of the form, typically requiring your personal information such as name, contact details, and social security number. Ensure accuracy and legibility when filling out this section.

04

Move on to the subsequent sections, which may ask for details such as income, assets, and liabilities. Be thorough and provide all requested information truthfully and accurately.

05

If there are any specific sections or questions that you find confusing or challenging, consider seeking assistance from a professional, such as a tax advisor or legal expert.

06

After completing all the necessary sections, review the form to ensure all information is accurate and complete. Make any necessary corrections before moving forward.

07

Sign and date the form as required, typically at the end of the document. Failure to sign the form may result in it being deemed incomplete.

08

Make copies of the completed form for your records and any additional copies that may be required by the relevant authorities.

09

Submit the form as instructed, whether it be through mail, online submission, or in-person delivery. Keep any receipts or confirmation of submission for your reference.

Who needs sa 5243 rev form:

01

Individuals who are applying for a particular program, benefit, or service that requires the completion of sa 5243 rev form.

02

Those who are required to provide detailed financial information as part of an application, evaluation, or review process.

03

Individuals who have been specifically instructed or directed to complete and submit the sa 5243 rev form by a government agency, organization, or the relevant authority.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

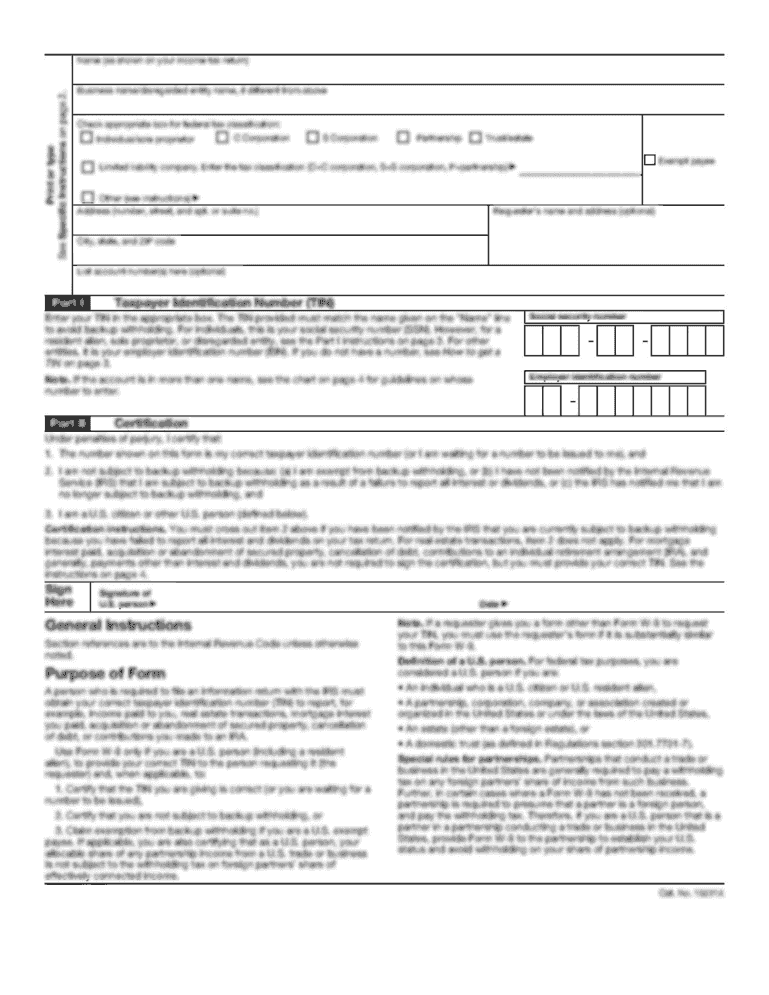

What is sa 5243 rev form?

The sa 5243 rev form is a tax form used for reporting certain financial information.

Who is required to file sa 5243 rev form?

Any individual or organization that meets the requirements outlined in the instructions for the sa 5243 rev form must file it.

How to fill out sa 5243 rev form?

To fill out the sa 5243 rev form, you need to carefully read the instructions provided with the form and enter the requested information accurately.

What is the purpose of sa 5243 rev form?

The purpose of the sa 5243 rev form is to gather relevant financial information from individuals or organizations for tax reporting purposes.

What information must be reported on sa 5243 rev form?

The specific information that must be reported on the sa 5243 rev form can be found in the accompanying instructions. It typically includes details about income, deductions, and other financial transactions.

When is the deadline to file sa 5243 rev form in 2023?

The deadline to file the sa 5243 rev form in 2023 is typically mentioned in the instructions or can be obtained from the relevant tax authority.

What is the penalty for the late filing of sa 5243 rev form?

The penalty for filing the sa 5243 rev form late may vary depending on the jurisdiction and circumstances. It is advisable to refer to the instructions or consult with a tax professional for accurate penalty information.

How can I modify sa 5243 rev form without leaving Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like sa 5243 rev form, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How do I fill out sa 5243 rev form using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign sa 5243 rev form and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

How do I complete sa 5243 rev form on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your sa 5243 rev form. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

Fill out your sa 5243 rev form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.