Get the free Credit Application–Customer Statement

Show details

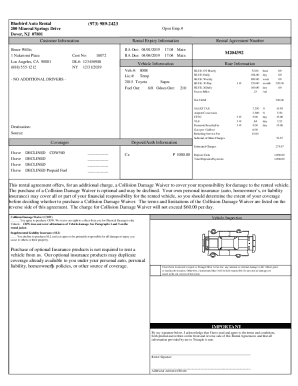

This document serves as a credit application for individuals seeking financing through Eaglemark Savings Bank, requiring detailed personal and financial information from the applicant and potentially

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign credit applicationcustomer statement

Edit your credit applicationcustomer statement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your credit applicationcustomer statement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing credit applicationcustomer statement online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit credit applicationcustomer statement. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out credit applicationcustomer statement

How to fill out Credit Application–Customer Statement

01

Begin by entering your personal information, including your full name, address, phone number, and email.

02

Provide your Social Security Number (SSN) and date of birth for identity verification.

03

Enter your employment information, including your employer's name, your job title, and your income.

04

List any other sources of income, if applicable, and specify the amounts.

05

Detail your financial obligations by listing outstanding debts, mortgages, or loans.

06

Indicate your desired credit limit and purpose for the credit application.

07

Review all the entered information for accuracy and completeness.

08

Sign and date the application to certify the accuracy of the information provided.

Who needs Credit Application–Customer Statement?

01

Individuals or businesses seeking credit from financial institutions or lenders.

02

Customers applying for credit cards or loans.

03

People looking to finance a large purchase or investment.

Fill

form

: Try Risk Free

People Also Ask about

How do you write a customer statement?

Here is how to write a customer statement and the elements you will need to get started: NAME AND ADDRESS. You should be including not only your customer's name and address on the statement, but your company name and address. REFERENCE. DATE. OPENING BALANCE. HEADINGS. TOTALS.

What should a customer statement show?

You can produce statements to send to your customers to show the status of their accounts. The statement shows all transactions and the total invoiced to the customer for a particular date range. It also shows the amount the customer has paid and the amount outstanding at the end of the period specified.

What is an example of a consumer information?

the information needed by consumers when researching, purchasing, and completing a purchase. Examples of consumer information needs include: product attributes (e.g. specification, price, quality standards), expert and consumer opinions, and vendor reputation.

What is an example of a consumer statement?

For example, if you lost your job or were out of work due to an illness or injury and did not make regular payments on some of your credit card accounts or loans, you might add a Consumer Statement to explain, “I was unable to work from March to December. When I got a new job, I started making regular payments.”

How do I put a consumer statement on my credit report?

You're able to submit a consumer statement to a credit bureau by mail or online. Bureau websites will contain specific instructions. However, consumer statements are usually limited to a certain number of characters or words.

What is an example of a consumer insight statement?

Example: “We enjoy using our outdoor pool but are often bothered by Mosquitos.” Keep in mind: The context — and a consumer insight statement in general — should be very objective.

What is a consumer statement?

Consumer statements are written explanations that individuals can add to their credit reports to contextualize or explain certain information. They are typically used to clarify errors, dispute inaccuracies, explain negative activity or address special circumstances.

What is an example of a consumer document?

Many consumer documents, such as warranties, protect the rights of the purchaser and the seller. Other consumer documents include advertisements, contracts, instruction manuals, and product information.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Credit Application–Customer Statement?

The Credit Application–Customer Statement is a financial document used by businesses to request credit from suppliers or financial institutions. It provides an overview of a customer's financial health and payment history.

Who is required to file Credit Application–Customer Statement?

Businesses or individuals seeking credit or financing from suppliers or lending institutions are typically required to file a Credit Application–Customer Statement.

How to fill out Credit Application–Customer Statement?

To fill out the Credit Application–Customer Statement, applicants need to provide accurate information about their business or personal financial status, including name, address, contact details, credit references, and financial statements.

What is the purpose of Credit Application–Customer Statement?

The purpose of the Credit Application–Customer Statement is to assess the creditworthiness of a business or individual before extending credit. It helps lenders make informed decisions regarding credit risks.

What information must be reported on Credit Application–Customer Statement?

The information that must be reported on the Credit Application–Customer Statement generally includes the applicant's business and personal information, credit history, references, financial statements, and any outstanding debts.

Fill out your credit applicationcustomer statement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Credit Applicationcustomer Statement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.