Get the free LIFE INSURANCE ANNUITY amp FIXED BLOTTER - bfwgbbcomb

Show details

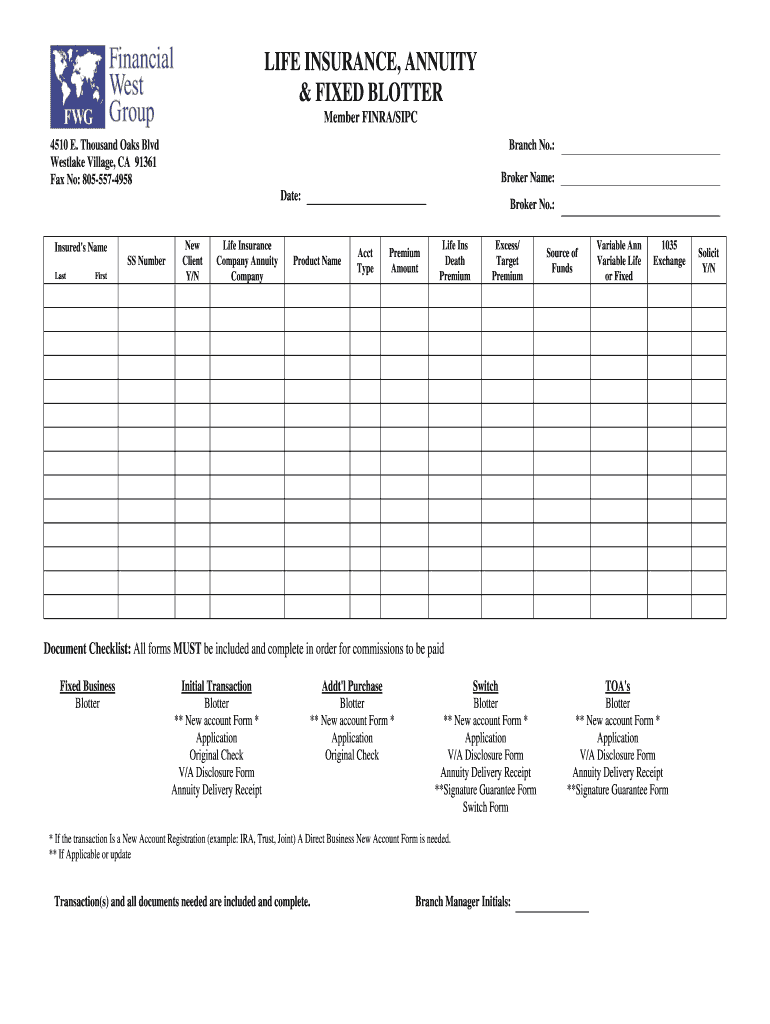

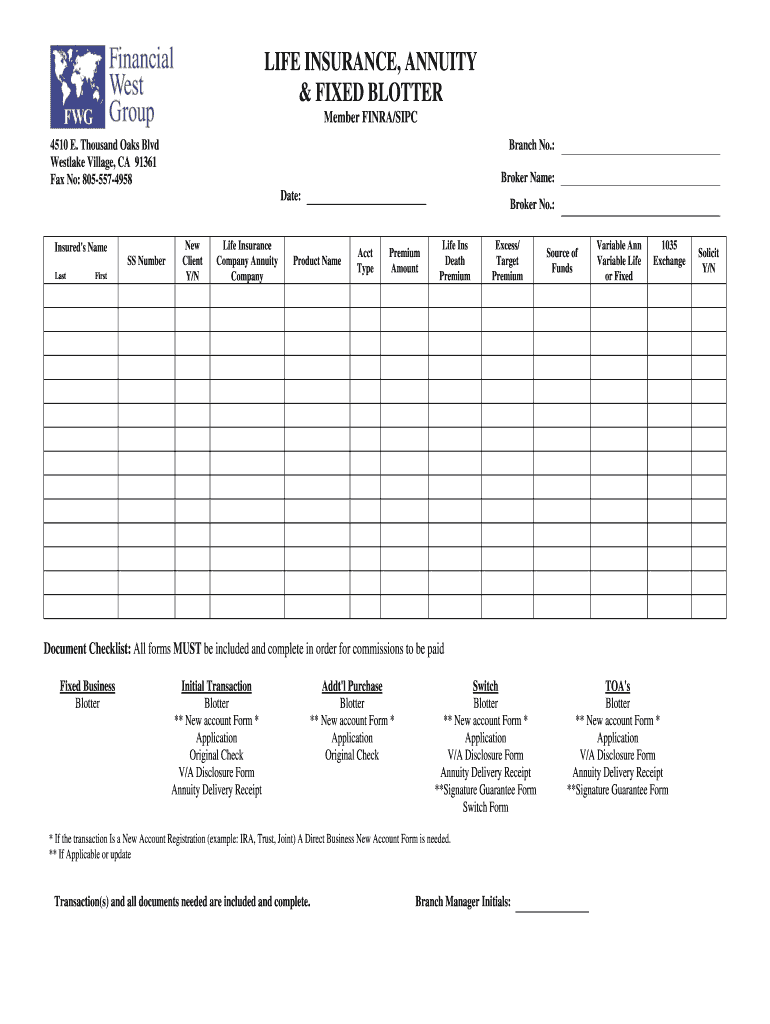

PRINT FORM CLEAR FORM LIFE INSURANCE, ANNUITY & FIXED BLOTTER Member FINRA SIPC 4510 E. Thousand Oaks Blvd Westlake Village, CA 91361 Fax No: 8055574958 Branch No.: Broker Name: Date: Insured's Name

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your life insurance annuity amp form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your life insurance annuity amp form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing life insurance annuity amp online

Follow the guidelines below to benefit from a competent PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit life insurance annuity amp. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

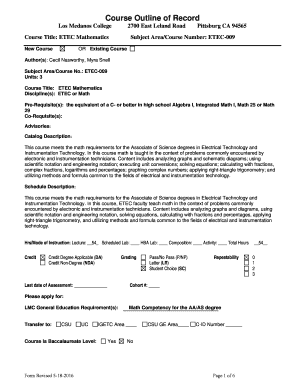

How to fill out life insurance annuity amp

How to fill out life insurance annuity amp:

01

Gather necessary information: Collect all relevant personal and financial details required for the application, such as your name, date of birth, social security number, contact information, and beneficiary details.

02

Understand your options: Familiarize yourself with the available types of life insurance annuity amp policies and their features. Educate yourself about the payout options, premium amounts, and any additional benefits or riders associated with the policy.

03

Determine coverage needs: Assess your financial goals and obligations to determine the appropriate coverage amount and duration for your life insurance annuity amp policy. Consider factors such as income replacement, debt repayment, mortgage or rent payments, education expenses for dependents, and future financial security for your family.

04

Compare quotes: Request quotes from multiple insurance companies offering life insurance annuity amp policies. Compare the premium costs, coverage features, and customer reviews to make an informed decision about the best policy for your needs.

05

Fill out the application: Complete the application form accurately and thoroughly. Provide all the necessary information, including your personal details, medical history, lifestyle habits, and financial information. Ensure you provide truthful and updated information to avoid any issues during the underwriting process.

06

Undergo medical examination if required: Depending on the policy and coverage amount, you may be required to undergo a medical examination. Schedule the examination and follow the instructions provided by the insurance company. Cooperate fully and be transparent regarding your health conditions to avoid any discrepancies.

07

