Get the free Real Property Transfer Tax Declaration Form 7551

Show details

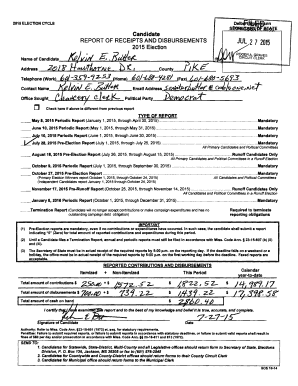

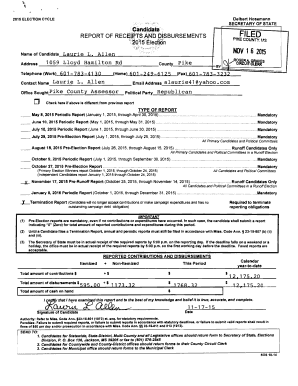

Cityofchicago. org/revenue by clicking on License and Tax Info then clicking on Property Transfer Tax and then clicking on Form 7551. TO Chicago Area Members and Regional Agents FROM August R. Butera DATE January 16 2003 RE City of Chicago Real Property Transfer Declaration Form 7551 Dear Members and Agents This is an important reminder that the Chicago Department of Revenue has revised the Real Property Transfer Tax Declaration Form Form 7551.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your real property transfer tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your real property transfer tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit real property transfer tax online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit real property transfer tax. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

How to fill out real property transfer tax

How to fill out real property transfer tax:

01

Obtain the necessary forms: Start by visiting the local tax authority's website or office to obtain the specific forms required to fill out the real property transfer tax. These forms may vary depending on your location and the type of property being transferred.

02

Gather all required information: Collect all the necessary information needed to complete the real property transfer tax forms. This may include details such as the property address, sale price, names of the buyer and seller, and any applicable exemptions or credits.

03

Determine the tax rate: Look up the tax rate applicable to your jurisdiction. Real property transfer taxes are usually calculated as a percentage of the property's sale price or assessed value. Ensure you are using the correct rate to accurately calculate the tax due.

04

Calculate the tax amount: Using the information gathered in step 2, calculate the amount of real property transfer tax owed. This can be done by multiplying the sale price or assessed value of the property by the applicable tax rate.

05

Complete the forms: Fill out the real property transfer tax forms accurately and legibly. Provide all the required information, double-checking for any errors or omissions that could delay the processing of the tax payment.

06

Submit the forms: Once the forms are completed, submit them to the appropriate tax authority. This can typically be done electronically or through mail. Be sure to include any required supporting documentation and payment for the real property transfer tax.

Who needs real property transfer tax?

01

Buyers: Individuals or entities purchasing real property are generally responsible for paying the real property transfer tax. This tax is imposed to cover the costs associated with the transfer of ownership and to generate revenue for the local government.

02

Sellers: In some jurisdictions, sellers may also be required to pay a portion of the real property transfer tax. The responsibility for the tax payment may be divided between the buyer and seller, depending on local laws and agreements made between the parties involved.

03

Local governments: Real property transfer tax is an important source of revenue for local governments. The funds collected from this tax are used to finance various public services and infrastructure projects that benefit the community as a whole.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is real property transfer tax?

Real property transfer tax is a tax imposed on the transfer of real property from one party to another.

Who is required to file real property transfer tax?

The buyer or transferee of the real property is usually required to file the real property transfer tax.

How to fill out real property transfer tax?

To fill out the real property transfer tax, the buyer or transferee needs to provide information such as the property details, purchase price, and any applicable exemptions.

What is the purpose of real property transfer tax?

The purpose of real property transfer tax is to generate revenue for the government and to ensure that taxes are paid on the transfer of real property.

What information must be reported on real property transfer tax?

The information that must be reported on real property transfer tax typically includes the property details, purchase price, and any applicable exemptions.

When is the deadline to file real property transfer tax in 2023?

The deadline to file real property transfer tax in 2023 may vary depending on the jurisdiction. It is advisable to consult the local tax authorities for the specific deadline.

What is the penalty for the late filing of real property transfer tax?

The penalty for late filing of real property transfer tax can vary depending on the jurisdiction and the amount of tax owed. It is advisable to consult the local tax authorities for the specific penalty rates.

How do I complete real property transfer tax online?

With pdfFiller, you may easily complete and sign real property transfer tax online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I make edits in real property transfer tax without leaving Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing real property transfer tax and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

How do I edit real property transfer tax on an iOS device?

Create, modify, and share real property transfer tax using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

Fill out your real property transfer tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.