Get the free Alternative Investment Profile - Prime Capital Services, Inc.

Show details

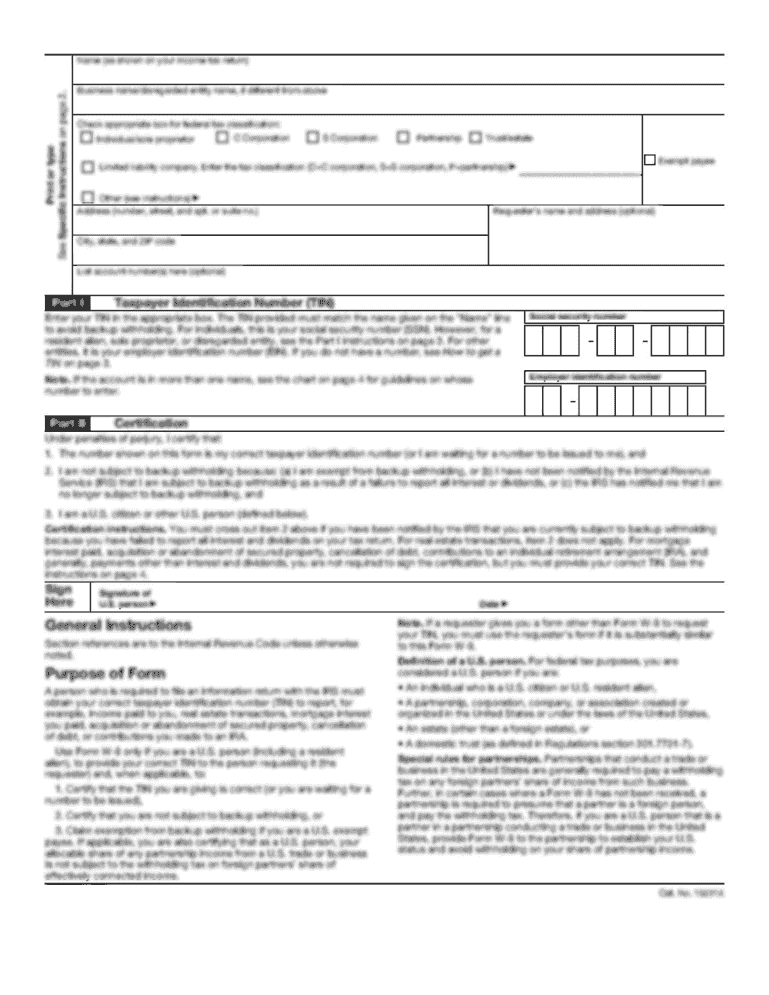

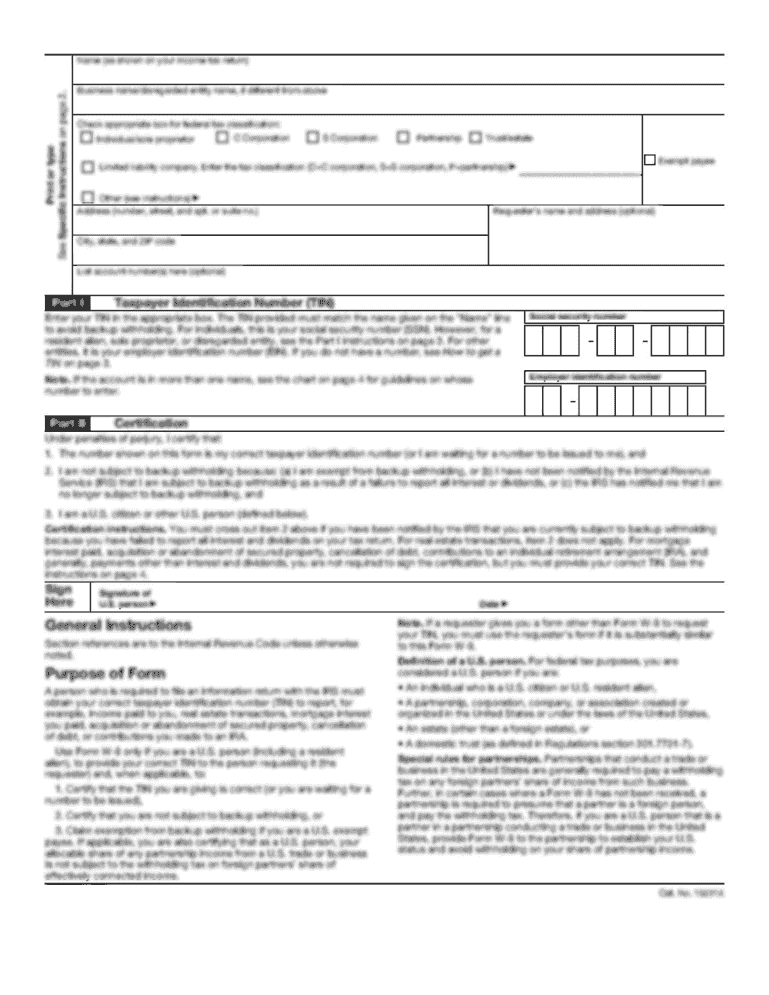

Print Reset Save Alternative Investment Profile Use this form to provide information regarding an Alternative Investment. Complete this form and supply the required Fund Sponsor documents noted on

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your alternative investment profile form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your alternative investment profile form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing alternative investment profile online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit alternative investment profile. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

How to fill out alternative investment profile

How to fill out alternative investment profile:

01

Begin by providing personal information such as your name, contact details, and current address. This is essential for identification and communication purposes.

02

Next, include your investment objectives. Clearly state whether you are seeking long-term growth, income generation, or a combination of both. It is important to align your investment goals with the alternatives you are considering.

03

Indicate your risk tolerance level. Different alternative investments carry varying degrees of risk, so understanding your comfort level is crucial in selecting suitable options.

04

Specify your investment experience. This includes any previous experience or knowledge you have in alternative investments. If you are a novice investor, be sure to mention this as well.

05

Provide information about your financial situation and net worth. This helps determine if you meet the minimum requirements for certain alternative investments and manage your risk accordingly.

06

Include your investment time horizon. This refers to the length of time you are willing to stay invested in alternative assets before needing access to funds.

07

Lastly, review and verify all the information you have entered to ensure accuracy and completeness.

Who needs alternative investment profile?

01

Individuals looking to diversify their investment portfolio: Alternative investments offer a way to spread risk and potentially enhance returns by adding assets that have a low correlation with traditional investments like stocks and bonds.

02

Accredited investors: Some alternative investments, such as hedge funds or private equity, are only available to accredited investors. These are individuals or entities that meet specific income or net worth requirements.

03

Experienced investors seeking higher potential returns: Alternative investments can provide opportunities for higher returns compared to traditional investments, albeit with greater risk. Those with a higher risk tolerance may find alternative investments appealing.

04

