Get the free Customer Identification Programs For Futures Commission Merchants And Introducing Br...

Show details

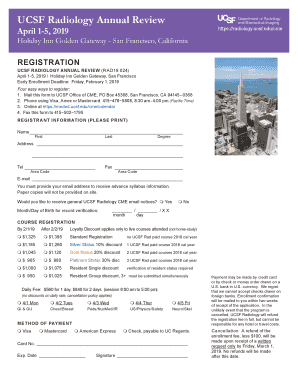

This document outlines the final rule implemented by the Financial Crimes Enforcement Network (FinCEN) and the Commodity Futures Trading Commission (CFTC) for Customer Identification Programs (CIPs)

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign customer identification programs for

Edit your customer identification programs for form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your customer identification programs for form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit customer identification programs for online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit customer identification programs for. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out customer identification programs for

How to fill out Customer Identification Programs For Futures Commission Merchants And Introducing Brokers

01

Gather relevant customer information, including name, date of birth, address, and identification number.

02

Verify the identity of the customer using government-issued ID or other reliable sources.

03

Conduct due diligence to understand the customer's background and business practices.

04

Create a risk assessment for the customer based on their profile.

05

Maintain records of the information collected and the verification process.

06

Implement a monitoring system to track transactions for suspicious activity.

07

Update customer information periodically and ensure compliance with regulatory changes.

Who needs Customer Identification Programs For Futures Commission Merchants And Introducing Brokers?

01

Futures Commission Merchants (FCMs)

02

Introducing Brokers (IBs)

03

Financial institutions that deal with futures trading

04

Compliance departments within trading firms

Fill

form

: Try Risk Free

People Also Ask about

What is the difference between a local and a futures commission merchant?

The trading volume during a certain period of time is the number of contracts traded during this period. What is the difference between a local and a futures commission merchant? A futures commission merchant trades on behalf of a client and charges a commission. A local trades on his or her own behalf.

Who are commission merchants?

Commission merchants advanced money to planters and manufacturers; in return, the products of farm and factory were consigned to them for sale. The planter and manufacturer were thus freed from the expense and trouble of selling and could devote their time, capital, and energy to the production of goods.

What is the difference between futures commission merchant and introducing broker?

An introducing broker acts as a middleman, matching an individual or a company seeking access to the futures markets with a futures commission merchant who will take on the responsibilities of making the trade and handling the back-office operations.

Who are futures commission merchants?

FCM is the term used in the Commodity Exchange Act to refer to registered firms that are in the business of soliciting or accepting orders, as broker, for the purchase or sale of any exchange- traded futures contract and options on futures contracts.

What is the customer identification procedure?

Customer identification means identifying the customer and verifying his/her identity by using reliable, independent source documents, data or information. Given below is the indicative procedure which may be reviewed and implemented by the Standing Committee on KYC/AML from time to time. Customer Identification–

Who is a futures commission merchant?

A futures commission merchant (FCM) is an entity that solicits or accepts orders to buy or sell futures contracts, options on futures, retail off-exchange forex contracts or swaps, and accepts money or other assets from customers to support such orders.

What is the difference between futures commission merchant and clearing member?

In the US, clearing members are known as futures commission merchants (FCMs). The clearing member assumes financial responsibility for the trades, and posts initial and variation margin to the CCP – in the case of client trades, the member collects the margin from the customer.

What is an example of a customer identification program?

Let's say, for example, a new customer walks into a bank branch to open a checking account. The bank's CIP mandates the customer to provide identification documents such as a driver's license, passport, or government-issued ID.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Customer Identification Programs For Futures Commission Merchants And Introducing Brokers?

Customer Identification Programs (CIPs) for Futures Commission Merchants (FCMs) and Introducing Brokers (IBs) are regulations requiring these financial entities to obtain, verify, and maintain specific information about their customers' identities to prevent money laundering and other financial crimes.

Who is required to file Customer Identification Programs For Futures Commission Merchants And Introducing Brokers?

Futures Commission Merchants (FCMs) and Introducing Brokers (IBs) that are registered with the Commodity Futures Trading Commission (CFTC) and are subject to the Bank Secrecy Act (BSA) are required to implement Customer Identification Programs.

How to fill out Customer Identification Programs For Futures Commission Merchants And Introducing Brokers?

To fill out Customer Identification Programs, FCMs and IBs must collect necessary customer information such as name, address, date of birth, and Social Security number or taxpayer identification number, and verify these details through reliable documents, services, or data sources.

What is the purpose of Customer Identification Programs For Futures Commission Merchants And Introducing Brokers?

The purpose of Customer Identification Programs is to ensure that FCMs and IBs can accurately identify their customers and assess the risk they may pose, thereby preventing illegal activities such as money laundering and financing of terrorism.

What information must be reported on Customer Identification Programs For Futures Commission Merchants And Introducing Brokers?

The reported information must include the customer's name, date of birth, address, identification number (Social Security or taxpayer ID), and any other relevant documentation or data necessary to verify the customer's identity.

Fill out your customer identification programs for online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Customer Identification Programs For is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.