Get the free Standard Mortgage Terms - Scotiabank

Show details

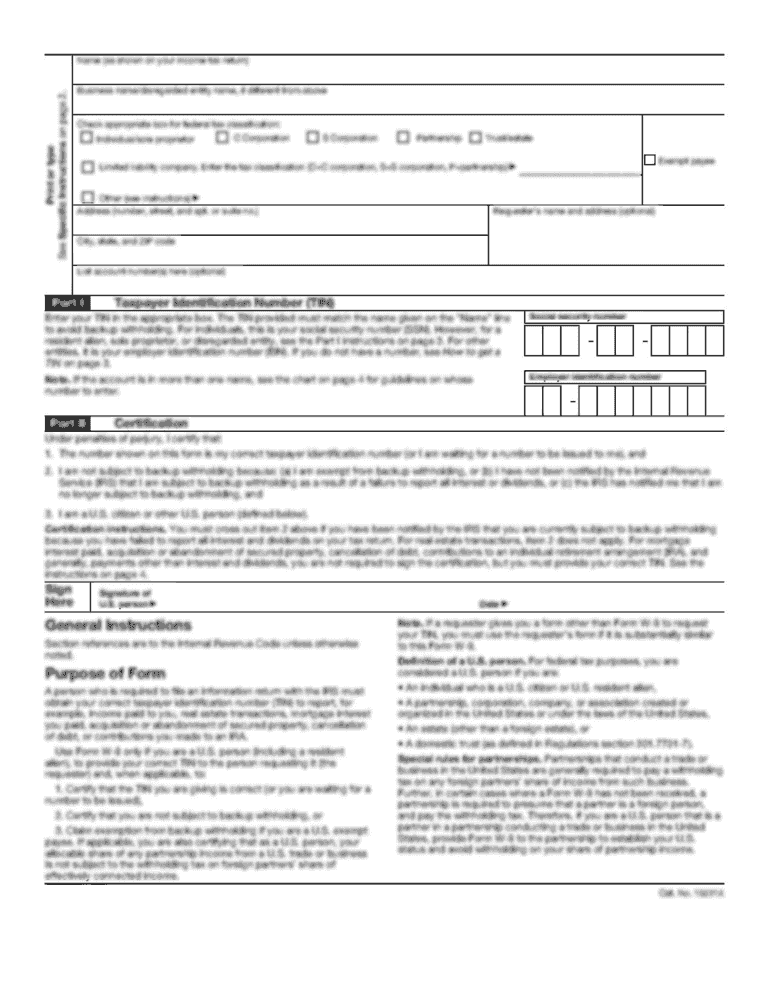

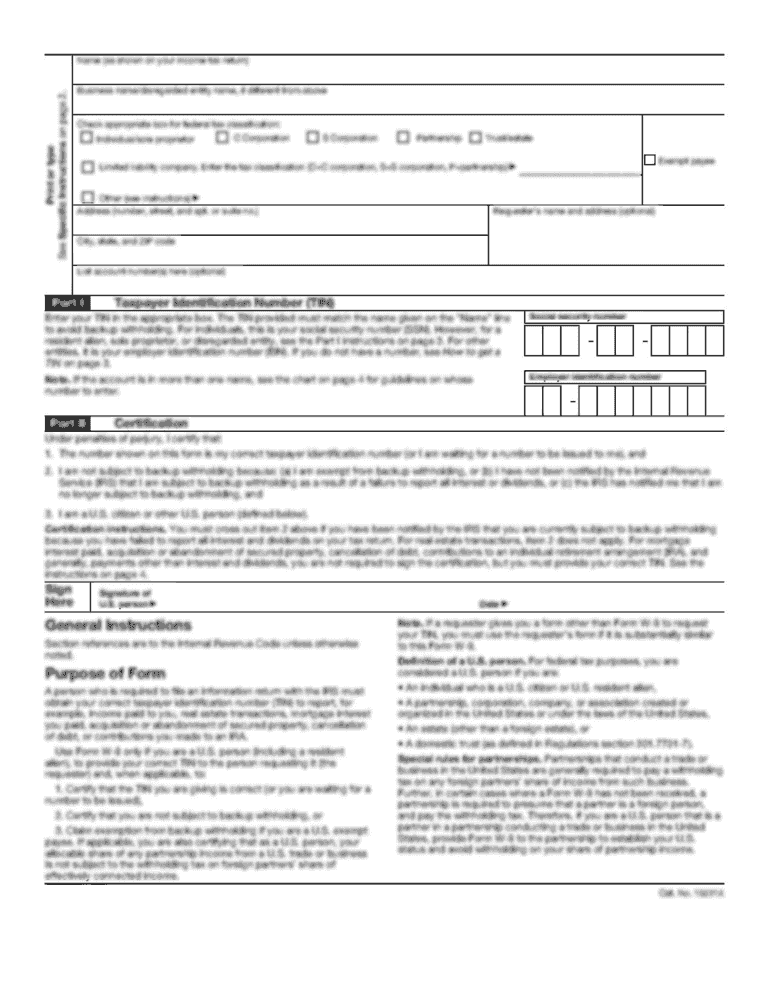

LAND TITLE ACT FORM B (Section 225) Province of British Columbia MORTGAGE ? PART 1 (This area for Land Title Office use) Page 1 of pages 1. APPLICATION: (Name, address, phone number and signature

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your standard mortgage terms form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your standard mortgage terms form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit standard mortgage terms online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit standard mortgage terms. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is simple using pdfFiller. Try it now!

How to fill out standard mortgage terms

01

To fill out standard mortgage terms, start by gathering all the necessary documentation such as identification, proof of income, and bank statements.

02

Next, carefully review and understand the terms and conditions of the mortgage agreement, including the interest rate, repayment schedule, and any additional fees or charges.

03

Fill out the required forms accurately, providing the requested information and double-checking for any errors or omissions.

04

If you are unsure about any terms or clauses in the mortgage agreement, seek professional advice from a mortgage broker or financial advisor.

05

Sign the completed mortgage documents and ensure that all parties involved, including the lender and borrower, have copies of the signed agreement.

06

Standard mortgage terms are typically needed by individuals or households who are applying for a mortgage loan to purchase a property or refinance an existing mortgage.

07

These terms outline the rights and responsibilities of both the lender and borrower, ensuring that the mortgage agreement is legally binding and protects the interests of all parties involved.

08

Whether you are a first-time homebuyer or a seasoned property owner, understanding and adhering to standard mortgage terms is crucial to navigate the mortgage process successfully.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is standard mortgage terms?

Standard mortgage terms refer to the agreed-upon conditions and provisions between a borrower and a lender regarding a mortgage loan.