Investors who want to hedge against inflation: Certain alternative investments, such as real estate or commodities, can serve as a hedge against inflation as they often have a value that increases with rising prices.

05

Individuals interested in unique investment opportunities: Alternative investments cover a wide range of asset classes, including art, wine, collectibles, and cryptocurrencies. Those with a penchant for unique investments may find alternative investment profiles attractive.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is alternative investment profile?

Alternative investment profile refers to a document that provides detailed information about an alternative investment, such as hedge funds, private equity, or real estate funds.

Who is required to file alternative investment profile?

Investment firms and individuals managing alternative investments are required to file alternative investment profile.

How to fill out alternative investment profile?

Alternative investment profile can be filled out by providing accurate and comprehensive information about the alternative investment, including its strategy, assets, performance, and risks.

What is the purpose of alternative investment profile?

The purpose of alternative investment profile is to provide transparency and disclosure to investors, regulators, and stakeholders regarding the nature and characteristics of the alternative investment.

What information must be reported on alternative investment profile?

The alternative investment profile must include information such as investment strategy, historical performance, risk factors, legal and regulatory compliance, and details about the investment manager.

When is the deadline to file alternative investment profile in 2023?

The specific deadline to file alternative investment profile in 2023 may vary depending on the jurisdiction and applicable regulations. It is advisable to consult the relevant regulatory authorities or legal counsel for the accurate deadline.

What is the penalty for the late filing of alternative investment profile?

The penalty for the late filing of alternative investment profile can vary depending on the jurisdiction and applicable regulations. It may include fines, sanctions, or other regulatory actions. The specific penalty should be verified with the relevant regulatory authorities or legal counsel.

How can I edit alternative investment profile from Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including alternative investment profile. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How do I complete alternative investment profile online?

With pdfFiller, you may easily complete and sign alternative investment profile online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I fill out alternative investment profile using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign alternative investment profile and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

Fill out your alternative investment profile online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.