Get the free 2000 Instructions for Form 1099-B Section references are to the Internal Revenue Cod...

Show details

2000 Instructions for Form 1099-B Section references are to the Internal Revenue Code unless otherwise noted. Department of the Treasury Internal Revenue Service What's New for 2000? To help make

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your 2000 instructions for form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2000 instructions for form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 2000 instructions for form online

To use the services of a skilled PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit 2000 instructions for form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

How to fill out 2000 instructions for form

01

The first step in filling out 2000 instructions for a form is to carefully read through all the provided instructions. Make sure you understand the purpose of the form and any specific requirements or guidelines mentioned.

02

Next, gather all the necessary information and documents that you will need to complete the form. This could include personal identification details, financial records, or any relevant supporting documents.

03

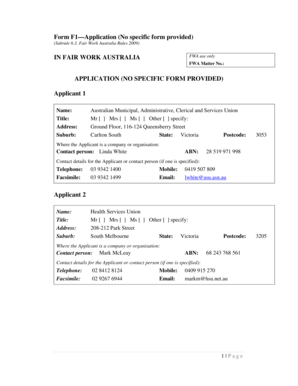

Begin filling out the form by following the instructions given. Start with the basic information such as your name, address, and contact details. Ensure that you provide accurate and up-to-date information.

04

Proceed to the specific sections of the form, addressing each field or question as instructed. Take your time and double-check your answers to ensure accuracy.

05

If there are any sections that you are unsure about or require additional clarification, refer back to the instructions provided. Pay attention to any specific formatting or formatting requirements, like using uppercase letters or inputting information in a certain order.

06

Attach any supporting documents or evidence as required. Follow the given instructions on how to properly attach or submit these documents, ensuring that they are clearly labeled and organized.

07

Once you have completed all the necessary fields and attached any required documents, review your answers carefully. Ensure that there are no omissions, errors, or inaccuracies that could affect the processing of your form.

08

Before submitting the form, it is advisable to make a copy of the completed form for your records. This will serve as a reference in case any issues arise or if you need to re-submit the form in the future.

Who needs 2000 instructions for form?

01

Individuals or organizations dealing with complex or highly detailed processes that require extensive documentation may need to fill out 2000 instructions for a form.

02

Professionals working in regulated industries, such as healthcare, finance, or law, may encounter forms with numerous instructions due to the nature of their work.

03

Government agencies, educational institutions, or large corporations often have forms that require detailed instructions to collect specific information or ensure compliance with regulations.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

