Get the free form 13614 c sp 2007

Show details

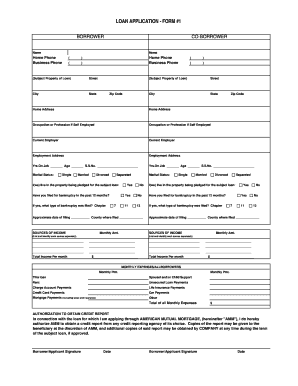

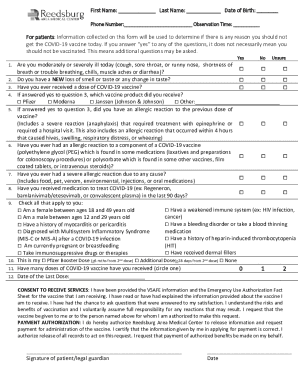

Department of the Treasury Internal Revenue Service Form 13614 SP Rev. Agosto-2007 Usted y su C nyuge necesitar n OMB 1545-1964 Entrevista y Hoja de Informaci n Prueba de Identidad Copias de TODAS las Formas W-2 1098 1099 El N mero de Seguro Social SSN o el N mero de Identificaci n Personal de Contribuyente ITIN para todas las personas mencionadas en la declaraci n N mero de identificaci n del proveedor s del cuido de menores Informaci n bancari...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your form 13614 c sp form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 13614 c sp form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 13614 c sp online

To use the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit form 13614 c sp. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

How to fill out form 13614 c sp

How to fill out Form 13614-C SP:

01

Start by accurately providing your personal information, such as your name, address, and Social Security number.

02

Carefully go through each section of the form and provide the necessary information requested, such as your filing status, dependents, and income.

03

Make sure to double-check your entries for accuracy and completeness before submitting the form.

Who needs Form 13614-C SP?

01

Individuals who are seeking assistance from the IRS through the Volunteer Income Tax Assistance (VITA) program might be required to fill out Form 13614-C SP.

02

This form is aimed at helping the IRS understand your financial situation and provide appropriate tax assistance.

03

The form is commonly used by individuals whose income falls within a certain threshold and who need guidance or help in their tax return preparation.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is form 13614 c sp?

Form 13614 c sp is a Special Edition of the Intake/Interview and Quality Review Sheet, which is commonly used by the Internal Revenue Service (IRS) for tax preparation purposes.

Who is required to file form 13614 c sp?

Individuals who need assistance with their tax preparation or filing and seek help from a Volunteer Income Tax Assistance (VITA) program or Tax Counseling for the Elderly (TCE) program are required to file form 13614 c sp.

How to fill out form 13614 c sp?

To fill out form 13614 c sp, individuals need to provide personal information, income details, tax deductions, and any changes in circumstances that might affect their tax situation. It is advisable to seek guidance from a certified tax preparer or utilize IRS-provided resources for accurate completion.

What is the purpose of form 13614 c sp?

The purpose of form 13614 c sp is to gather relevant information from taxpayers seeking assistance with their tax preparation, ensuring that the preparer can provide accurate and appropriate guidance based on the individual's situation.

What information must be reported on form 13614 c sp?

Form 13614 c sp requires taxpayers to report personal information such as name, address, Social Security number, marital status, and dependent information. It also requests details regarding income, deductions, credits, and any changes in circumstances during the tax year.

When is the deadline to file form 13614 c sp in 2023?

The IRS has not yet announced the specific deadline for filing form 13614 c sp for the year 2023. It is recommended to check the official IRS website or consult with a tax professional for the most up-to-date information.

What is the penalty for the late filing of form 13614 c sp?

There is no specific penalty associated with the late filing of form 13614 c sp. However, it is important to comply with all tax filing requirements and meet applicable deadlines to avoid potential penalties or disruptions in tax-related benefits.

How can I get form 13614 c sp?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the form 13614 c sp. Open it immediately and start altering it with sophisticated capabilities.

How do I execute form 13614 c sp online?

Easy online form 13614 c sp completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How can I edit form 13614 c sp on a smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing form 13614 c sp right away.

Fill out your form 13614 c sp online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.