Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

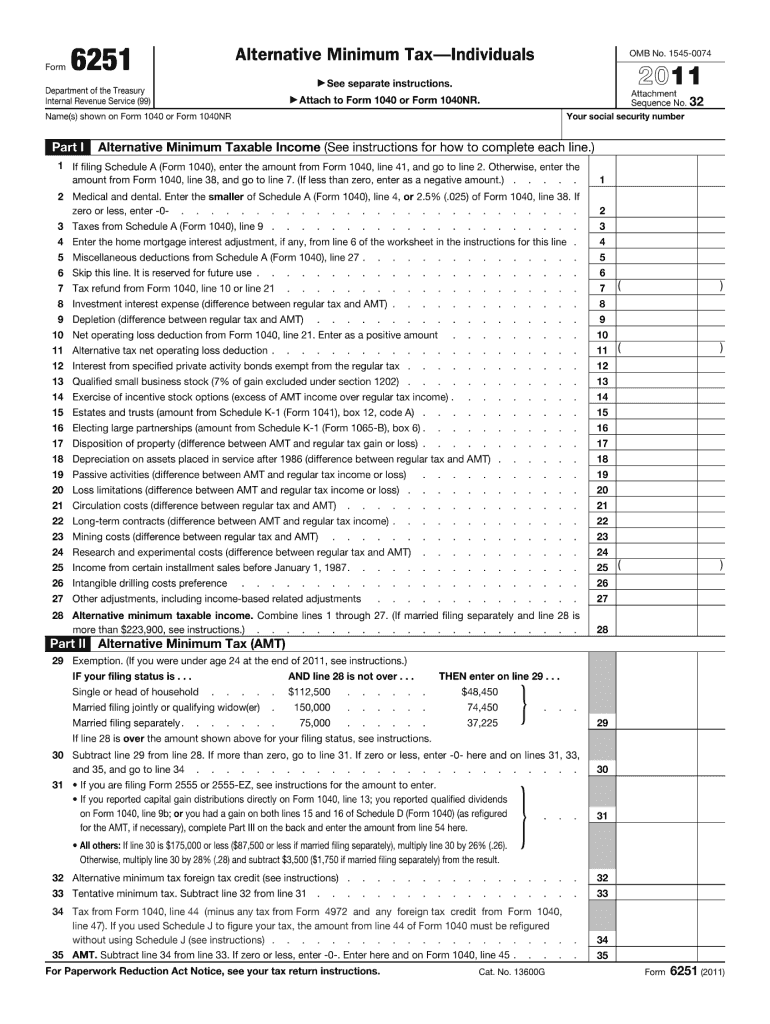

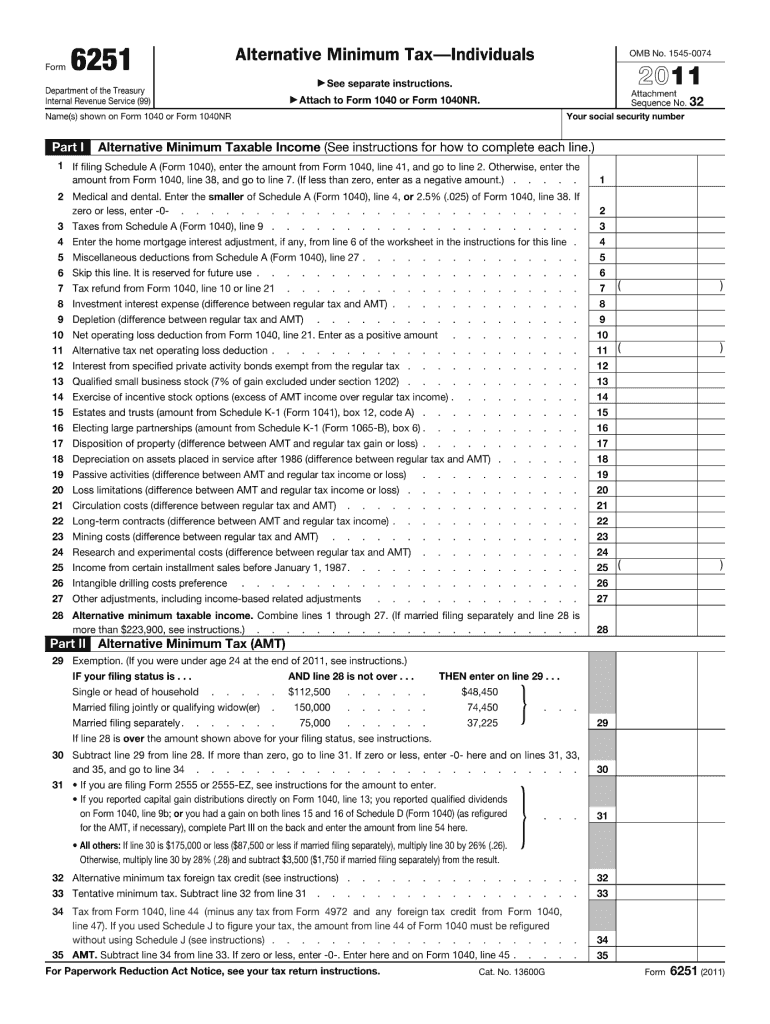

Form 6251 is a tax form used to calculate the Alternative Minimum Tax (AMT). The AMT is a parallel tax system designed to ensure that individuals and corporations who are eligible for certain tax benefits still pay a minimum amount of tax. Form 6251 helps determine if a taxpayer owes AMT by adding certain tax preference items and adjustments to their regular taxable income and comparing it to the AMT exemption amount. If the AMT amount is higher than the regular tax liability, the taxpayer may have to pay the difference as AMT.

Who is required to file form 6251?

