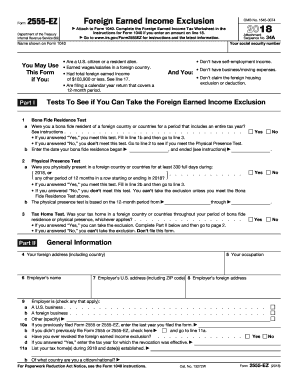

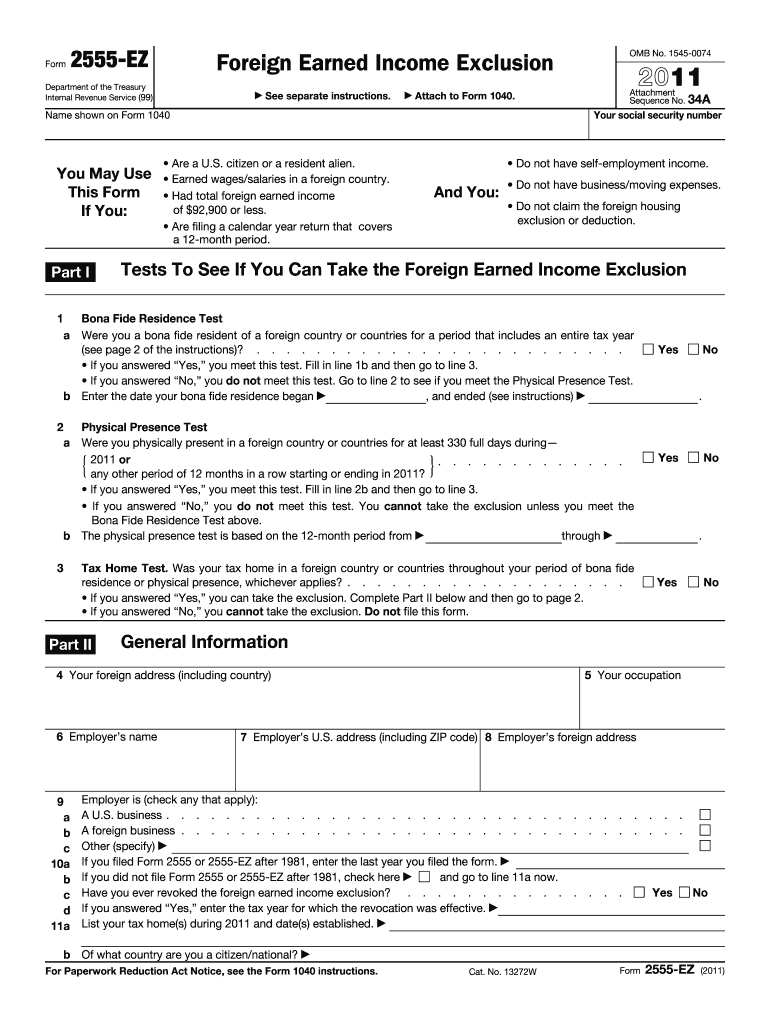

IRS 2555-EZ 2011 free printable template

Show details

Cat. No. 13272W Form 2555-EZ 2011 Page Days Present in the United States Complete this part if you were in the United States or its possessions during 2011. 92 900 00 days Multiply line 13 by line 15 Enter in U.S. dollars the total foreign earned income you earned and received in 2011 see instructions. Be sure to include this amount on Form 1040 line 7. on Form 1040 line 21. Next to the amount enter 2555-EZ. A foreign business. Other specify If you filed Form 2555 or 2555-EZ after 1981 enter...

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign

Edit your 2011 2555 ez form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2011 2555 ez form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 2011 2555 ez form online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 2011 2555 ez form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

IRS 2555-EZ Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out 2011 2555 ez form

How to fill out 2011 2555 ez form:

01

Enter your personal information such as name, address, and social security number in the designated fields.

02

Provide details about your foreign earned income, including the sources and amounts earned.

03

Calculate the allowable deductions and exemptions related to your foreign earned income.

04

Determine your foreign housing expenses and calculate the applicable exclusion amount.

05

Complete any additional sections of the form that pertain to your specific situation, such as the alternative minimum tax or self-employment tax.

06

Double-check all the information provided for accuracy and make sure all required fields are filled out.

07

Sign and date the form before submitting.

Who needs 2011 2555 ez form:

01

U.S. citizens or resident aliens who earned income from foreign sources during the year 2011.

02

Individuals who qualify for the foreign earned income exclusion and want to claim it on their tax returns.

03

Taxpayers who want to report and calculate their foreign housing expenses for the purpose of claiming the housing exclusion or deduction.

Fill form : Try Risk Free

People Also Ask about 2011 2555 ez form

What are forms 2555 and 2555-EZ used for?

Can form 2555 be filed electronically?

Can you fill out tax forms digitally?

What is the difference between 2555-EZ and 2555?

What is the IRS form 2555-EZ 2019?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 2555 ez form?

The 2555 ez form is a simplified version of Form 2555, which is used by U.S. citizens or resident aliens who live and work abroad to claim the Foreign Earned Income Exclusion on their income taxes.

Who is required to file 2555 ez form?

Individuals who meet the eligibility criteria for the Foreign Earned Income Exclusion and do not have any self-employment income can use the 2555 ez form to claim the exclusion. However, it is advisable to consult a tax professional to see if you are eligible and whether the 2555 ez form is suitable for your situation.

How to fill out 2555 ez form?

To fill out the 2555 ez form, you will need to provide information such as your name, address, social security number, and details about your foreign income and housing expenses. You can find detailed instructions and guidance on the IRS website or seek assistance from a tax professional.

What is the purpose of 2555 ez form?

The purpose of the 2555 ez form is to allow eligible individuals to claim the Foreign Earned Income Exclusion, which helps reduce their taxable income by excluding income earned abroad from U.S. taxation.

What information must be reported on 2555 ez form?

On the 2555 ez form, you will need to report your personal information, foreign income earned during the tax year, housing expenses, and any other relevant details required by the form.

When is the deadline to file 2555 ez form in 2023?

The deadline to file the 2555 ez form for the tax year 2023 is typically April 15th, unless there are any extensions granted by the IRS. It is always recommended to check the IRS website or consult a tax professional for the most up-to-date information.

What is the penalty for the late filing of 2555 ez form?

The penalty for late filing of the 2555 ez form is usually a percentage of the tax owed that is not paid by the deadline. The specific penalty amount can vary depending on the individual's circumstances and the length of the delay. It is advisable to consult the IRS guidelines or a tax professional for accurate information and potential penalty waivers or exceptions.

How do I edit 2011 2555 ez form straight from my smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing 2011 2555 ez form.

How do I fill out 2011 2555 ez form using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign 2011 2555 ez form and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

How do I complete 2011 2555 ez form on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your 2011 2555 ez form. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

Fill out your 2011 2555 ez form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.