Review and sign the policy: Once your application is reviewed and accepted, carefully review the terms and conditions of the life insurance annuity amp policy. Understand the coverage, premium, payout options, and any exclusions or limitations. Seek clarification from the insurance agent if you have any doubts or concerns before signing the policy documents.

Who needs life insurance annuity amp:

01

Individuals with financial dependents: Life insurance annuity amp is crucial for individuals who have family members or dependents who rely on their income to maintain their lifestyle or meet financial obligations. It ensures their loved ones are financially protected in the event of their untimely demise.

02

Business owners: Business owners often require life insurance annuity amp to protect their businesses from potential financial losses if a key person in the company passes away. It can provide funds to cover expenses, repay debts, or facilitate a smooth business transition.

03

Retirement planning: People looking to secure a stable income source during their retirement years can opt for life insurance annuity amp. It offers a way to accumulate savings and provides regular payments or a lump sum amount after retirement, ensuring financial stability and peace of mind.

04

Estate planning: Life insurance annuity amp can be a useful tool for estate planning. It helps individuals ensure that their financial assets are distributed according to their wishes by providing liquidity to pay estate taxes, debts, or any other financial obligations.

05

Individuals seeking tax advantages: Depending on the jurisdiction, life insurance annuity amp may offer tax advantages or incentives. Individuals aiming to minimize their tax liability or maximize their tax-deferred savings can consider this type of insurance. However, it's important to consult with a financial advisor or tax professional specific to your region to fully understand the tax implications.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit life insurance annuity amp from Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your life insurance annuity amp into a dynamic fillable form that can be managed and signed using any internet-connected device.

Can I create an eSignature for the life insurance annuity amp in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your life insurance annuity amp and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

How do I fill out life insurance annuity amp on an Android device?

Complete your life insurance annuity amp and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

Fill out your life insurance annuity amp online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.