Get the free form No 8.doc. Connecticut Workers' Compensation Commission Agency Forms

Show details

Date of This Report District of Columbia Government Office of Worker s Compensation P.O. Box 56098 Washington, DC 20011 (202) 671-1000 Employee Social Security No. Warning: It is a crime to provide

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your form no 8doc connecticut form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form no 8doc connecticut form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form no 8doc connecticut online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit form no 8doc connecticut. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

How to fill out form no 8doc connecticut

How to fill out form no 8doc Connecticut:

01

Start by obtaining the form: You can download form no 8doc Connecticut from the official website of the Connecticut Department of Revenue Services or obtain a physical copy from their office.

02

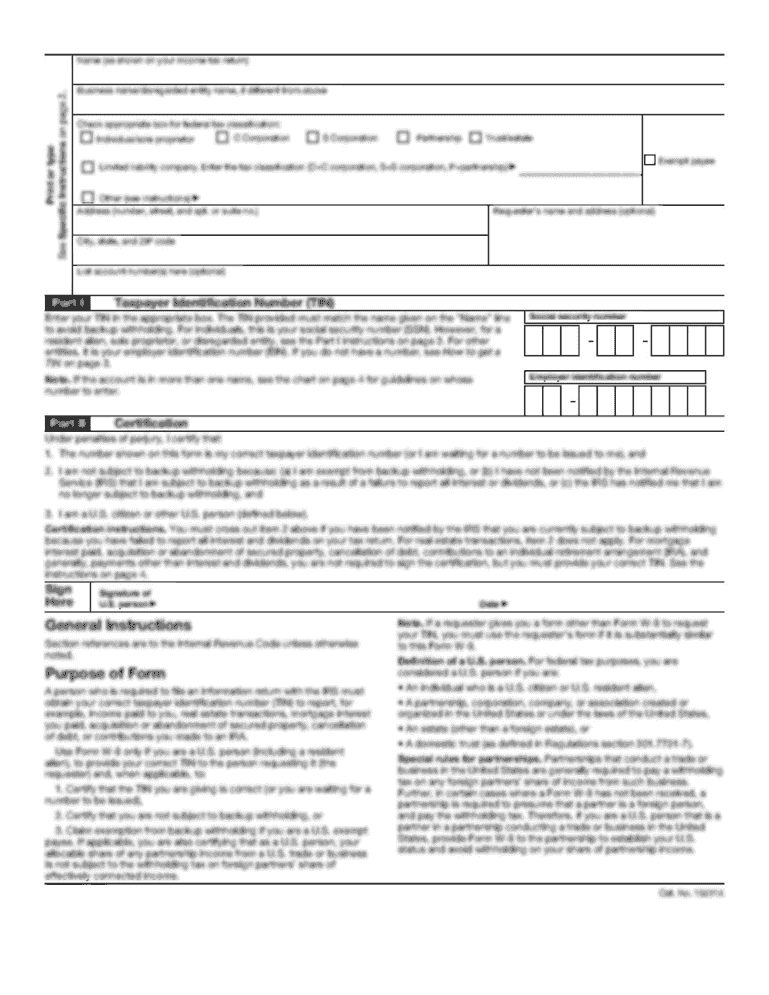

Provide personal information: Begin by entering your full name, address, Social Security number, and any other requested personal details in the designated sections of the form. Make sure to fill in the information accurately and legibly.

03

Specify the tax period: Indicate the relevant tax period for which you are filing the form. This typically includes the month and year.

04

Report your income: Fill out the sections related to your income. This may include information from your W-2, 1099 forms, or any other relevant income sources. Enter the amounts as specified and double-check for any errors.

05

Deductions and credits: If applicable, provide details of any deductions or credits you are eligible for. This could include expenses related to education, homeownership, healthcare, or other eligible categories. Follow the instructions on the form to calculate the correct amounts.

06

Calculate your taxes: Follow the instructions on the form to determine your tax liability. This may involve various calculations based on your income, deductions, and credits. Ensure that all calculations are accurate and double-check your work.

07

Sign and date the form: At the end of the form, you will find a section for your signature and date. Sign the form using your legal signature and date it accordingly. By signing, you certify that the information provided is true and accurate to the best of your knowledge.

Who needs form no 8doc Connecticut?

01

Individuals who are residents of Connecticut and have income from various sources need to complete form no 8doc Connecticut. This includes employees, self-employed individuals, and those who receive income from investments, pensions, or rental properties.

02

Individuals who have had Connecticut income tax withheld from their wages or who made estimated tax payments during the tax year may need to fill out form no 8doc Connecticut to reconcile their tax liability.

03

It is essential to fill out form no 8doc Connecticut accurately and submit it by the deadline to ensure compliance with Connecticut tax laws and avoid any penalties or fines.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is form no 8doc connecticut?

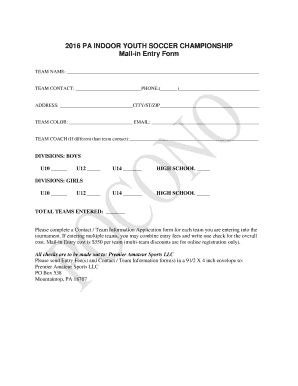

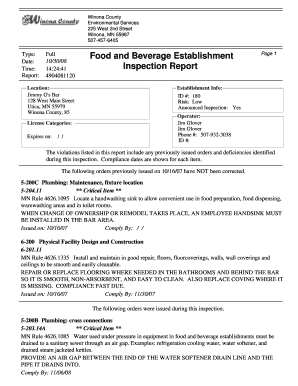

Form No 8doc Connecticut is a form used for reporting certain transactions on nonresident sellers or transferors of Connecticut real property.

Who is required to file form no 8doc connecticut?

Nonresident sellers or transferors of Connecticut real property are required to file form no 8doc Connecticut.

How to fill out form no 8doc connecticut?

Form no 8doc Connecticut can be filled out by providing the required information, such as the seller's or transferor's details, property information, and transaction details.

What is the purpose of form no 8doc connecticut?

The purpose of form no 8doc Connecticut is to report transactions on nonresident sellers or transferors of Connecticut real property for tax purposes.

What information must be reported on form no 8doc connecticut?

Form no 8doc Connecticut requires reporting of information such as the seller's or transferor's name, address, taxpayer identification number, property details, and transaction details.

When is the deadline to file form no 8doc connecticut in 2023?

The deadline to file form no 8doc Connecticut in 2023 is April 15th.

What is the penalty for the late filing of form no 8doc connecticut?

The penalty for the late filing of form no 8doc Connecticut is $50 per late day, up to a maximum of $1,500.

How can I manage my form no 8doc connecticut directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign form no 8doc connecticut and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How do I edit form no 8doc connecticut online?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your form no 8doc connecticut and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

How do I edit form no 8doc connecticut in Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing form no 8doc connecticut and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

Fill out your form no 8doc connecticut online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.