Who is required to file standard mortgage terms?

Both the borrower and the lender are responsible for agreeing upon and signing the standard mortgage terms.

How to fill out standard mortgage terms?

To fill out standard mortgage terms, both parties should review and agree upon the terms and conditions. They can then complete the necessary paperwork, including the mortgage agreement, and incorporate the agreed-upon terms into the document.

What is the purpose of standard mortgage terms?

The purpose of standard mortgage terms is to outline the rights and obligations of the borrower and the lender in relation to a mortgage loan. It provides clarity and sets the expectations for both parties involved.

What information must be reported on standard mortgage terms?

Standard mortgage terms typically include details such as the loan amount, interest rate, repayment schedule, penalties for late payments, conditions for prepayment, and any additional fees or charges.

When is the deadline to file standard mortgage terms in 2023?

The specific deadline to file standard mortgage terms in 2023 may vary depending on the jurisdiction and the terms agreed upon. It is advisable to consult with legal professionals or relevant authorities for accurate information.

What is the penalty for the late filing of standard mortgage terms?

The penalty for the late filing of standard mortgage terms can vary depending on local regulations and contractual agreements. It is recommended to refer to the specific terms and conditions outlined in the agreement or consult legal professionals for accurate information about the penalties.

How can I manage my standard mortgage terms directly from Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your standard mortgage terms and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How do I make edits in standard mortgage terms without leaving Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your standard mortgage terms, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

How do I edit standard mortgage terms on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign standard mortgage terms right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

Fill out your standard mortgage terms online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.