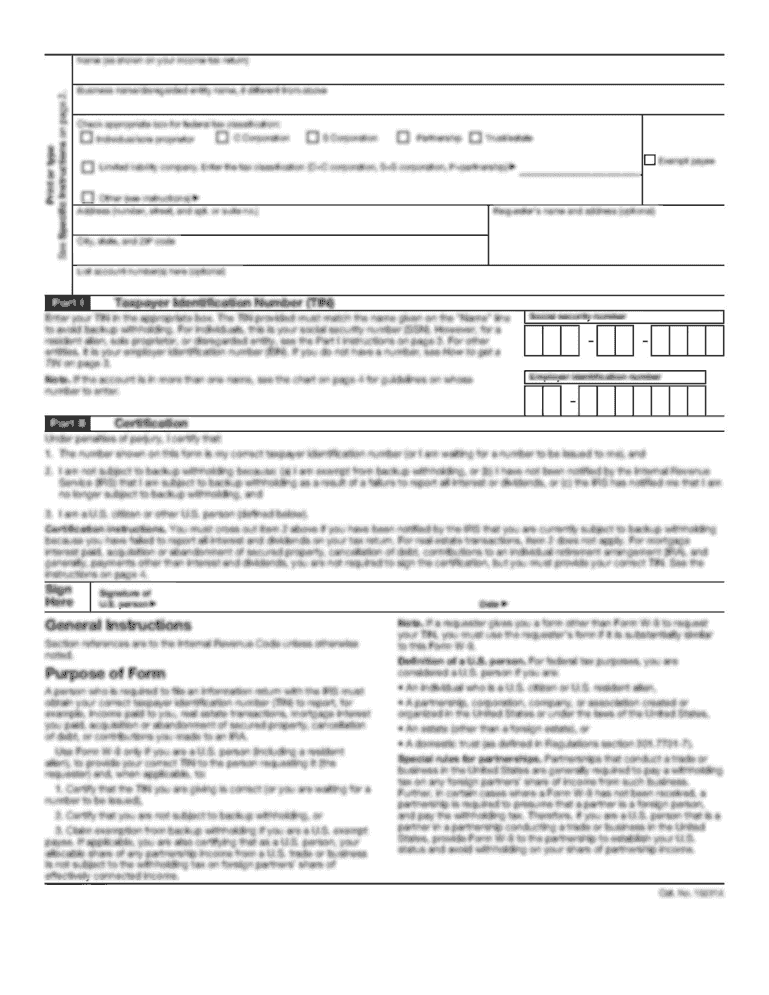

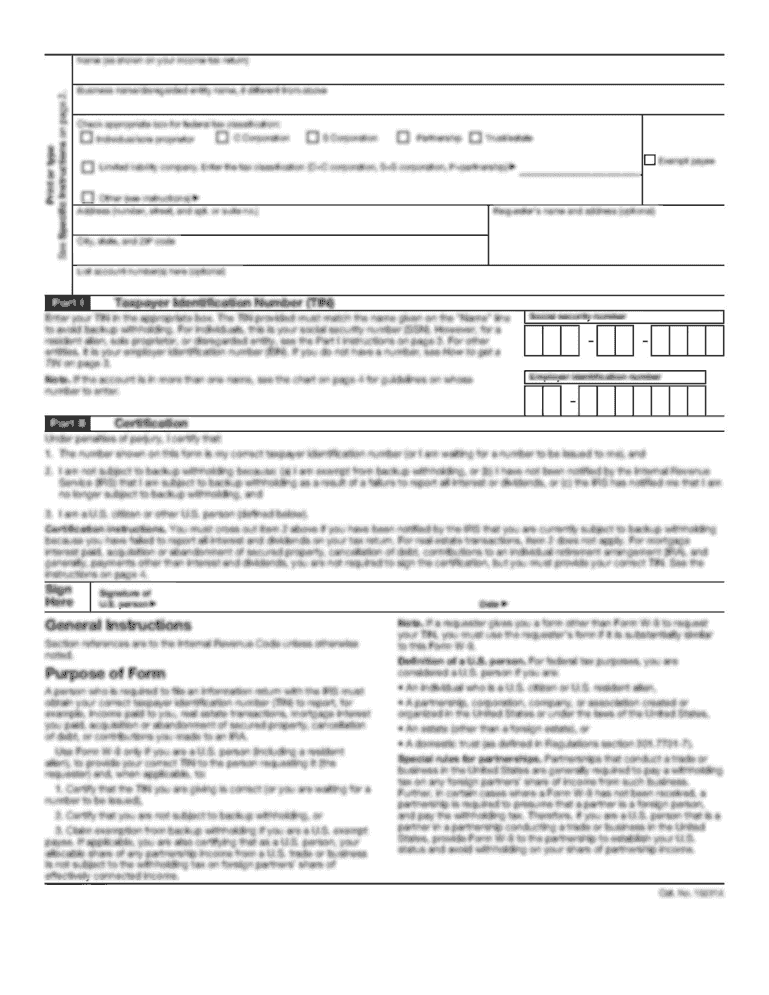

What is instructions for form 1099-b?

Form 1099-B instructions provide guidance on how to report sales or redemptions of securities, futures transactions, and barter exchange transactions for taxpayers and businesses.

Who is required to file instructions for form 1099-b?

Financial institutions, brokers, and other entities that engage in specified transactions are required to file Form 1099-B and provide a copy to the taxpayer.

How to fill out instructions for form 1099-b?

To fill out Form 1099-B, you need to provide the taxpayer's identification number, the description and quantity of the security or property sold, the date acquired and sold, the gross proceeds, and any adjustments.

What is the purpose of instructions for form 1099-b?

The purpose of Form 1099-B instructions is to ensure accurate reporting of transactions involving securities, futures, and barter exchanges to help taxpayers and the IRS correctly report and calculate their taxable income.

What information must be reported on instructions for form 1099-b?

The information that must be reported on Form 1099-B includes the taxpayer's identification number, description and quantity of the security or property sold, date acquired and sold, gross proceeds, and any adjustments.

When is the deadline to file instructions for form 1099-b in 2023?

The deadline to file Form 1099-B in 2023 is typically January 31st, but it is recommended to consult the IRS instructions for any updates or changes to the deadline.

What is the penalty for the late filing of instructions for form 1099-b?

The penalty for the late filing of Form 1099-B can range from $30 to $100 per form, depending on the delay period and the size of the filer's business or organization.

How do I modify my 2000 instructions for form in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your 2000 instructions for form and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How do I execute 2000 instructions for form online?

Easy online 2000 instructions for form completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How do I edit 2000 instructions for form straight from my smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing 2000 instructions for form, you need to install and log in to the app.

Fill out your 2000 instructions for form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.