Individuals who meet specific criteria related to alternative minimum tax (AMT) are required to file Form 6251, the Alternative Minimum Tax - Individuals. This form is used to determine if an individual owes AMT based on their income, deductions, and exemptions. Generally, you will need to file Form 6251 if you have certain types of income, deductions, or special tax situations, such as:

1. Having a high amount of tax preference items, such as incentive stock options, tax-exempt interest, or certain types of deductions.

2. Claiming certain credits, such as the foreign tax credit or the credit for child and dependent care expenses.

3. Exercising incentive stock options and not selling the stock in the same year.

4. Taking a large amount of itemized deductions, particularly those related to state and local taxes.

5. Having a significant amount of adjusted gross income or filing status changes during the year.

It is recommended to consult a tax professional or refer to the official IRS guidelines to determine if you are required to file Form 6251.

How to fill out form 6251?

Form 6251, also known as the Alternative Minimum Tax (AMT) form, is used to determine if an individual or a corporation may owe an alternative minimum tax. Here's a step-by-step guide on how to fill out this form:

1. Personal Information: Fill in your name, Social Security number, and address at the top of the form.

2. Filing Status: Indicate your filing status (single, married filing jointly, etc.) in Part I.

3. Exemptions: In Part II, enter the number of exemptions you are claiming, which generally includes yourself, your spouse, and dependents.

4. Determine Tentative Minimum Tax: In Part III, you will calculate your tentative minimum tax (TMT). Start by filling in the adjusted gross income from your regular tax return. Then, follow the instructions to compute various adjustments and additions to determine your TMT.

5. Compare Regular Tax and Alternative Minimum Tax: Part IV compares your regular tax liability and tentative minimum tax. Subtract your TMT from your regular tax. If the result is positive, you may owe alternative minimum tax.

6. Complete the Worksheet: Fill out the worksheet in Part V. This worksheet helps you calculate the AMT exemption amount based on your filing status, income, and exemptions claimed.

7. Calculate Alternative Minimum Tax: Use the information from the worksheet to calculate the alternative minimum tax in Part VI. Refer to the charts and tables provided in the instructions to determine the appropriate percentage rates for your income level.

8. Compare Taxes: In Part VII, compare your total alternative minimum tax (from Part VI) with the regular tax amount (from line 47 of your regular tax return). Subtract the regular tax from the alternative minimum tax to obtain the AMT owed.

9. Other Taxes: Part VIII asks for any other taxes, such as foreign tax credits, that may affect your AMT calculation.

10. Penalty for Underpayment: In Part IX, calculate any penalty for underpayment of AMT during the year. This applies if you did not pay enough AMT during the year through withholding or estimated tax payments.

11. Sign and Date: Sign and date the form at the bottom.

Note: Form 6251 is subject to change, so it's important to refer to the most recent instructions provided by the IRS when filling out the form. Additionally, seeking assistance from a tax professional or using tax software can ensure accuracy and address any individual complexities that may arise.

What is the purpose of form 6251?

The purpose of Form 6251 is to calculate and determine whether an individual or taxpayer is subject to the Alternative Minimum Tax (AMT). The AMT is a supplemental income tax imposed on certain individuals who have certain types of income or deductions that are exempt or treated differently under regular income tax rules. Form 6251 helps in determining the amount of AMT owed by adjusting certain items of income and deductions and comparing the result with the regular tax liability calculated on Form 1040.

What information must be reported on form 6251?

Form 6251, also known as the Alternative Minimum Tax (AMT) form, is used by individuals who may be subject to the alternative minimum tax. The following information must be reported on Form 6251:

1. Personal information: Name, Social Security number, and address.

2. Exemption amount: The taxpayer's exemption amount, which is used to determine the taxable alternative minimum taxable income.

3. Calculation of alternative minimum taxable income (AMTI): This includes adjustments to the regular taxable income, such as certain deductions and tax preferences.

4. Adjustments and preferences: Various adjustments and preferences need to be reported, including tax-exempt interest on private activity bonds, accelerated depreciation adjustments, and certain itemized deductions.

5. Tentative minimum tax: Calculation of the tentative minimum tax (AMT), which is the alternative tax rate applied to the AMTI.

6. AMT exemption: Calculation of the AMT exemption amount, which reduces the AMT liability. This amount is based on filing status, and it reduces as income increases.

7. Alternative minimum tax: The actual amount of alternative minimum tax calculated based on the tentative minimum tax and the AMT exemption.

8. Foreign tax credit: If applicable, the foreign tax credit that reduces the AMT liability may also need to be reported.

It's important to note that Form 6251 requires taxpayers to perform multiple calculations and compare the regular tax liability to the alternative minimum tax liability. Depending on the complexity of an individual's tax situation, additional schedules may be required for reporting certain items.

When is the deadline to file form 6251 in 2023?

The deadline to file Form 6251 in 2023 would be April 17, 2023, assuming that the regular tax deadline for individuals for that year remains April 15th. However, it is always recommended to confirm with the IRS or a tax professional for the most up-to-date information.

What is the penalty for the late filing of form 6251?

The penalty for the late filing of Form 6251, which is used to calculate the Alternative Minimum Tax (AMT), is typically a percentage of the unpaid tax amount. As of 2021, the penalty for filing late is generally 5% of the unpaid tax per month, up to a maximum of 25%. However, the penalty amount can vary depending on individual circumstances, so it is recommended to consult the official IRS guidelines or a tax professional for specific information.

How do I complete form 6251 online?

pdfFiller makes it easy to finish and sign 2010 form 6251 online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How can I edit form 6251 on a smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit 2010 form 6251.

Can I edit form 6251 on an iOS device?

Create, edit, and share 2010 form 6251 from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.