Get the free Georgia dept of revenue application for alcohol permit alcohol

Show details

“ +:;, ×.c ATT.15 GEORGIA DEPT OF REVENUE APPLICATION FOR ALCOHOL PERMIT ALCOHOL & TOBACCO DIVISION P. O. BOX 49728 A PLANT A, GEORGIA 30359 '- c 1. STATETAXPAYER IDENTIFIER: 2. NAME FIRM: OF LEGAL

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your georgia dept of revenue form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your georgia dept of revenue form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit georgia dept of revenue online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit georgia dept of revenue. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

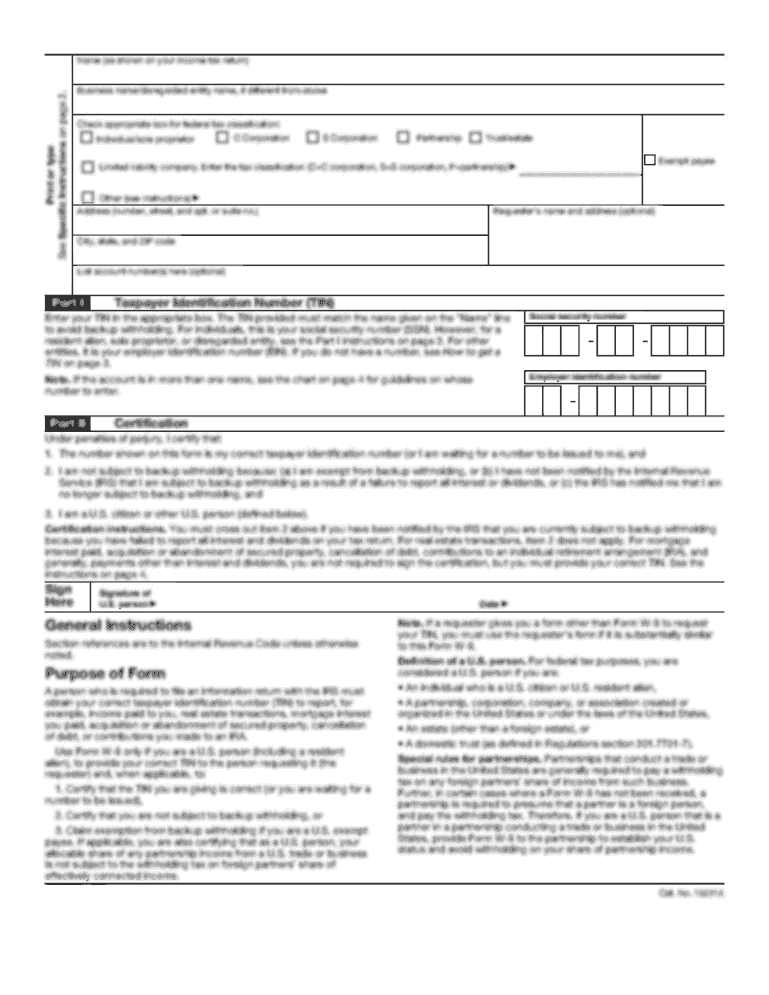

How to fill out georgia dept of revenue

How to fill out Georgia Dept of Revenue:

01

Gather all necessary information and documents such as your social security number, income statements, and residency documents.

02

Visit the Georgia Dept of Revenue website or office to obtain the appropriate forms or download them online.

03

Carefully read the instructions provided with the forms to ensure you understand all the requirements and deadlines.

04

Enter your personal information accurately and completely, including your name, address, and contact information.

05

Provide details about your income, deductions, credits, and any other relevant information as required by the specific form.

06

Double-check all the information you have filled in to ensure accuracy and completeness.

07

Sign and date the form as instructed, and attach any necessary supporting documents.

08

Submit the completed form and any additional documents to the Georgia Dept of Revenue either electronically or by mail.

Who needs Georgia Dept of Revenue:

01

Individuals who are residents of Georgia and have taxable income are required to file with the Georgia Dept of Revenue.

02

Businesses operating in Georgia, such as corporations, partnerships, and sole proprietors, need to file various tax forms with the Georgia Dept of Revenue.

03

Non-residents who have earned income in Georgia may also need to file with the Georgia Dept of Revenue depending on certain criteria.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is georgia dept of revenue?

The Georgia Department of Revenue is a government agency in the state of Georgia responsible for the administration of tax laws and the collection of state taxes.

Who is required to file georgia dept of revenue?

Individuals and businesses that meet certain criteria, such as earning income or conducting business in the state of Georgia, are required to file with the Georgia Department of Revenue.

How to fill out georgia dept of revenue?

To fill out the Georgia Department of Revenue forms, individuals and businesses must provide the necessary information regarding their income, expenses, deductions, and any other required details as outlined in the instructions provided with the forms.

What is the purpose of georgia dept of revenue?

The purpose of the Georgia Department of Revenue is to ensure compliance with tax laws, collect state taxes, and allocate the revenue towards various government initiatives, such as funding education, transportation, and public services.

What information must be reported on georgia dept of revenue?

The information that must be reported on the Georgia Department of Revenue forms varies depending on the type of taxpayer (individual or business) and the specific form being filed. Generally, it includes details about income, deductions, credits, and any other relevant financial information.

When is the deadline to file georgia dept of revenue in 2023?

The deadline to file Georgia Department of Revenue forms in 2023 will be determined and announced by the department closer to the tax filing season. It is generally April 15th for individual taxpayers, but it may vary for certain business entities.

What is the penalty for the late filing of georgia dept of revenue?

The penalty for late filing of Georgia Department of Revenue forms depends on various factors, such as the type of taxpayer and the amount of tax owed. Penalties may include monetary fines, interest charges on unpaid taxes, and other consequences as determined by the department.

Where do I find georgia dept of revenue?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific georgia dept of revenue and other forms. Find the template you want and tweak it with powerful editing tools.

Can I create an electronic signature for signing my georgia dept of revenue in Gmail?

Create your eSignature using pdfFiller and then eSign your georgia dept of revenue immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How do I edit georgia dept of revenue straight from my smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit georgia dept of revenue.

Fill out your georgia dept of revenue online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.